Key Post Office deal agreed for future of cash

- Published

- comments

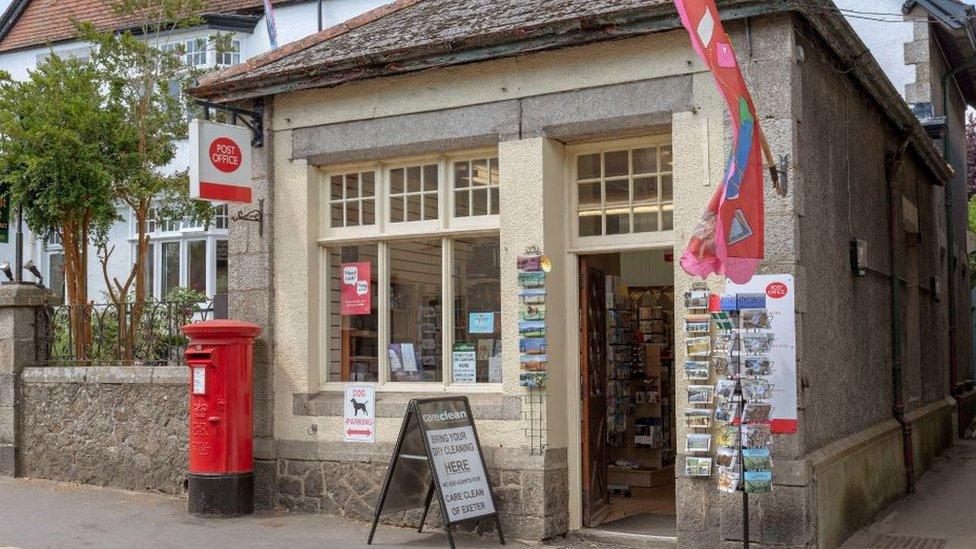

Customers of about 30 UK banks and building societies can continue to use post office counters for basic banking until at least 2026.

The new deal, which covers three years from next January, is seen as key in securing the future acceptance of cash.

Individuals and small businesses can withdraw and deposit notes and coins from their accounts at 11,500 post office counters.

But one leading bank - Monzo - has not signed up to the deal.

"Monzo is a branchless bank, with customers able to carry out the majority of their banking needs through the Monzo app. Customers can also deposit cash at Paypoint, which is available in over 28,000 convenience stores, corner shops and retailers across the UK," a spokeswoman for the bank said.

The Post Office said £3bn a month was deposited and withdrawn over its counters.

The new agreement, known as "Banking Framework 3", has been signed after months of negotiations.

Nick Read, chief executive of the Post Office, said: "This agreement provides a continued lifeline to the millions of people and small businesses that rely on cash nationwide. While banks are cutting their branch networks, Post Offices are seeing more and more deposits and withdrawals."

Some post office branches have also been shutting, consumer campaigners have pointed out.

When the last Post Office banking agreement was signed in 2019, Barclays caused controversy by refusing to join - a decision it later reversed.

The signatories to the new agreement are: Barclays, Lloyds, HSBC, Santander, NatWest, RBS, TSB, Halifax, Adam & Co, Allied Irish Bank, AIB, Bank of Ireland, Bank of Scotland, Cahoot, Cashplus Bank, Coutts, Co-op, Danske, First Direct, Handelsbanken, Metro, Nationwide, Smile, Starling Bank, Thinkmoney, Ulster, Virgin Money, Yorkshire Bank, Clydesdale Bank, CAF Bank and credit union Incuto.

- Published15 December 2021

- Published1 December 2021

- Published24 October 2019