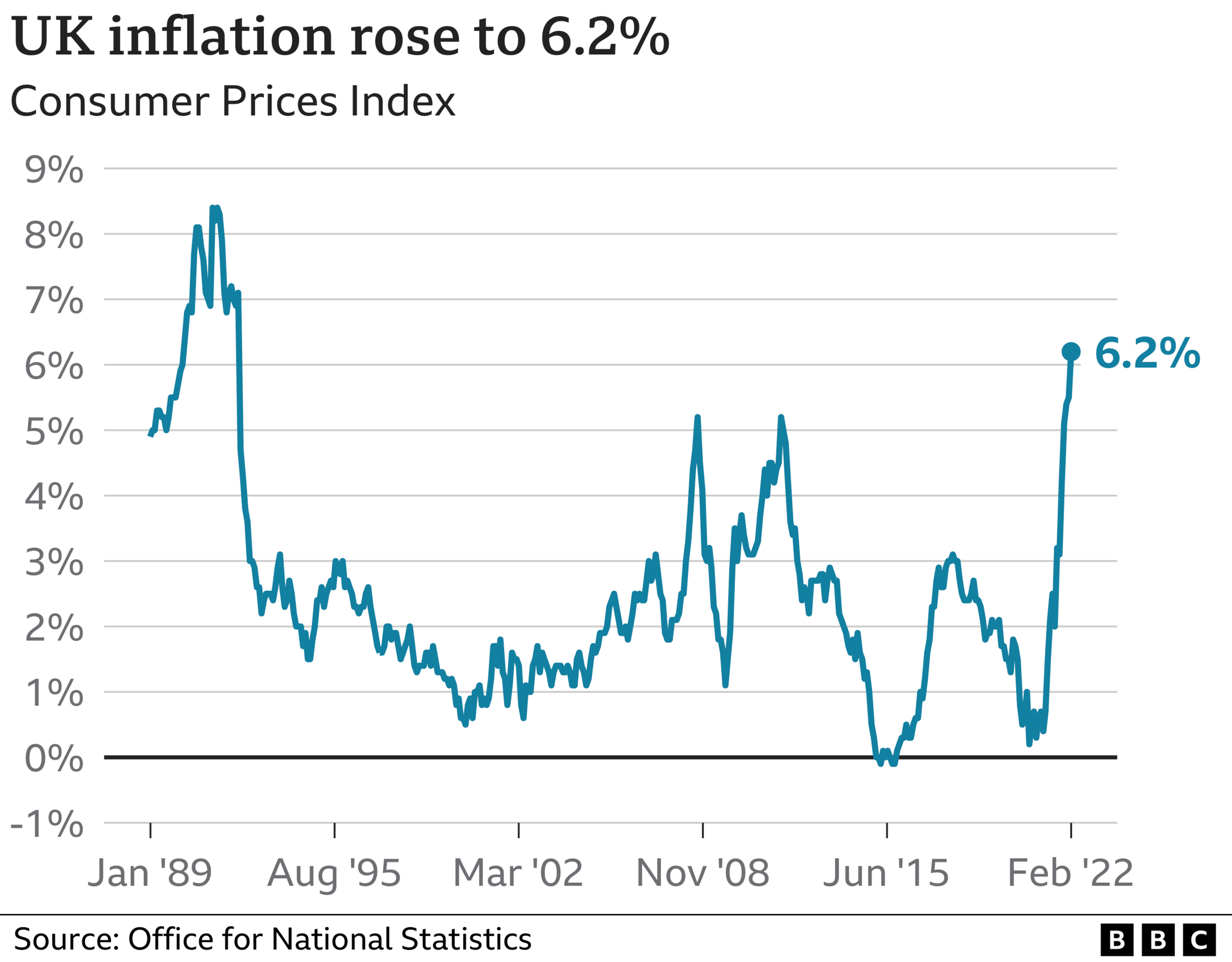

Inflation hits new 30-year high in February

- Published

- comments

The cost of living continued to soar last month, according to official figures.

Prices rose by 6.2% in the 12 months to February - the fastest for 30 years - as fuel, energy and food costs surged.

Prices are rising faster than wages and the Bank of England thinks it could hit double digits this year.

Chancellor Rishi Sunak and Prime Minister Boris Johnson have been under pressure to do more to help struggling households.

Inflation is the rate at which prices rise. If a bottle of milk costs £1 and that rises by 5p, then milk inflation is 5%.

Since December last year, prices have been rising at their fastest rate since the 1990s.

Inflation is expected to speed up in April when the energy price cap is increased.

This will push up the average household fuel bill up by £693 a year in England, Scotland and Wales, while a planned rise in National Insurance will also put pressure on household budgets.

"Rising inflation remains a significant concern for the economy, squeezing household incomes and increasing cost pressures on retailers," said Helen Dickinson, chief executive of the British Retail Consortium.

Paul Dales, chief UK economist at Capital Economics, said the pick up in inflation "adds to the pressure on the chancellor to offset more of the cost of living crisis".

In his Spring Statement, Mr Sunak said that the war in Ukraine had a "significant impact" on the cost of living in the UK.

In the statement he cut fuel duty by 5p per litre, raised the threshold for National Insurance to £12,570, and announced a cut to the basic rate of income tax to 19% from 20% in 2024.

But Labour's shadow chancellor Rachel Reeves said Mr Sunak's choices "were making the cost of living crisis worse, not better".

She said he should have put a windfall tax on oil and gas companies and scrapped the national insurance hike.

The Office for National Statistics (ONS) said gas prices were almost a third higher in February than a year earlier, and electricity prices were up by nearly a fifth.

Average diesel prices hit their highest on record during the month, while food prices rose nearly 1% - the largest monthly increase since 2012.

ONS chief economist Grant Fitzner said prices of other goods such as toys, clothing and furniture also climbed.

"The price of goods leaving UK factories has also been rising substantially and is now at its highest rate for 14 years," he added.

What these figures lay bare is that the cost of living crunch is unavoidable.

Consumers have already been facing the financial reality of more expensive food, fuel and energy - all of which are necessities for pretty much every household.

Now the ONS has confirmed that price rises are more widespread.

Buying your child a toy for their birthday is more expensive than it was a year ago.

Getting a new sofa takes a bigger chunk of your disposable income.

The worry is that there is more of this to come, not least that analysts are predicting that a typical household energy bill will rise by £500 a year in October, on top of the annual £693 increase which takes effect at the start of April.

As pandemic restrictions have eased around the world, firms have faced higher energy, shipping and wage costs, which they have passed on to consumers.

Russia's invasion of Ukraine is now driving the price of oil and other commodities even higher.

Average petrol and diesel prices hit new record highs on Tuesday, according to the RAC, with petrol hitting 167.30p per litre and diesel hitting 179.72p.

RAC fuel spokesman Simon Williams said cheaper wholesale prices had yet to be passed on to consumers.

"The cost of filling an average 55-litre family car with petrol is now more than £92 and nearly £99 for diesel, making the £100 tank inevitable," he said.

How is the rising cost of living affecting you? Email: haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

WhatsApp: +44 7756 165803, external

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

Stevie Hall has been batch-cooking to save money, and may have to borrow from her auntie Pauline

Stevie Hall in Halifax says rising food, fuel and energy bills have nudged her into debt already.

She told the BBC she had been batch cooking to save money and is only driving when there is a real need.

"We're just trying to get by, I'm trying to stay upbeat about it," she said.

Andrew Selley is chief executive of Bidfood, one of the largest UK food wholesalers, which supplies more than 45,000 caterers and food firms.

He told the BBC's Today programme that food prices were rising fast. "We're seeing much bigger increases on things like cooking oil, chicken, cheese, butter. Nothing exotic - these are standard food staples and we're seeing much bigger increases in those at the moment."

Mr Selley said that compared with last year the price of diesel was up by 40% and electricity by 250%, "and those two things together make up over 10% of our total costs".

He added that a cut in fuel duty would help: "I mean, fuel is obviously a driver across the whole industry, both from getting [food] from the farmer to the manufacturer, from the manufacturers to ourselves and from ourselves to the customers, so any relief on fuel would help to mitigate some of those increases coming through."

- Published22 March 2022

- Published14 August 2023

- Published23 March 2022