Price rises trigger shift from saving to borrowing

- Published

A greater number of people are borrowing more and expecting to save less as the rising cost of living bites in the UK, official figures suggest.

Nearly one in five (17%) said they were borrowing more than they did a year ago, based on a survey conducted in March.

Some 43% said they would not be able to save money in the next 12 months.

At no time in the past two years has that figure been any higher, the Office for National Statistics (ONS) said., external

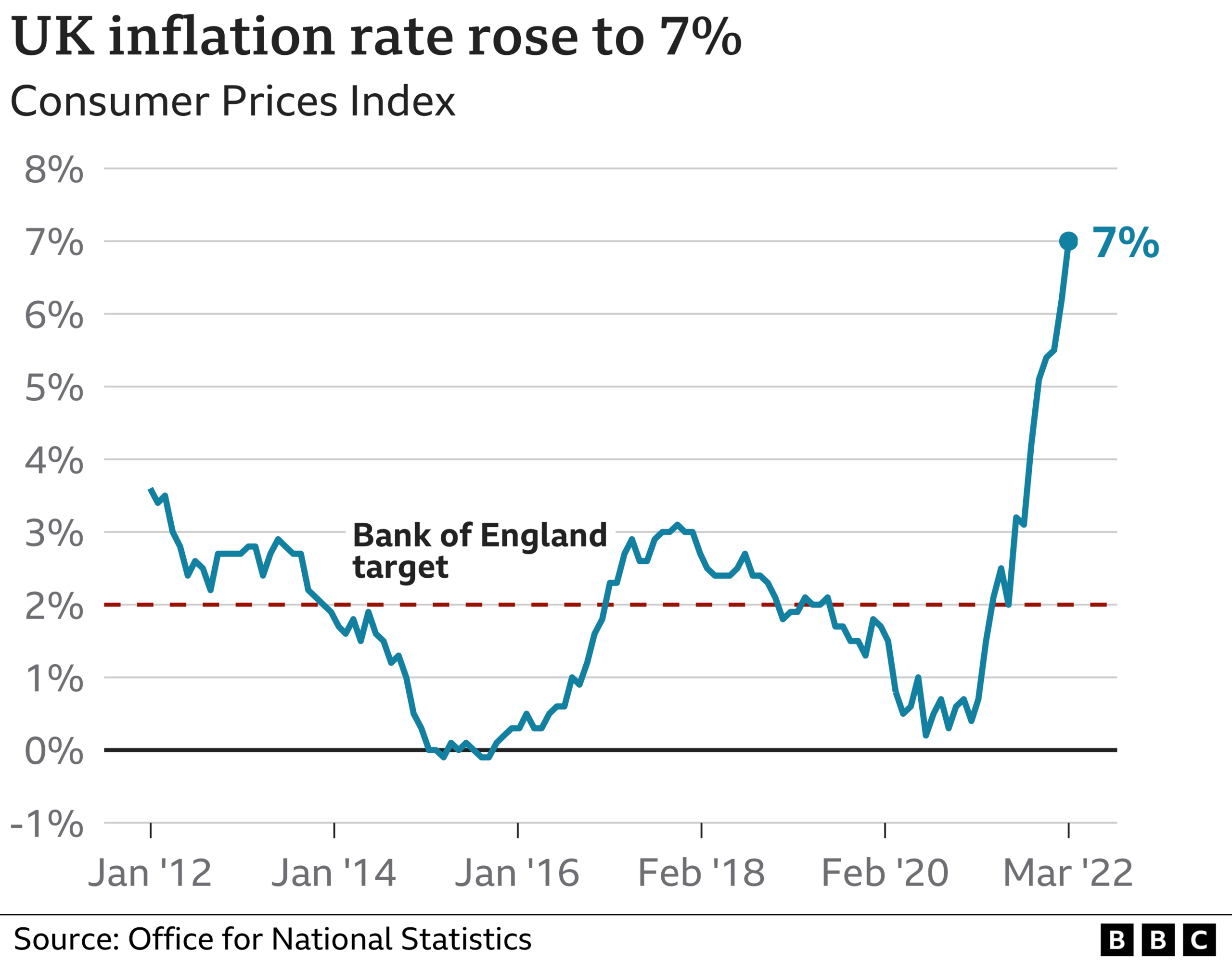

Surging price rises, for essentials such as food and fuel, have affected household budgets in recent months. The chief reason for the squeeze has been the rising cost of gas and electricity.

The ONS survey was conducted before a 54% rise in domestic energy bills took effect in April, but still takes into account the general trend of sharply rising prices, as measured by inflation.

The survey also showed that 23% of adults reported that it was either very difficult or difficult to pay their usual household bills in the previous month, compared with a year earlier.

That was a higher proportion that the 17% of adults who gave the same answer in November last year.

Even though the steepest rise in energy bills had yet to kick in, among those who pay energy bills, 43% reported that it was very or somewhat difficult to afford them.

The vast majority of people (87%) said their cost of living had risen in the previous month. Those hit harder were those renting properties and people living in less affluent areas, the figures showed.

"While rising household bills will affect most households across the country, they are more likely to disproportionately affect those in the most deprived areas," the ONS said.

Laura Suter, from investment platform AJ Bell, said: "Those who had already taken on debt will have had to borrow more and we will undoubtedly see more people turning to debt in the coming months as their pandemic savings run dry.

"Anyone struggling to meet the cost of their basic bills or housing costs needs to take action now, as the cost of living crisis is not going away any time soon. We are facing another increase in energy bills later this year and expected further rises to the Base Rate means that housing and borrowing costs are also likely to jump."

How have you been affected by the issues in this story? haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

WhatsApp: +44 7756 165803

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk, external. Please include your name, age and location with any submission.

War in Ukraine: More coverage

EXPLAINED: Why Russia wants to seize eastern Donbas

ON THE GROUND: Tourist town braces for assault

CHILDREN: 'He would see tanks in his dreams'

READ MORE: Full coverage of the crisis, external

Related topics

- Published1 April 2022

- Published13 April 2022

- Published25 April 2022