Tax cut 'gamble' will make debt unsustainable, says IFS

- Published

Tax cuts, due to be announced on Friday, are likely to push UK borrowing and debt to unsustainable levels, a leading economic think tank has warned.

The UK will spend billions helping households and firms with energy bills, but tax cuts will have a longer-term impact on public finances, the Institute for Fiscal Studies said.

Even after that support ends, the UK will borrow £100bn a year, it says.

Tax cuts amounted to a "gamble" that may not pay off, the IFS warned.

In Friday's mini-budget the government is expected to reverse a rise in National Insurance and scrap a planned increase in corporation tax, which could cost £30bn.

The Treasury has refused to publish a forecast of the UK's economic outlook alongside this Friday's mini-Budget.

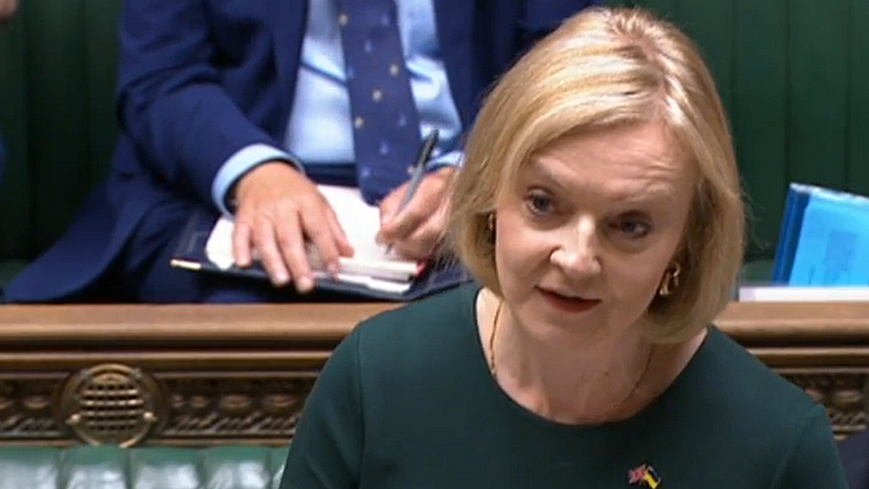

The IFS said it was publishing its own research, setting out "how much red ink" would be added to the country's financial position as a result of the strategy led by new prime minister Liz Truss.

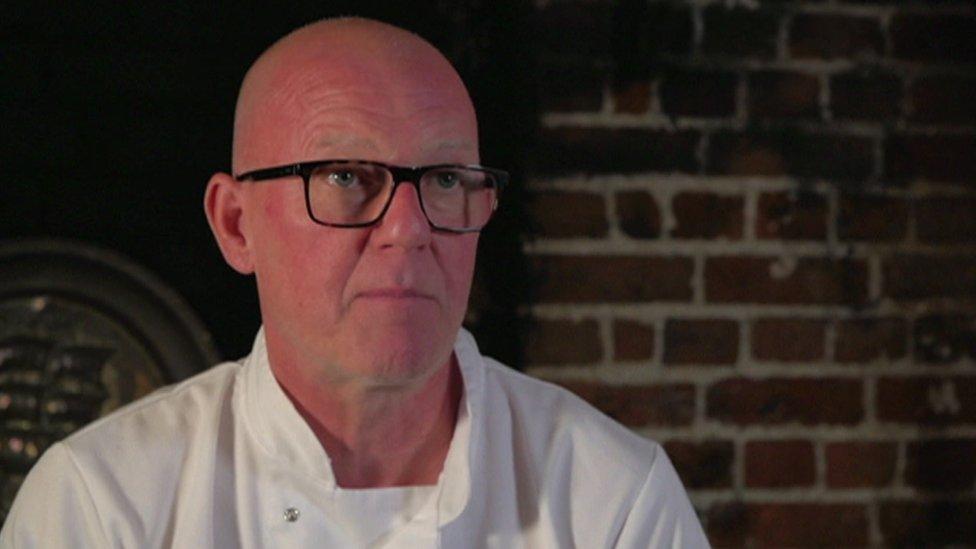

Carl Emmerson, deputy director at the IFS and an author of the research, said the government's tax cutting plans meant borrowing would remain high, even after the cost of subsidising energy bills had fallen away, adding to overall debt.

"While we would get to enjoy lower taxes now, ever-increasing debt would eventually prove unsustainable," Mr Emmerson said.

"The government is choosing to ramp up borrowing just as it becomes more expensive to do so, in a gamble on growth that may not pay off."

The sums indicated by the IFS are staggering. No doubt the government will argue they do not take into account their growth plans, but the government rejected the OBR offer to bring out an official forecast.

Hundreds of billions extra in borrowing seems a reasonable indication of the cost of the energy rescue packages, the economic shocks and then permanent planned tax cuts. An increase of this scale has not occurred in recent memory, without at the same time, the Bank of England in the market buying up government debts.

The government's own recently legislated rules for limiting borrowing would also be broken, if these forecasts are right.

While some of this is down to the spending on energy, much is down to the forecast increase in borrowing from permanent tax cuts.

There appears to be a clear break occurring in tax and spending policy. An official forecast would have revealed this change clearly. The reality will come soon enough.

Boost growth

The new prime minister has outlined her plans for the economy, arguing that cutting taxes will "boost business-led growth and investment".

The pace of growth that would be required to keep national debt at sustainable levels was not impossible but would require "a great deal of luck over a long period or a concerted change in policy direction," Mr Emmerson said.

The government has said it wants the economy to grow by 2.5% a year on average.

The IFS said finding a way to boost the UK's rate of economic growth would "undoubtedly help", but said the government should not underestimate the scale of that challenge.

Higher borrowing

Borrowing of nearly £100bn a year is significantly higher than previously forecast. In March, borrowing was predicted to be £50bn next year and well below £40bn by the mid-2020s.

The £100bn figure is equivalent to around 3.5% of national income, which is high in historical terms. In the 60 years before the financial crisis, borrowing averaged 1.9% of national income, the IFS said.The fluctuating wholesale price of energy means the cost of government subsidies for households, public bodies and private firms, is hard to estimate.

However the think tank calculates the planned tax cuts would leave government revenues around £30bn lower than they would have been.

Related topics

- Published20 September 2022

- Published8 September 2022

- Published30 August 2022