Cost of living: Charity warns Christmas debt could take years to repay

- Published

Money borrowed to pay for Christmas could take years to repay, according to debt advice charity StepChange.

The charity said worries about debt had led to a surge in enquiries as soon as the festive season was over.

Its warning comes as a poll for the BBC suggests fears over unmanageable debt.

A third of respondents to the poll who used credit to help get through Christmas and the holiday season said they were not confident about their ability to repay.

StepChange said it had advised more people on 3 January, the first working day after the festive break, than on any day last year.

"Christmas can put great financial pressure on people, causing some to rely on credit and spend more than they can afford. In some cases, this can lead to a debt hangover in the new year that may take many months or even years to repay," said Richard Lane, from StepChange.

He urged those struggling not to "suffer in silence".

The government has promised support payments to those most in need.

The online poll of 4,187 UK adults by Savanta Comres, external for BBC News, Morning Live and Rip Off Britain was carried out on 4-6 January. It found that more than eight in 10 of those asked were worried about the rising cost of living, with some losing sleep over it.

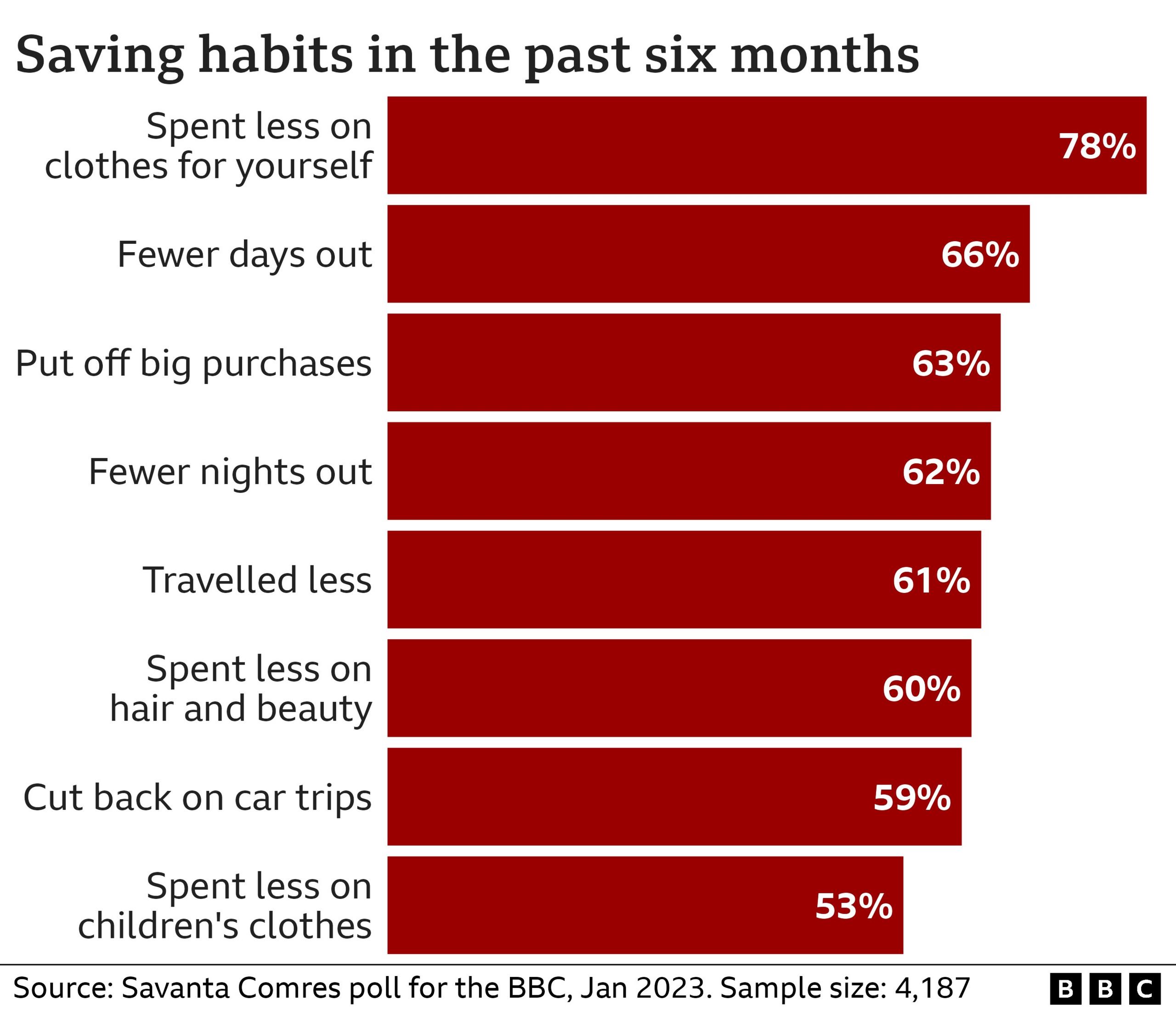

But it suggests people are finding different ways to cut costs to pay their bills. A majority of respondents have been turning the heating down and lights off, or reducing their grocery shop.

Natasha and Linda have found ways to save money

That is also the case for Natasha Miller and her mum Linda, who spoke to BBC News as they took six-month-old Lana and two-year-old Penny to a free story and rhyme session in Garforth, Leeds.

"We try not to bath the girls every night, that's the big one," Natasha said.

Linda added: "With food prices, we've tried to budget, to only buy the things we need and not waste as much. We switch off the lights, and we keep the temperature at 16C to 18C in the house.

"Normally we buy each other presents but we did a Secret Santa this year so we weren't buying for everyone."

The poll for the BBC shows half those asked paid for at least some of their Christmas and holiday season spending on credit, and many would have received credit card bills in recent days.

The Office for National Statistics, external has found almost one in 10 people (8%) have had a direct debit, bill or standing order they have been unable to pay in the past month, rising to 10% of those aged 16 to 29, and 13% of those aged 30-49.

Guide to dealing with debts

Work out how much you owe, who to, and how much you need to pay each month

Identify your most urgent debts. Rent or mortgage, energy and council tax are called priority debts as there can be serious consequences if you do not pay them, and so they should be paid first

Calculate how much you can cover in debt repayments. Create a budget by adding up your essential living costs like food and housing, and taking these away from any income such as your wage or benefits you receive

See how you could boost your income, primarily by checking what benefits you are entitled to, and whether you are eligible for a council tax reduction or a lower tariff on your broadband or TV package

If you think you cannot pay your debts or are finding dealing with them overwhelming, seek support straightaway. You are not alone and there is help available. A trained debt adviser can talk you through the options available

Source: Citizens Advice

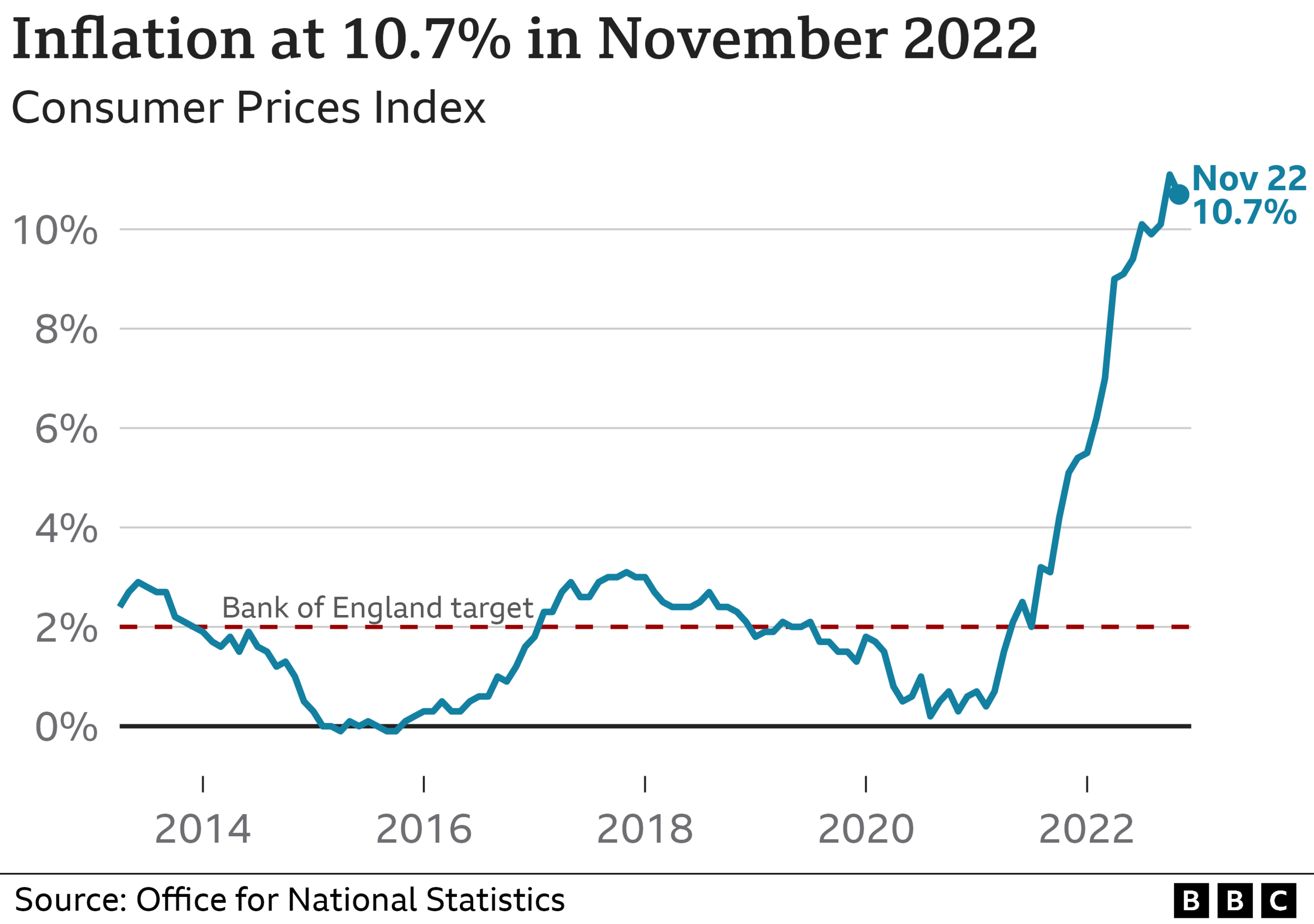

Prices are rising at a rate not seen for 40 years, with annual inflation hitting 10.7% in November. That means something which cost £100 a year earlier would typically have gone up in price to £110.70.

Inflation is beginning to ease, with price rises slowing, but the poll for the BBC suggests that higher bills - driven primarily by food and energy - are causing anxiety and people are trying to cut spending.

Comparable polls for the BBC in June and October last year showed more than eight in 10 people were worried about the rising cost of living.

This time, two-thirds of those said it was affecting their mental health. Among that group, 80% said they were feeling anxious, 62% had trouble sleeping and 50% had avoided social activities.

Energy bills are set to rise again in April, from £2,500 to £3,000 a year for a typical household. Yet the poll for the BBC suggests a number of people have already fallen behind on their energy bills, with renters (29%) or those in social and council housing (32%) most likely to have done so in the past six months.

To reduce energy bills, 68% of respondents said they had turned down their thermostat during the winter, about half (49%) had only heated certain rooms in their home and a similar proportion (45%) had bought warmer clothes.

Frankie Lakin says parents feel financial pressure

People are also trying to save money by spending less on clothes and cover bills.

Frankie Lakin, a mum of two from Kippax in West Yorkshire, said: "I personally sometimes feel the pressure of social media, you see all your friends doing stuff with their children and sometimes it's a bit overwhelming. I had to say no. I did cut it down a lot this year.

"You spend on your card and it is literally just a tap for everything and you don't realise how much you are spending."

The government has said eight million people receiving benefits and on low incomes will receive £900 cost-of-living payments in three instalments in the next 18 months to help pay the bills.

Ministers also confirmed that a £150 cost-of-living payment would automatically go to those with disabilities during the summer, a further £300 payment would be paid to pensioners during the winter of 2023-24, and benefits and the state pension would rise in line with prices in April.

"Tackling inflation is this government's number one priority, we have a plan that will help to more than halve inflation this year and lay the foundations for long-term growth to improve living standards for everyone," a Treasury spokesman said.

"We are also providing significant support to help people through these tough times by holding down energy bills and delivering up to £1,350 in direct cash payments to millions of vulnerable households."

Related topics

- Published11 January 2023

- Published3 April 2024

- Published6 December 2022

- Published7 November 2022

- Published2 December 2022