Confectionery firms try to sugar coat price rises

- Published

The giant trade show in Germany attracts confectionery firms from around the world

It's 10am and I'm already 15 minutes late for my first appointment.

The mind-bogglingly expansive floor space at ISM Cologne, the giant, annual sweets and snacks fair in Germany, has beaten me again.

It's heralded as the biggest confectionery trade event in the world, and when I was last here, in 2019, I was looking at how the industry was dealing with the introduction of sugar taxes.

In 2023 a whole new issue is front and centre - rocketing sugar and cocoa prices.

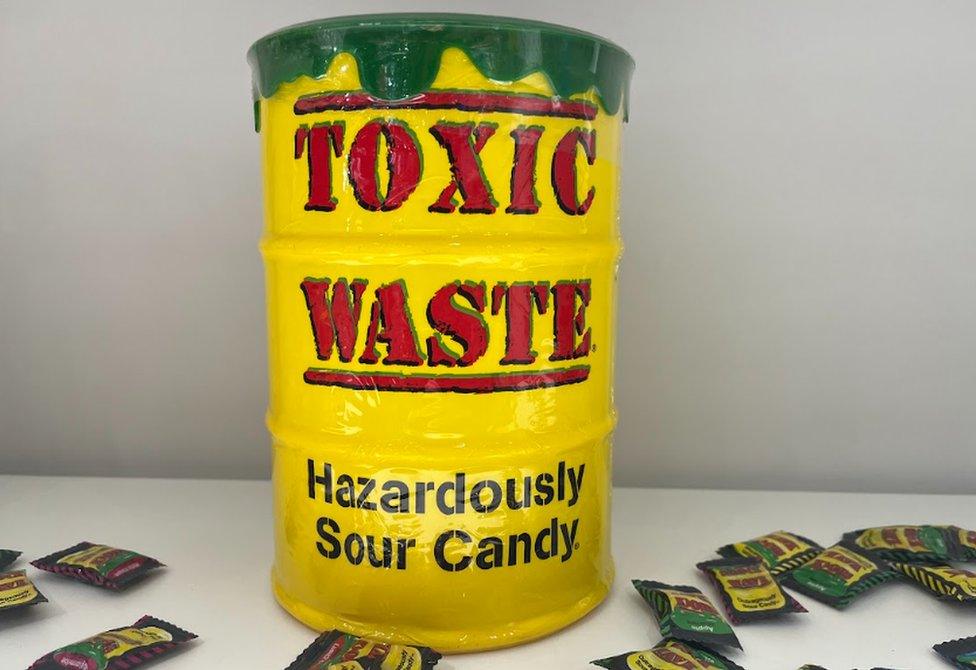

In amongst the brightly lit stands vying for attention, one brand name really stands out - "Toxic Waste". It is an extra sour sweet that is sold in containers made to look like mini industrial waste drums.

In the words of Hayley Peyron, marketing manager at US-based Candy Dynamics which makes the sweets: "The whole purpose around our candy is that it's supposed to be something so sour it almost needs to be contained."

Hayley Peyron admits that her firm, Candy Dynamics, has reduced pack sizes

And because the product is aimed at children, the company needs to be sensitive about passing on higher sugar costs, according to Ms Peyron.

"We've had conversations with our manufacturers about how we can get it to a price point that is still comparable to what we've had in the past," she says. "Because the last thing we want is there to be a huge price increase so kids can no longer afford it with their allowance. We've increased prices, but by a small amount, it would be within about 10%."

Another option is to decrease pack sizes, according to Ms Peyron. "We have started to do that, especially in the UK where there's been a big request for smaller pack sizes. And we try to provide a variety in the sizing, so that any consumer at any price point can enjoy the candy."

There are numerous ways of buying cocoa and sugar, but the prices quoted on the commodities markets are used as a benchmark indicator of the cost.

At the end of April, raw sugar was trading, external at more than 27 cents (22p) per pound, the highest it has been since 2011. Meanwhile cocoa is hovering around, external $3,000 a tonne, the highest since 2016.

There's a multitude of factors behind rising prices, from bad weather, to the war in Ukraine, according to Diana Gomes, an analyst at market research group Bloomberg Intelligence.

"The sugar price has been surging recently, because we are expecting a shortfall in terms of production, and the weather risk is really what's driving this inflationary pressure," she says.

This weather concern is focused on the growing expectation of meteorologists that 2023 will experience the latest El Niño climatic phenomenon, external.

Caused by warm water in the western Pacific Ocean moving eastwards, it results in much higher levels of rainfall in South America. For Brazil, the world's biggest producer of sugar cane, this would mean reduced yields, as the water would both disrupt harvesting and lower the sucrose content of the plants.

The El Niño is tipped to start around August, and would be the first since 2019. It comes after India, the world's second-largest sugar cane producer, has already seen lower yields this year due to excess rain.

Toxic Waste sweets are boldly named and marketed

Some 80% of the world's sugar supply comes from sugar cane, with sugar beet providing the remainder. Ms Gomes says that beet production in Europe has also been affected by the weather.

"In Europe, the dry summers over the last few years, and drought, means production has been hurt," she says.

The climate is also having an impact on cocoa crops, according to Ms Gomes. "Cocoa has passed the psychological barrier of $3,000 a tonne, and that is being driven by weather concerns, as well as the fact that the Ivory Coast and Ghana, two of the major cocoa-producing countries, have been struggling with very expensive fertilisers."

Russia is a major exporter of fertiliser, and the war in Ukraine has impacted supplies, adding costs to farmers around the world, and eventually therefore to consumers. Combine this with global wage inflation and price increases in other areas of the supply chain, and it means confectionery companies are having to make some difficult choices.

Global Trade

At the premium end of the market, Swiss firm Goldkenn specialises in making chocolates for the duty free, airport shopping market. Its range includes bars and coins covered in golden foil, so as to look like solid gold bullion.

It also has tie-ups with brands such as Jack Daniels and Captain Morgan for its line of liqueur chocolates and bars.

Linda Gay, the company's export manager, is philosophical about the challenges facing the business, where the US is the biggest market. "We need to increase our prices because of transport, cocoa, sugar and packaging, but consumers are ready to pay a bit more in order to get the product," she says.

Even so, Ms Gay says that there's a limit to how much people will pay, and that savings have to be made in other areas,

"We pay attention to everything, we try to get better quotations for transport, then for packaging we try to group and do a bigger volume at the same time to get a smaller price."

In another cavernous hall at the vast Koelnmesse exhibition venue where ISM Cologne is being held, Bill Gow, finance director of Scottish stalwart Tunnock's, says that its sales are holding up in the face of soaring costs.

Bill Gow says that Tunnock's has worked hard to absorb prices and boost productivity

The company's popular chocolate products include Teacakes, Caramel Wafer Biscuits and Snowballs.

"Since about March last year, our raw material costs have gone up 40%," says Mr Gow. "We've passed a small element of that to the consumer, but as a company we've taken the long-term view and are financing the vast majority of it."

Like Goldkenn, Tunnock's has been trying to find savings. "We can run the factory more efficiently," says Mr Gow.

"Over the past eight years we've spent approximately £60m on plant and machinery, and that gives us labour efficiencies, and efficiencies in terms of the scrap and yield we've achieved from our raw materials."

Currently global demand for sweets and chocolates appears to be holding up, as producers try to limit how much they pass cost increases onto customers.

Manufacturers hope that that consumer appetite will remain, especially if prices have to rise sharply in the future.