Customers withdraw record amount of savings in May

- Published

- comments

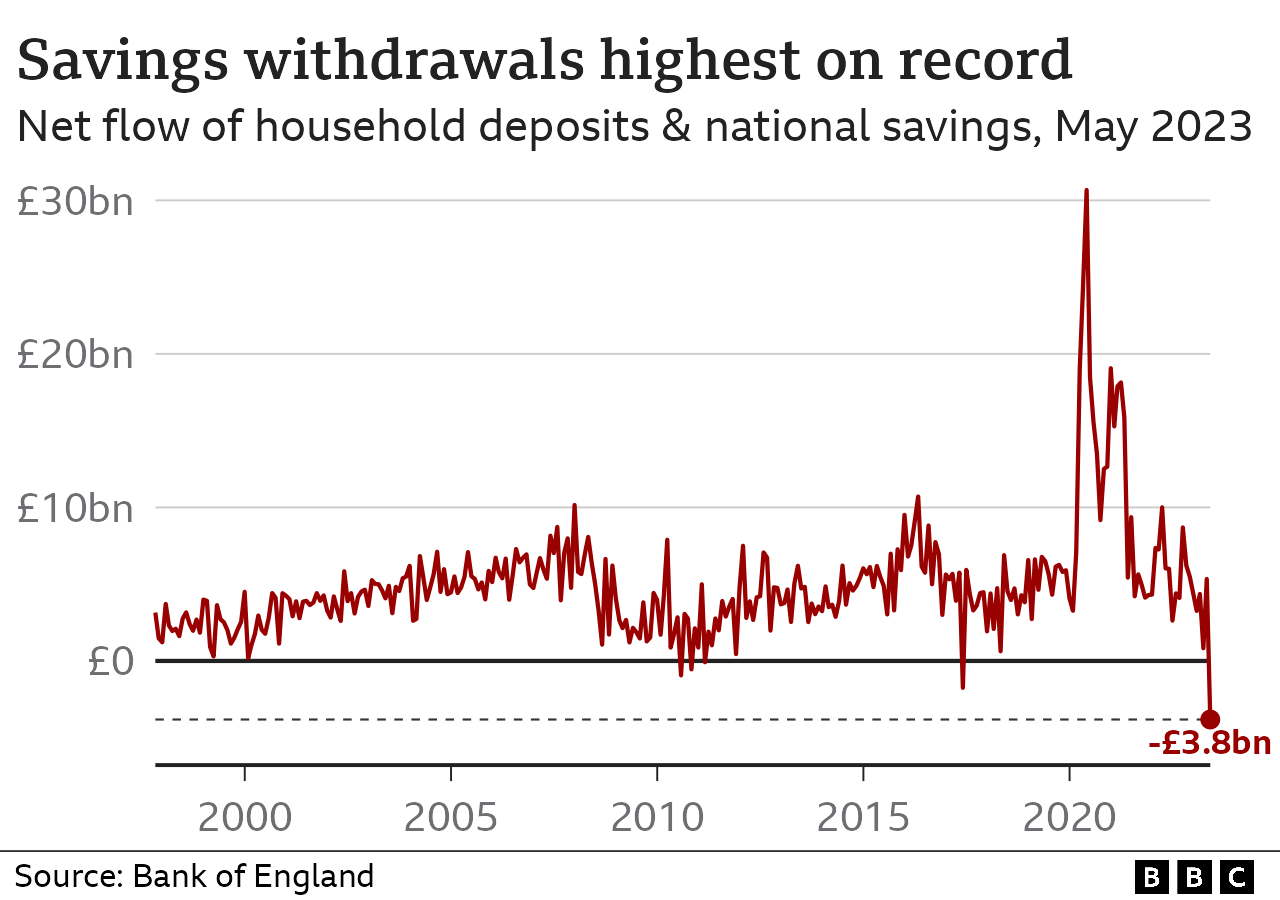

Billpayers dipped into bank and savings accounts at a record level in May, prompting warnings from charities about the ongoing high cost of living.

There was £4.6bn more withdrawn than paid into bank and building society accounts, the Bank of England said, external.

That was the highest level seen since comparable records began 26 years ago.

The rising cost of living, including grocery bills, mortgage payments, and rent, is putting household finances under strain.

Richard Lane, director of external affairs at debt charity StepChange, said it was vital that people were supported to build up savings to provide resilience against unexpected bills.

"This is the latest in a long line of warnings that more and more people are struggling to cope with the cost of living," he said.

"Cost pressures are everywhere and eroding people's financial headroom, leaving them more vulnerable to harmful borrowing and problem debt."

Pressure on banks

The latest figure marks a sharp turnaround from April when net deposits saw £3.7bn added to bank and building society accounts.

When savings held in National Savings and Investment accounts were also included in the total, there was a net withdrawal of £3.8bn made from accounts in May, compared with a £5.3bn increase in April.

Banks have been accused of offering "measly" interest rates to savers, and failing to adequately pass on the higher Bank of England base rate in the returns they offer.

Chancellor Jeremy Hunt said it was "taking too long" to pass on increases in interest rates to savers. People with instant access accounts were being particularly hit by the "issue that needs solving", he said.

UK Finance, the trade body for the banking sector, said: "Savings rates are driven by a number of factors, not just the Bank of England's bank rate - one key factor is whether someone wants instant access or can deposit money for a longer period of time."

But MPs on the Treasury Committee have raised the issue of savings rates not being raised in line with mortgage costs regularly in recent months.

Alice Haine, personal finance analyst at investment platform Bestinvest, said some savings deals had improved but savers still needed to be on their toes.

"Despite better savings rates on the table, households raided their savings pots. While many may be dipping into savings to meet rising living costs, savers should still shop around for the best deal available to them to ensure their money is working as hard as possible," she said.

Some households are also paying more in tax. New figures from HM Revenue and Customs, external show that there is expected to be an extra 1.3 million income taxpayers this financial year, compared with the previous 12 months, with the majority of these being women.

The chancellor has frozen the income tax personal allowance at £12,570 until April 2028. Basic rate taxpayers do not have to pay any tax on income below this level. Anyone receiving a pay rise that takes their income above this level will then start paying tax.

The chancellor has also frozen the point (threshold) at which people start paying the higher tax rates, and it was reduced for the highest rate in April.

This has contributed to the number of top "additional" rate taxpayers rising from from 555,000 last year to 862,000 this year. The total paying at the 40% income tax rate rose from 5.28 million to 5.59 million over the same period.

Former pensions minister Steve Webb, now a partner at consultancy LCP, said: "A combination of high inflation and frozen tax allowances means that well over eight million people aged 65 or over are now paying tax, a doubling in the last two decades."

The Bank of England figures also showed the number of mortgage approvals made to home buyers increased from 49,000 in April to 50,500 in May. Approvals for remortgaging saw a rise from 32,500 to 33,600 during the same period.

However, lenders are continuing to raise the rates they charge for new fixed rate deals.

Sign up for our morning newsletter and get BBC News in your inbox.

- Published26 June 2023

- Published29 June 2023

- Published28 June 2023

- Published8 June 2023