Mortgage rates: Average five-year fix rises above 6%

- Published

- comments

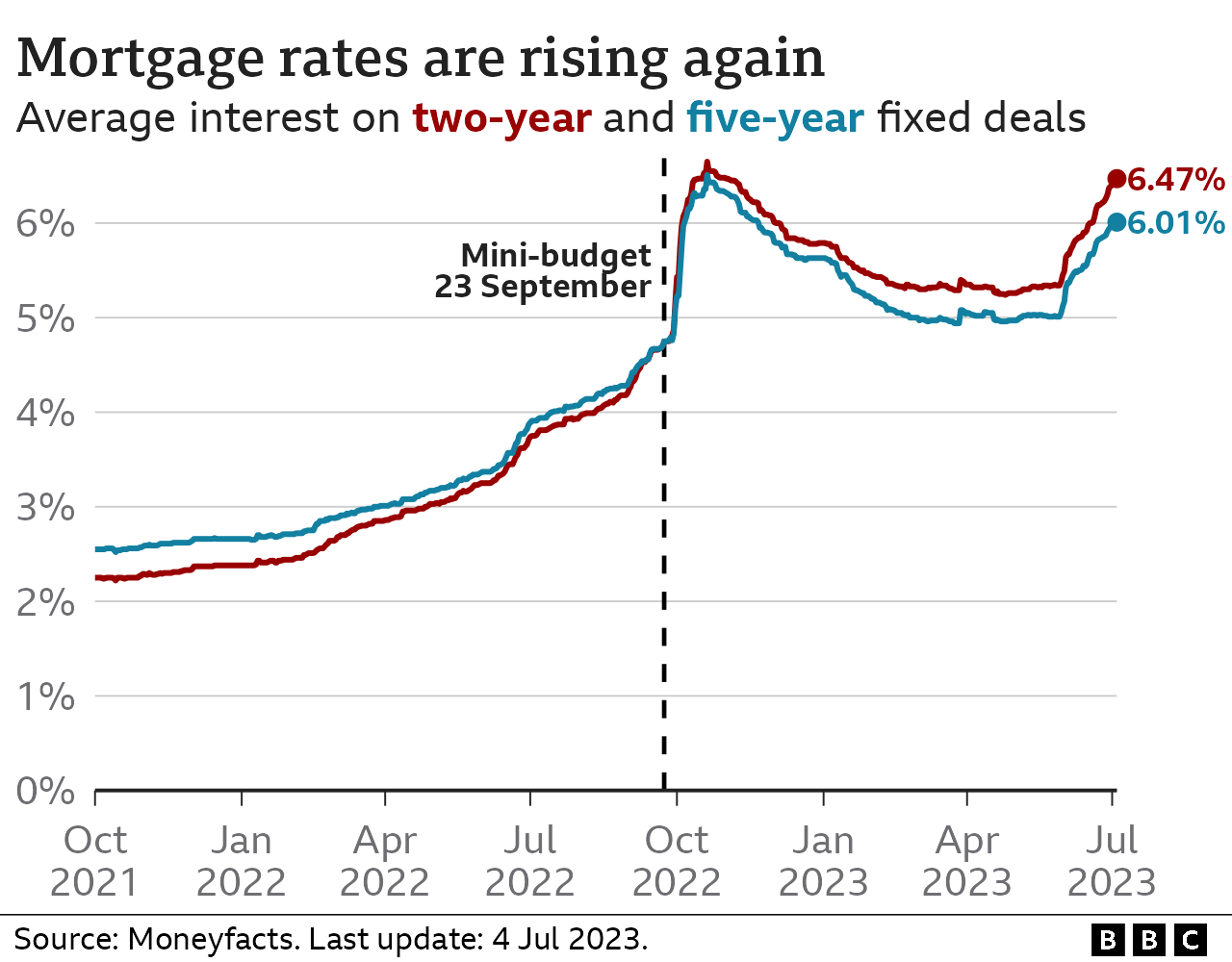

A typical five-year fixed mortgage deal now has an interest rate of more than 6%.

It comes after the Bank of England raised interest rates to a 15-year high of 5% last month, as it tries to bring down inflation.

Mortgage lenders have been increasing rates and withdrawing deals recently, driving up costs for homeowners.

Prime Minister Rishi Sunak has urged homeowners to "hold their nerve" over rising rates.

On Tuesday, the average rate for a five-year fixed mortgage stood at 6.01%, according to the financial information service Moneyfacts. The average two-year fixed deal is now 6.47%.

The last time those rates both topped 6% was in November last year, when interest rates rose sharply in the aftermath of then-Chancellor Kwasi Kwarteng's mini-budget.

But after a period of calm they have climbed steadily again in recent weeks.

However, while mortgage rates have risen rapidly, the rates on savings accounts have not gone up as fast.

With the average rate for a two-year mortgage now 6.47%, the average easy access savings rate is 2.45%, according to Moneyfacts. That is a gap of 4.02 percentage points.

Bank bosses have been summoned by the Financial Conduct Authority to explain the low saving rates on offer.

A year ago, typical rates on fixed mortgage deals were closer to 3%.

The rapid increase in rates is leaving people like Rose Askwith facing steep rises in their monthly payments.

The 38-year-old primary school teacher from Romsey in Kent will see her monthly payments go from £550 to £1,200 if she is put on a variable rate at the end of July.

She applied for a mortgage holiday for August but was refused, so is now racing to complete a new fixed deal.

The lowest she could find would keep monthly payments down to £800, but extends her mortgage term to 35 years.

"At the moment my biggest fear is August," she says. But even if she manages to get the new fix, things will be tight.

Rose Askwith says she is "in limbo" hoping for a new fixed rate deal by the end of the month

"The scary thing is being a single mum and making sure the children have a roof over their heads.

"Having to find the extra £300 that would have gone to the kids, or food, or funding my son at university. I've had to say, 'I cannot support you how I would want to.'"

The Bank of England has raised interest rates 13 times since December 2021.

The idea is that by making it more expensive for people to borrow money, and more worthwhile for them to save, they will spend less and price increases will cool.

But inflation - which measures the rate at which prices are rising - remained stubbornly high at 8.7% in May.

The prime minister has pledged to halve inflation by the end of the year, and has backed the Bank of England's rate rises.

On Tuesday, his official spokesperson said the government recognised it was a "very difficult time" for mortgage holders and renters, but that "the single biggest thing government can do is to work with the Bank of England in lockstep to reduce inflation".

The Bank of England's base interest rate is a key influence on mortgage rates. Expectations that the Bank could continue to raise rates, and that they will stay higher for longer, have been reflected in the funding cost of mortgages, hitting new borrowers, and those trying to re-mortgage.

Lenders have been pulling deals and putting up rates at short notice, while some have been inundated with demand and so forced to pull or raise rates again.

More than 400,000 people will see their existing fixed deals end between July and September, a comparatively high number. Many face the prospect of having to budget for monthly repayments that are hundreds of pounds more expensive than they have become accustomed to.

The recent rises in mortgage costs are also likely to have a knock-on effect on renters who could face higher payments as landlords seek to recoup the rising cost of higher mortgages. Squeezed landlords may decide to sell properties, which could lead to fewer homes available to rent, according to the National Residential Landlords Association.

However, in a move to help mortgage-holders, banks and building societies will offer more flexibility on repayment terms. Borrowers will be able to make a temporary change to their mortgage terms, then will be able to return to their original deal within six months, allowing some to have lower repayments for a short time by just paying the interest on the home loan.

Rising interest rates and mortgage costs weighed on UK economic growth in April, but Chancellor Jeremy Hunt said the UK has "no alternative" but to increase interest rates in an attempt to tackle rising prices.

What happens if I miss a mortgage payment?

A shortfall equivalent to two or more months' repayments means you are officially in arrears

Your lender must then treat you fairly by considering any requests about changing how you pay, perhaps with lower repayments for a short period

Any arrangement you come to will be reflected on your credit file - affecting your ability to borrow money in the future

How have you been affected by the higher mortgage rates? Email haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

WhatsApp: +44 7756 165803

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk, external. Please include your name, age and location with any submission.

Sign up for our morning newsletter and get BBC News in your inbox.

Related topics

- Published13 June 2023

- Published25 June 2023

- Published19 June 2023

- Published23 June 2023

- Published4 July 2023