Mortgage rates: Six reasons why the pain isn't as bad as it could be

- Published

Misery has been heaped on stretched homeowners and hopeful first-time buyers in recent days.

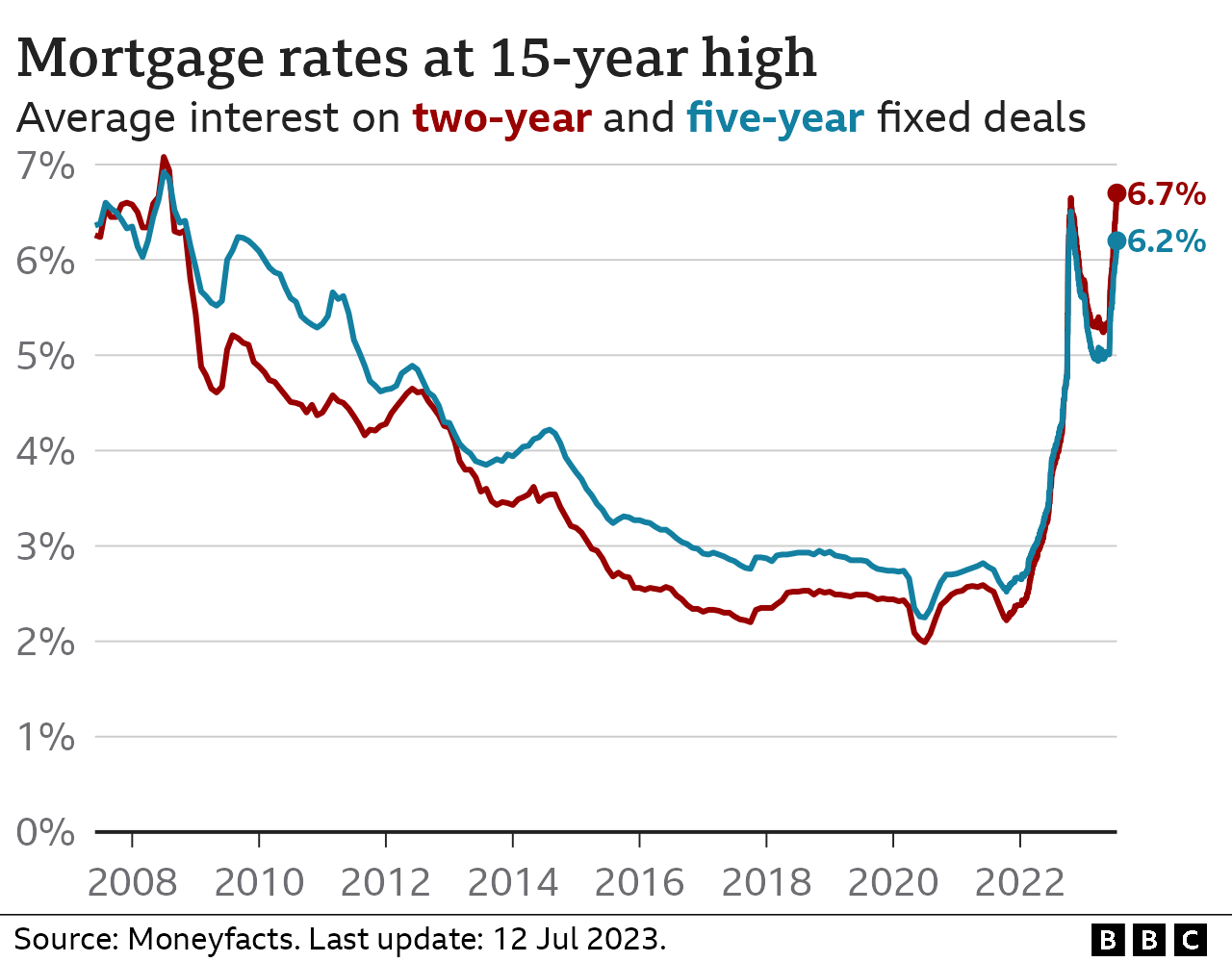

The cost of a mortgage has now hit a 15-year high, with the average rate on a two-year fixed deal approaching 7% - surpassing the level seen after the Liz Truss government's mini-budget.

One million people will see their mortgage bill rise by more than £500 a month by the end of 2026, the Bank of England has said.

Given the severity of the situation, you might expect a wave of homes being put up for sale and the housing market to be in freefall.

In the market downturn of the 1990s, keys were being handed over to lenders at a rate of 5,000 a month.

But that has not been the case so far this time, according to mortgage lenders.

People trying to buy a home still face difficult decisions, and many homeowners will be put under financial strain, but here are six factors that may explain why we may not see a repeat of crises of the past.

1. The chances of losing your home are slim

When somebody falls behind on mortgage payments and shows little prospect of being able to pay, a lender may seek to repossess the property.

However, in the first three months of this year, there were only 750 homes and 410 buy-to-let properties that were repossessed, according to figures from banking trade body UK Finance., external

Banks say they do not want to repossess homes and would much rather come up with a payment plan with their customer.

Everyone's tipping point from stretched borrowing to unmanageable debt is different, but the number falling over the edge so far is very low.

2. Higher house prices and savings create a buffer

During the pandemic, there were two significant trends among those whose incomes were relatively unaffected by illness and lockdowns.

The first was a race for space, which created high levels of demand from homebuyers. That raised house prices sharply.

In turn, that means millions of homeowners have more equity in the property. In other words, the difference between the value of the home and the mortgage is greater. When homeowners come to get a new deal, that could mean the home loan is not as expensive as it might otherwise have been.

The second trend was high levels of savings, as spending options such as overseas travel were diminished. Some of that money is now being used to pay down mortgages.

3. Some stress may have been helpful

When lenders received a mortgage application they would "stress test" the finances of the applicant to see if they were able to afford interest rates at a higher level before approving it.

Although the rules have now changed, it does mean that - now rates are higher - some people have not been saddled with unmanageable outstanding loans.

Critics said that stress testing, which began in 2014, meant some applicants were turned down by lenders, even though they could have paid the interest rate at the time.

Now, lenders are testing applicants to see whether they can cope with interest rates of 8% or 9% - although each lender's exact requirements are commercially sensitive.

What happens if I miss a mortgage payment?

A shortfall equivalent to two or more months' repayments means you are officially in arrears

Your lender must then treat you fairly by considering any requests about changing how you pay, perhaps with lower repayments for a short period

Any arrangement you come to will be reflected on your credit file - affecting your ability to borrow money in the future

4. Buyers and homeowners are being flexible

Faced with a rising interest rate and more expensive repayments, existing borrowers are considering their options to mitigate the higher bills.

That could include extending the term of their mortgage - although that does mean that ultimately they will pay more over a longer period of time. However, lenders are encouraging borrowers to discuss what can be done with them or a broker, rather than burying their heads in the sand.

First-time buyers too are open to changing their plans. At the Treasury Committee hearing in the Commons earlier in the week, Andrew Asaam, homes director at Lloyds Banking Group - the UK's largest mortgage lender, said: "People are either putting down a larger deposit or buying a smaller property because affordability is tighter.

"We won't lend as much now, so people are moderating what they can afford to buy."

5. Jobs have been relatively secure

Companies' borrowing costs, just like those of consumers, have been rising. However, so far, there have been no signs of big staff cuts.

The jobs market remains resilient. So, when someone has a secure job and a regular income, they might still be able to afford higher mortgage bills - even if it means some pain and a change of priorities.

Lenders say the most common reasons for people falling behind or having a home repossessed are generally life-changing events such as a job loss, or serious illness.

6. Landlords often don't have a mortgage

The interest rates being demanded for buy-to-let mortgages are higher than those for homeowners. Often, landlords are on interest-only deals, leaving them even more vulnerable to rate rises.

However, MPs heard that, of about 5.5 million properties in the private rental sector, only about two million are mortgaged.

That means some landlords may be immune to rate rises.

Tenants might feel the benefit of landlords not needing to pass on higher mortgage rates in higher rent. However, landlords' other costs are rising, as is the market rate for rent, so that quickly becomes a more complex picture.

Related topics

- Published9 January 2024

- Published12 July 2023

- Published13 July 2023

- Published8 January 2024

- Published8 July 2023

- Published25 June 2023

- Published11 July 2023

- Published23 June 2023