UK economy shrinks more than expected as rain and strikes hit

- Published

- comments

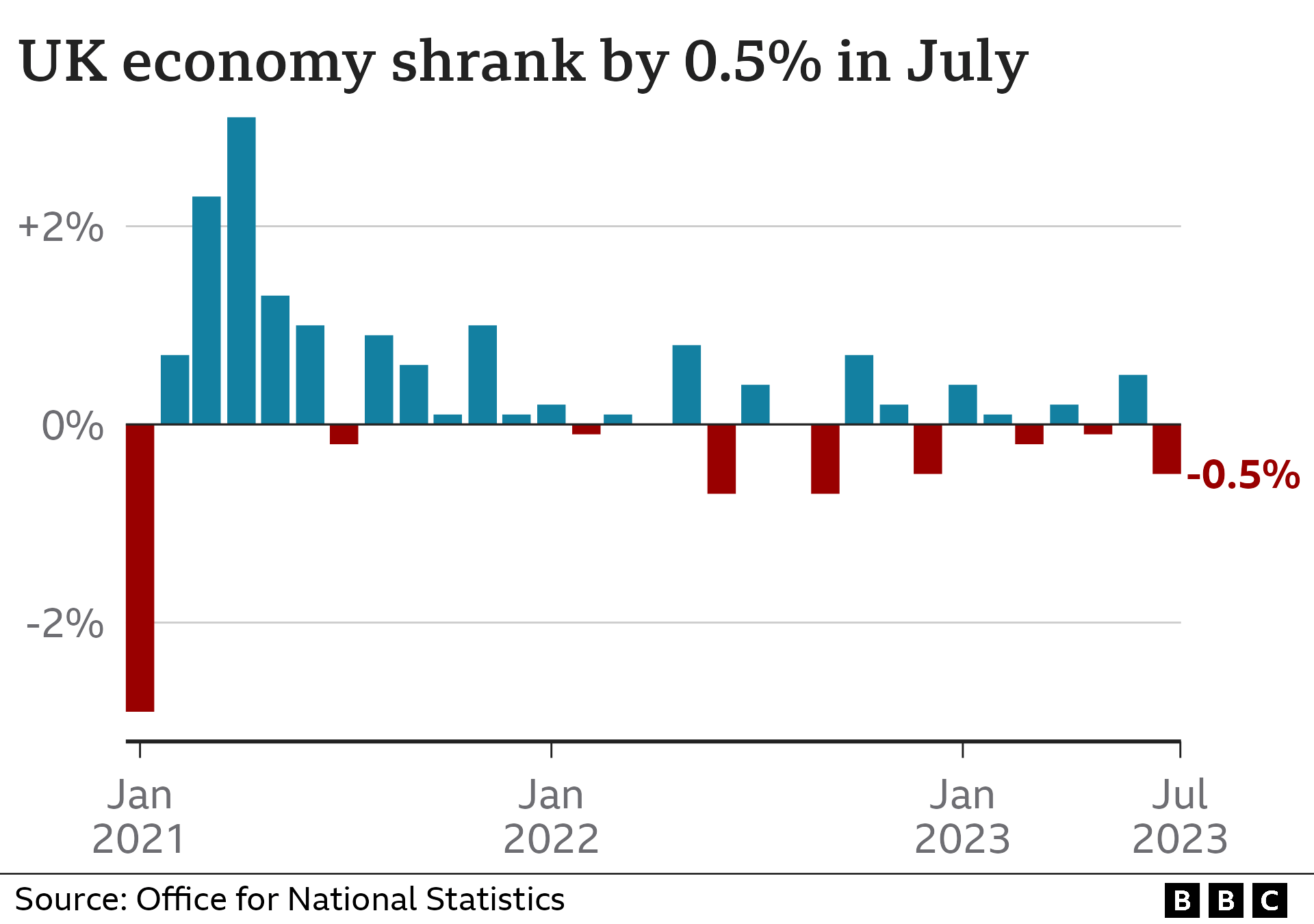

The UK economy shrank more than expected in July, driven by strike action by NHS workers and teachers, according to official figures.

Wet weather also hit the construction and retail industries, the Office for National Statistics (ONS) said, causing the economy to contract by 0.5%.

The figures were worse than analysts had predicted and continue a trend of weak economic growth in the UK.

But the ONS said the "broader picture" for the country looked "more positive".

Darren Morgan, director of economic statistics at the ONS, said that while July saw the economy shrink, output across the services, production and construction sectors had grown 0.2% in the three months to July.

He said "a busy schedule" of sporting events and increased theme park visits had provided a slight boost to the economy.

The drag on the economy for July was partly due to a fall in output from the services sector, which includes the NHS. The ONS said the drop was driven by the industrial action, with senior doctors and radiographers striking over pay on two days each, and junior doctors walking out on five days in the month.

Chancellor Jeremy Hunt said the latest economic figures showed "many reasons to be confident about the future" and that the UK economy was now on course to grow faster than Germany, France and Italy.

The figure produced by the ONS to show the health of the UK economy is known as gross domestic product (GDP).

GDP is a measure - or an attempt to measure - all the activity of companies, governments and individuals in a country.

If the figure is increasing, it means the economy is growing and people are doing more work and getting a little bit richer, on average.

But if GDP is falling, then the economy is shrinking which can be bad news for businesses. If GDP falls for two quarters in a row, it is typically defined as an economic recession.

The UK is currently not in recession, but there have been concerns over the economy's weak performance in recent months.

Rachel Reeves, Labour's Shadow Chancellor, said the new statistics on Wednesday marked "another dismal day for growth" and that the "Conservatives' low growth trap" was "leaving working people worse off".

Annie Rose, owner of horse riding company Cumbrian Heavy Horses, said July's wet weather affected her business because about 40% of her customers are tourists.

"When they have consistently poor weather, they'll go and do other things that are inside or they'll go on low level walks around a lake, that's not going to cost them a lot of money. Not sit on a horse in the pouring rain," she told the BBC.

She said many recreational riding stables had closed in the UK "simply because horse riding is expensive" and keeping the animals is proving too costly. She said the cost of hay to feed her horses had trebled from around £4,000 to more than £12,000 last winter, piling further pressure on her budget.

Paul Dales, chief UK economist at forecaster Capital Economics, suggested that July's economic figures could mean a "mild recession" has begun. but added he expected the Bank of England to raise interest rates a final time from 5.25% to 5.5%.

The Bank has been hiking rates in a bid to control the rate at which consumer prices in the UK have been rising, known as inflation.

The economic theory behind increasing rates is that by making it more expensive for people to borrow money, they will then have less excess cash to spend, meaning households will buy fewer things and then price rises will ease. But it's a balancing act as raising rates too aggressively could cause a recession.

Inflation fell to 6.8% in the 12 months to July, but the level is still more than three times the Bank's 2% target.

Households have been grappling with higher prices for everything from food to energy in recent times and wage growth, on average, has only just caught up with the rate of inflation for the first time in nearly two years.

But with interest rates at the highest level for 15 years, the cost of borrowing including for loans such as mortgages has soared, although people with savings should benefit and get better returns on their money.

The latest GDP figures released are an estimate of how the economy is doing by the ONS. It produces one of the quickest estimates of GDP of the world's major economies, about 40 days after the quarter in question.

At that stage, only about 60% of the data is available, so the figure is revised when more information comes in, and can change at a later date.

Dharshini David, chief economics correspondent, BBC News

Much as we all like to moan about the weather, there was more than abnormally heavy rainfall impacting July's GDP figures. While these are just an initial stab at estimating what activity was up to based on limited data, and could be a blip, the numbers are a reminder that we may be looking at a dampening for the economy.

Strikes - in health, education - impacted certain sectors. The pattern of bank holidays this year has caused some volatility in monthly numbers too. A wetter July for activity was perhaps inevitable after an economically glowing June. Such volatility is why economists prefer to look at trends over quarters - and activity did still perk up between May and July as a whole.

It was consumer spending that drove a resilient economy in the first half of the year - and that continued in some areas in July. Attendance at the likes of sporting activities and festivals did well. But was that partly down to true grit, a determination to brave the weather after splashing out on tickets and to treat ourselves after the lockdown years?

Or could it be a last splash? As fixed rate mortgages deals end, over half of residential mortgage holders and a bigger slice of landlords with buy-to-let loans have been exposed to higher interest rates, monthly repayments rising typically by hundreds of pounds.

The forthcoming data will be scrutinised as closely as meteorologists do their weather charts.

Related topics

- Published10 September 2023