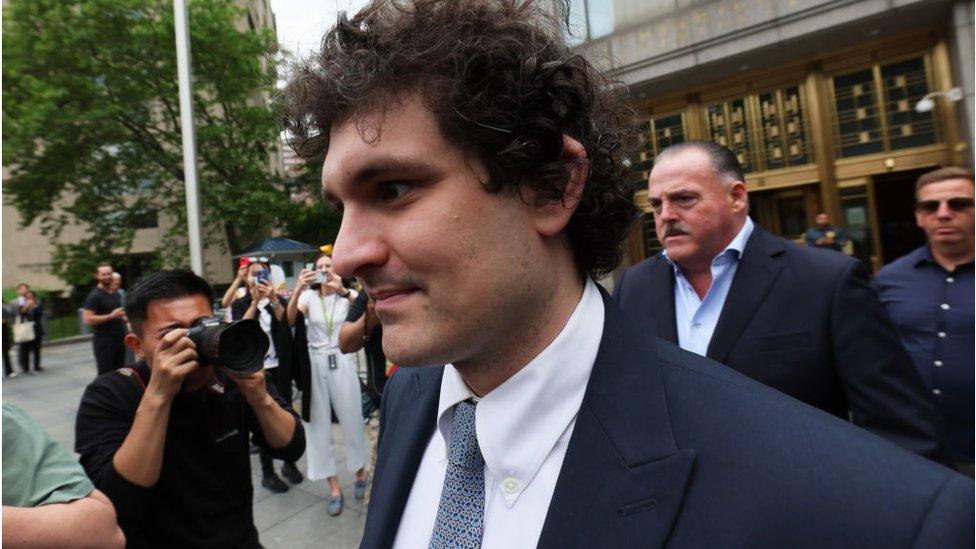

FTX: Prosecutors accuse Crypto King Sam Bankman-Fried of 'deceit'

- Published

Prosecutors have accused former crypto boss Sam Bankman-Fried of deceit as his US fraud trial draws to a close, claiming he repeatedly lied to customers, the public and the jury.

Mr Bankman-Fried is facing charges of fraud and money laundering.

Prosecutors say he precipitated the collapse of his cryptocurrency exchange, FTX, by stealing billions of dollars from customers.

He denies the charges and has claimed he was acting in "good faith".

Mr Bankman-Fried's defence lawyer said that prosecutors had failed to prove beyond reasonable doubt that the entrepreneur had acted with criminal intent.

But prosecutor Nick Roos said that arguments that Mr Bankman-Fried was not aware of what was going on at his company were not "remotely credible".

"This was a pyramid of deceit built by the defendant on a foundation of lies and false promises," he told the jury that will decide his fate.

"He took the money, he knew it was wrong and he did it anyway because he thought he was smarter and better… He thought he could talk his way out of it," he added. "That ends with you."

Prosecutors for the US government have argued that Mr Bankman-Fried directed special systems to be set up, such as a massive line of credit, that allowed his crypto hedge fund Alameda Research to take billions in FTX customer deposits.

They say he then spent the money to repay Alameda lenders, buy property, make investments and political donations.

When FTX collapsed last year, $8bn (£6.6bn) in customer funds was missing, owed by Alameda.

"There is just one person who had the motive" for such activity, Mr Roos said.

"This is not about complicated issues of crypto urgency, it's not about hedging, it's not about technical jargon," Mr Roos said. "It's about deception, it's about stealing, it's about greed."

He challenged Mr Bankman-Fried's testimony, saying he had become a "different person" depending on whether he faced friendly questions from his own lawyers or cross-examination by the government.

Lawyers for the two sides summed up their cases for the jury on Wednesday, staying late to finish. Deliberations are expected to begin on Thursday.

The entrepreneur denies the charges and has claimed he was acting in "good faith".

He spent much of his lawyer's closing argument facing the jury, his hands resting below the desk, unlike the morning, when he could be seen passing notes to his team and typing on the internet-disabled laptop he received a special exception to have in the courtroom.

'Bad business judgements not a crime'

His lawyer, Mark Cohen, said the special features of Alameda's account that prosecutors focused on had been set up for "valid business reasons, not to carry out some grand fraudulent scheme".

"In the real world, things get messy," he said. "Bad business judgments are not a crime."

He also said that prosecutors had sought to portray Mr Bankman-Fried as a "villain" and "monster".

The 31-year-old is a former billionaire and was arrested last year after the collapse of his firm, FTX.

The downfall left many customers unable to recover their funds.

Before the collapse of his companies, Mr Bankman-Fried was known for socialising with celebrities and appearing frequently in Washington DC and in the media with a head of wild curls to discuss the sector.

Mr Cohen said the government had introduced elements like Mr Bankman-Fried's messy hair and cargo shorts that were irrelevant to criminality.

He added: "Every movie needs a villain... And let's face it, an awkward high school math nerd doesn't look particularly villainous.

"So what did they do? They wrote him into the movie as a villain."

Mr Bankman-Fried faces decades in prison if convicted.

The rapid growth of his firm and his deal-making last year, when a market downturn hit other firms, earned him the moniker the "Crypto King".

During the trial that began early in October, the entrepreneur admitted he had made "mistakes" in managing his business empire, but said that he never committed fraud.

He depicted himself as overwhelmed by work and claimed he only became aware of the issues facing Alameda when it was too late.

He said the problems at the company arose because his instructions were ignored by employees, including his former girlfriend.

Related topics

- Published27 October 2023