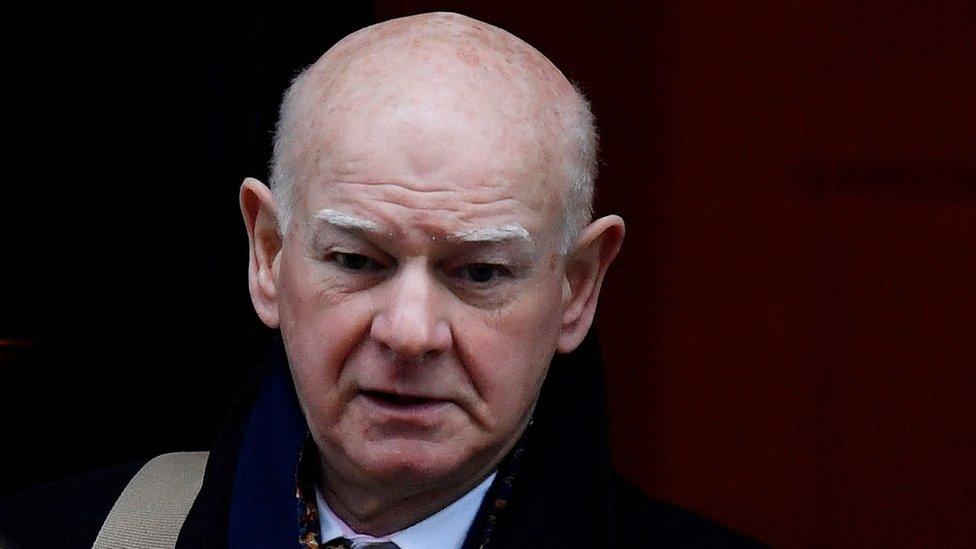

Sir Howard Davies: Not that difficult to buy a home, says NatWest chair

- Published

- comments

Sir Howard Davies: Not that difficult to buy a home, says NatWest chair

NatWest's chair has said he believes it is not currently "that difficult" for people to get on the housing ladder.

Sir Howard Davies said people have always had to save for a deposit but admitted they had to save more today, warning of "easy access" to credit.

Critics said his comments on the BBC's Today programme were "astounding" and "out of touch with reality".

Sir Howard later sought to clarify his remarks, saying he "did not intend to underplay" the challenges buyers face.

"My comment was meant to reflect that in this context, access to mortgages is less difficult than it has been," a statement said. "I fully realise it did not come across in that way."

The average price of a UK property is currently £287,105, according to latest figures from Halifax, the UK's biggest mortgage lender.

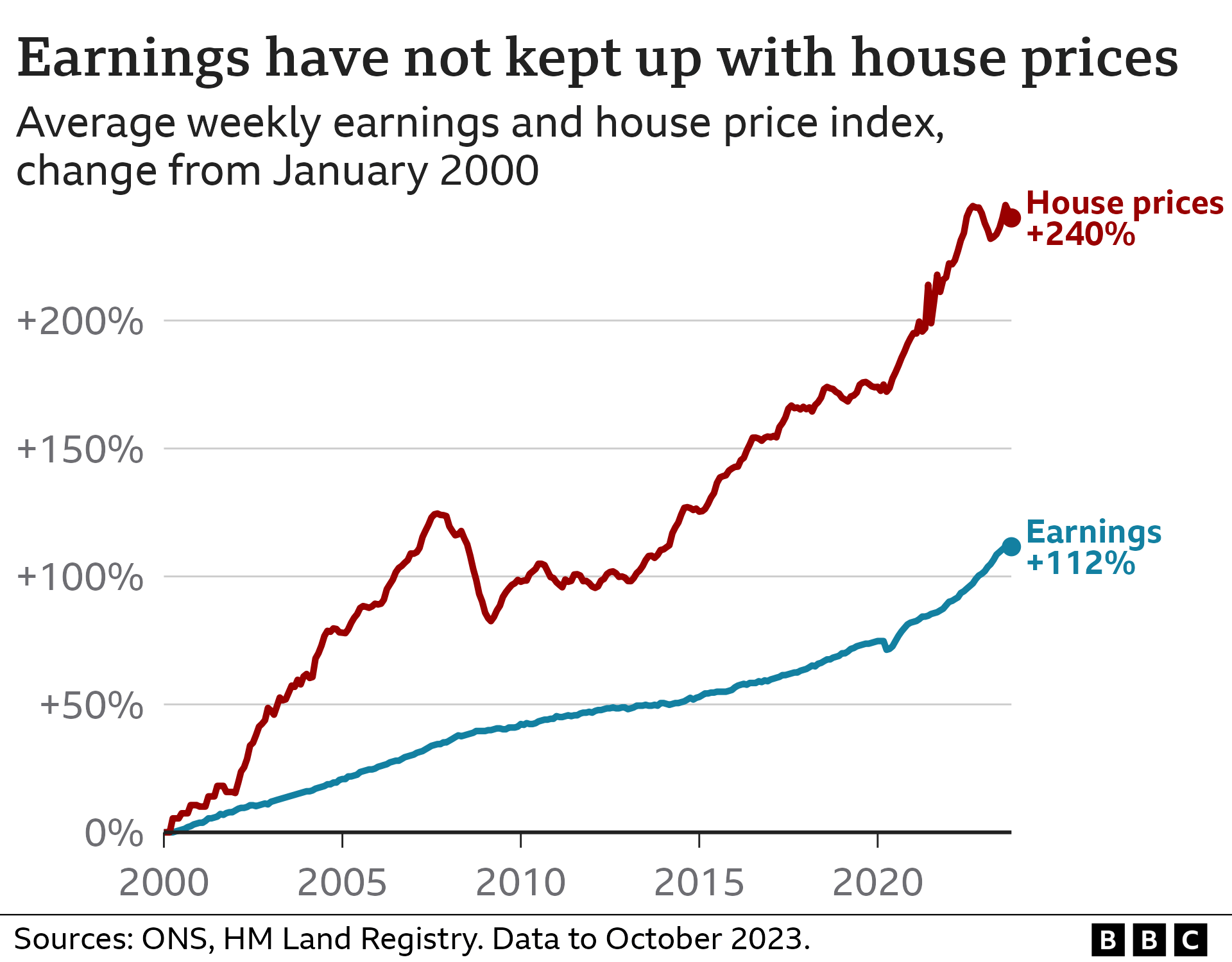

Typically, borrowers need a deposit of at least 10% of a property's value to get a mortgage. With the gap between house prices and average earnings widening over decades, saving enough money to put down initially is the biggest hurdle for many hoping to buy a home.

It is also one factor in why the average age of a first-time buyer has risen to 32.

In the interview, Sir Howard was asked when he thought it would be easier for people to get on to the property ladder in the UK. He replied: "Well, I don't think it's that difficult at the moment. You have to save, and that's the way it always used to be."

Pressed on his reasoning, the NatWest chair admitted people found it "difficult to start the process" in saving, but said it was also due to fundamental changes in the housing market seen in the wake of the 2008 financial crisis.

"What we saw in the financial crisis was the risk of having people being able to borrow 100% and then suffering severe falls in the equity value of their houses and having to leave and having a bad credit record so there were dangers in very, very easy access to mortgage credit," he added.

'Ludicrous'

Ben Twomey, chief executive of campaign group Generation Rent, said Sir Howard's comments were "astounding to hear from a senior banker".

"What planet does he live on?" he added.

Katy Eatenton, a mortgage and protection specialist at Lifetime Wealth Management, called Sir Howard's comments "ludicrous" and "totally out of touch with reality".

"The cost of living is the highest it has been, rents are increasing year on year and house prices, interest rates and the lack of first-time buyer schemes are all adding to the difficulty in getting on the property ladder," she said.

Sir Howard has been chair of NatWest, which is 39%-owned by the taxpayer, since 2015, having previously been the deputy governor of the Bank of England.

He receives a salary of more than £750,000 a year and is due to stand down in April.

Sir Howard said later on Friday that he recognised the difficulty in buying a home, acknowledging it "is very tough for first-time buyers".

He said the role of banks was to "lend responsibly and support customers to build a savings habit and move towards home ownership".

While people have to save more cash for a deposit, the rising cost of living in recent times has hindered many people's ability to set money aside.

Inflation - the rate prices rise at - hit a 40-year high in 2022 and as a result, the Bank of England has increased interest rates to try to slow it down, making the cost of borrowing money more expensive.

Renters hoping to save have also seen their monthly outgoings rise sharply, with a new let costing £1,201 a month on average, according to Zoopla. High demand has driven the increase, while supply has also narrowed with some private landlords selling up as a result of higher mortgage rates.

Mr Twomey, of Generation Rent, said the cost of rent was making it "incredibly hard" for people to buy a home, with tenants handing "a third of our wages every month over to our landlord".

He argued the circumstances to save for a deposit were now "far worse", with the time required for the average earner in England to save enough increasing to almost 10 years.

He said more homes needed to be built, including social housing, to ease pressure on the market.

Torsten Bell, boss of the Resolution Foundation think tank which focuses on improving living standards, said it was "increasingly not true" that people save for a house deposit, due to half of first-time buyers in their 20s getting help of an average of £25,000 from their parents.

Prior to Sir Howard's comments, Mr Bell said the most common living arrangement for an adult aged between 18 and 34 in 1997 was "being in a couple with children" but now it was "living with your parents"., external

But there are signs pressure on mortgage-holders is easing, with several big lenders announcing cuts. Many homeowners coming off fixed-rate deals will, however, still face big repayment increases.

On Friday, the average two-year fixed rate stood at 5.83%, while a five-year deal was 5.43%, according to financial information service Moneyfacts.

Kim Kinnaird, director at Halifax Mortgages, said with mortgage rates easing, buyers' confidence could increase in the coming months.

Halifax said house prices rose for the third month in a row in December, but it forecast a fall this year with buyers perhaps becoming more cautious due to economic uncertainty.

The lender's figures only take into account buyers with mortgages - about two-thirds of all sales - and do not include those who purchase homes with cash or buy-to-let deals.

Separate figures from the Bank of England published on Thursday showed the number of mortgage approvals rose slightly in November, which could be seen as a sign of more confidence from buyers.

- Published28 July 2023