Are we going to get a 'pudding tax'?

- Published

- comments

After a Christmas of over-indulgence for many, the idea of a "pudding tax" may seem like a good idea.

Public health experts have suggested it may be needed to tackle the high rates of sugar consumption.

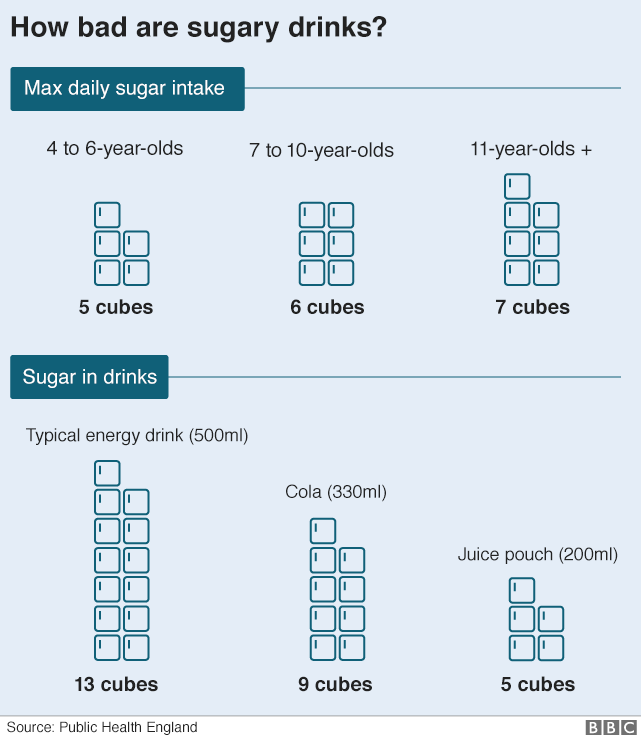

By the age of 10, the average child has exceeded the recommended level of sugar intake for an 18-year-old.

The news prompted Public Health England chief nutritionist Dr Alison Tedstone to suggest there may be a case for introducing a sugar tax on puddings.

Don't we already have a sugar tax?

Yes. A sugar tax was introduced in April 2018, but it just applies to fizzy drinks.

The levy is applied to manufacturers - whether they pass it on to consumers or not is up to them. There are 457 producers registered for the levy.

Drinks with more than 8g per 100ml face a tax rate equivalent to 24p per litre.

Those containing 5-8g of sugar per 100ml face a slightly lower rate of tax, of 18p per litre.

Pure fruit juices are exempt as they do not carry added sugar, while drinks with a high milk content are also exempt due to their calcium content.

Originally, the Treasury forecast it would raise more than £500m a year, but that has now been reduced to £240m because some manufacturers have reduced the sugar content in their products.

In England that income is being invested in school sports and breakfast clubs.

Products such as cakes, biscuits, puddings and other foods are not covered by the tax.

Puddings are in the firing line

But that does not mean puddings are not being targeted in any way.

They are covered by a separate initiative that is encouraging manufacturers to reduce the sugar content of those items voluntarily.

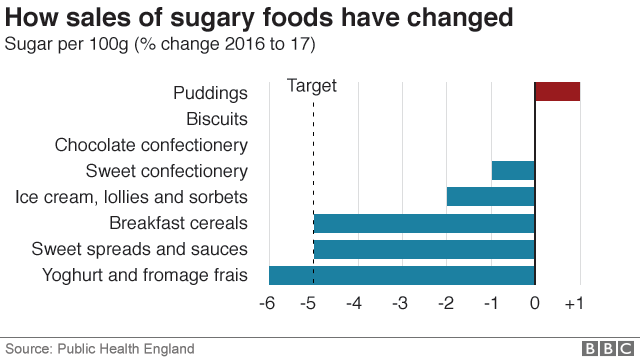

Public Health England launched a sugar reduction programme in 2017 to cut the amount of sugar in popular foods by a fifth by 2020.

It identified 10 categories of foods. Puddings is one, and others include yoghurts, cereals and chocolate sweets.

The programme is based on the sugar levels consumed.

So, to hit the target, industry must not only produce lower-sugar alternatives but also persuade consumers to buy more of them.

How much sugar are we consuming?

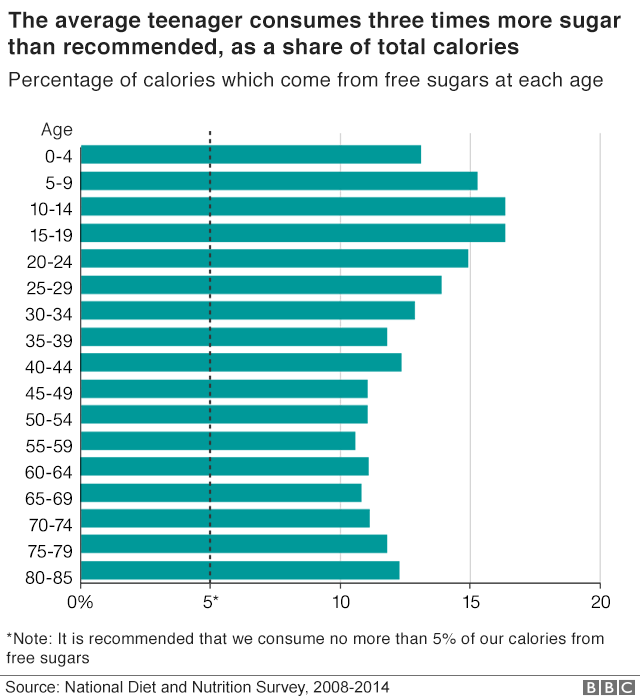

Too much. All age groups are having more than the recommended amount with teenagers consuming three times more than they should, according to government guidelines.

There is some evidence from the National Diet and Nutrition Survey that the amount being consumed has begun to fall over the past decade.

However, this relies on a self-reported survey where people are expected to remember what food and drink they have had - and research suggests this approach leads to an underestimation of consumption.

The high levels of sugar consumption have been linked to obesity.

More than one in five children are overweight or obese when they start primary school and by the time they finish that has risen to one in three.

When it comes to sugar, 10% of a child's intake comes from soft drinks, but more than twice that comes from puddings, ice cream and sweets.

Is a 'pudding tax' going to happen?

Dr Tedstone is not the only person to float the idea of extending the sugar tax.

Before Christmas, England's Chief Medical Officer Dame Sally Davies said there needed to be more taxes on unhealthy products, as she was not yet convinced industry could be relied on to act voluntarily.

But ultimately the decision will be the government's.

While it is not being ruled out, there is a desire to see how the sugar reduction programme is going first.

There has already been a one-year progress report.

It showed progress in some areas, particularly for yoghurts, but not in other areas.

In fact, sugar consumption from pudding actually increased, which may explain some of the interest in the pudding tax at the moment.

Public Health England believes it is too early to judge the success of the programme.

A second-year report is due out later this year and a close eye will be cast over how the different manufacturers are doing.

Until then, the idea of a pudding tax will remain on the shelf - an option but not one yet ready to be deployed.

- Published2 January 2019

- Published8 February 2017

- Published8 February 2017

- Published6 January 2017

- Published12 December 2016

- Published13 September 2016