Goodnightpublished at 21:30

That's it for us tonight. But join us tomorrow from 6am when we'll be reporting on the latest for BHS, as well as results from oil giant BP and Costa Coffee owner Whitbread.

BHS retailer files for administration

Almost 11,000 jobs under threat

Retailer's 164 UK stores will continue to trade

Pensions Regulator to investigate

Collapse is the biggest retail failure since the fall of Woolworths in 2009

Russell Hotten

That's it for us tonight. But join us tomorrow from 6am when we'll be reporting on the latest for BHS, as well as results from oil giant BP and Costa Coffee owner Whitbread.

Wall Street has closed slightly lower, hurt by a fall in energy shares after oil prices slipped. The Dow Jones closed 0.15% lower at 17,977.24, while the S&P dropped 0.18% to 2087.79 and the Nasdaq lost just 0.2% to 4895.79.

Local investors have cheered Saudi Arabia's new economic reforms aimed at moving the country away from its dependence on oil profits.

The Saudi stock market jumped 2.5% after news the changes were approved by the Saudi cabinet.

"If these economic reforms and liberalisation can be successfully implemented over the next five to 10 years, future economic and political analysts may end up identifying this current oil price decline as a blessing in disguise for Saudi Arabia and rest of the Gulf region," said Shakeel Sarwar, head of asset management at Bahrain's Securities & Investment Co.

The US Justice Department has approved Charter Communications proposed purchase of Time Warner Cable and Bright House networks, which would create the second-largest broadband provider and third-largest video-provider.

Following the deal, the merged company will be called New Charter. Under terms, New Charter agreed to refrain from telling its content providers that they cannot also sell shows online, the Justice Department said in a statement.

The Justice Department wanted to ensure that cable companies do not stop video from moving online. The Justice Department valued the purchase of Time Warner Cable at $78bn and Bright House at $10.4bn.

Oil prices fell more than 2% on Monday as data pointed to fresh US crude stocks. US crude was down $1.09, or 2.5%, at $42.64 a barrel. Brent closed down 63 cents, or 1.4%, at $44.48.

Image source, PA

Image source, PAFacebook is developing a stand-alone camera app, similar to disappearing photo app Snapchat, the Wall Street Journal reports. The WSJ cites unnamed sources as saying the project is in its early stages and may never come to fruition. The WSJ also says Facebook is planning a feature that allows a user to record video through the app to begin live streaming.

Volkswagen has yet to fix any of the 1.2 million cars in the UK affected by the diesel emissions scandal, transport minister Robert Goodwill told the Commons Transport Select Committee.

"They haven't fixed any cars yet, I'm disappointed to announce, and they will need to have their fix approved by us before they do it," he told the committee on Monday.

US stocks have failed to pick up in afternoon trading, continuing a day of losses on the major markets after European and Asian shares also fell.

The Dow Jones is currently down 80.37 points, or 0.45%, to 17923.38, while the Nasdaq is 15.08 points, or 0.31%, lower at 4891.15.

It follows a decline in the dollar and a 0.9% drop in the price of Brent Crude to $44.70.

We ask what has prompted a major rethink of Saudi Arabia's future plans.

The Saudi Arabian government wants to make the country less reliant on oil. It's approved a plan aimed at modernising the economy over the next fifteen years. Measures include creating a $2tn global investment fund, and selling a small number of shares in Aramco, the biggest oil company in the world, which is currently entirely state owned. John Sfakianakis is a former adviser to the Saudi economic minister and now director of economics at the Gulf Research Center in Riyadh. Alex Ritson asked him where the money for the $2tn fund was coming from.

1

This Oppenheimer Blue diamond may fetch $45m (£31m) when it is offered at auction next month, says Christie's. The rectangular-cut 14.62-carat stone will feature among 280 lots from 19th century pieces to contemporary designs.

Last year, a rare and flawless Blue Moon Diamond sold for $48.4m.

Image source, PA

Image source, PAThere are no plans to make immediate redundancies at high street chain BHS after it fell into administration, business minister Anna Soubry says.

Read MoreBHS statement

Conservative MP Richard Fuller is worried about the BHS pension scheme, and wonders if the retailer's problems are the result of the "unacceptable face of capitalism".

Business minister Anna Soubry replies that the pensions regulator should be allowed to do the job of investigating. But she adds: "If there is any suggestion of impropriety, we will come after people."

BHS statement

House of Commons

House of Commons

Parliament

Business Minister Anna Soubry responds to the SNP's Hannah Bardell saying it is "important not to talk down" BHS while its shops remain open and staff have not lost their jobs.

BHS statement

House of Commons

House of Commons

Parliament

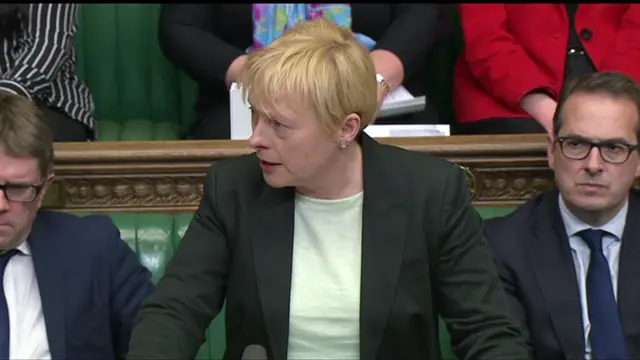

Responding to the government statement, shadow business secretary Angela Eagle says former BHS owner Philip Green has "questions to answer" over his handling of BHS, which he sold last year for £1.

House of Commons

House of Commons

Parliament

Business minister Anna Soubry now rises to make a statement on BHS.

The retailer has filed for administration putting almost 11,000 jobs at risk. BHS has debts totalling £1.3bn and a pensions deficit of £571m.

The company’s pensions debt is said to have put off potential buyers.

London shares close lower, dragged down by mining stocks. The FTSE 100 index fell by 49.52 points, or 0.78%, at 6260.9, with Anglo American and BHP Billiton among the biggest losers. It comes after Asian markets sank again, following pre-weekend losses on Wall Street.

It is a busy week ahead globally, with policy meetings at the US Federal Reserve and Bank of Japan as well as earnings reports from major firms.

FTSE 100 winners included Imperial Brands, Berkeley Group, British Land Company, and ITV.

On the currency markets, the pound rose 0.56% against the dollar to $1.4489, and was 0.06% higher against the euro at €1.2856.

BBC transport correspondent Richard Westcott tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesUS newspaper group Gannett bids $815m (£563m) for rival Tribune Publishing to create a powerhouse combining USA Today with the Los Angeles Times and Chicago Tribune.

The plan "would deliver substantial strategic and financial benefits for the combined company," says Gannett chairman John Jeffry Louis. Gannett chief executive Robert Dickey says the deal "would bring together two highly complementary organizations with a shared goal of providing trusted, premium content for the readers and communities we serve".

Tribune's board says it will review the offer and its "numerous contingencies" and would "respond to Gannett as quickly as feasible."

Image source, BAE Systems

Image source, BAE SystemsQuote MessageOur stewards are clear in their determination to make sure the UK government keeps its promise and will use everything in their armoury to defend the UK's historic ability to design and build its own warships. Defence ministers in Westminster should not underestimate their anger or the feeling of betrayal which has resulted from the government's backtracking and BAE's review. Our stewards today have signalled that they will not stand by and allow shipbuilding on the Clyde to be hollowed out and the UK stripped of its ability to make its own warships."

Ian Waddell, Unite national officer

Tom McPhail, head of retirement policy at financial services company Hargreaves Lansdowne, tells the World at One that the regulator may well seek more money from former BHS owner Sir Philip Green. Listen to the interview here.

Sir Philip Green could be asked for additional contributions to BHS pensions scheme