Lagarde: 'We hope for the best'published at 19:13 BST 24 June 2016

Image source, AFP/Getty Images

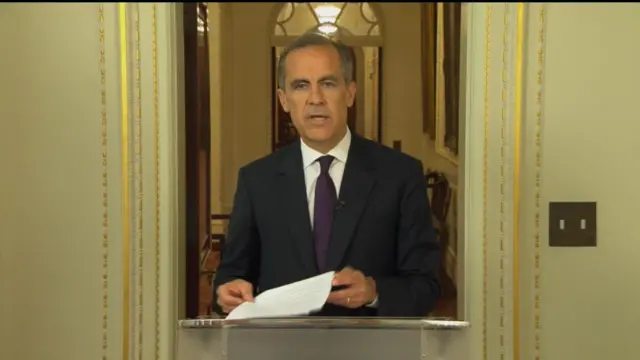

Image source, AFP/Getty ImagesChristine Lagarde, the head of the International Monetary Fund - which had warned a Leave vote would trigger a recession in the UK - tells the BBC:

Quote MessageWe are respecting completely the decision of the British people. We hope very much for a smooth and predictable transition period and we are very reassured by the statements made by [Bank of England governor Mark] Carney and we ourselves stand ready in a spirit of good cooperation in order to face the current situation and we hope for the best."