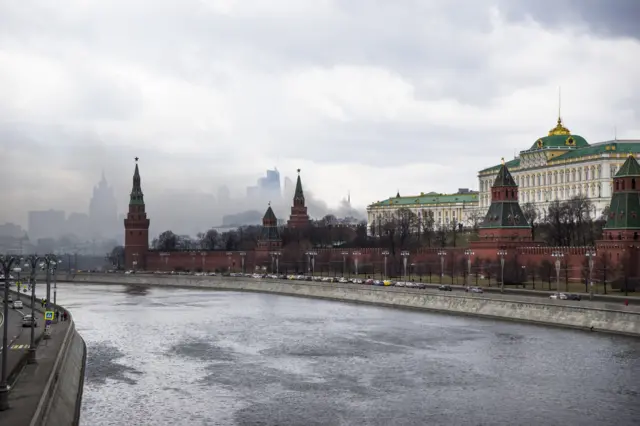

Russia reacts to Brexitpublished at 11:14 BST 24 June 2016

Image source, PA

Image source, PAReuters is reporting on Russia's reaction to the Brexit vote.

"Moscow wants the EU to remain a major economic power which is prosperous, stable and predictable," Kremlin spokesman Dmitry Peskov said.

"We have a pretty heavy burden of uneasy ties with Great Britain," he added.

"We hope that in the new realities, an understanding of the need for good relations with our country will prevail."