Guide to the Conservative leadership racepublished at 13:16 BST 8 July 2016Breaking

Theresa May and Andrea Leadsom are in the final round of the contest to become Conservative Party leader and prime minister. How will it unfold?

Read MoreFTSE 100 and FTSE 250 both end the day up by more than 1%

Osborne signals abandonment of Budget surplus target

UK government bond yields tumble

Shell boss in North Sea rethink

Karen Hoggan

Theresa May and Andrea Leadsom are in the final round of the contest to become Conservative Party leader and prime minister. How will it unfold?

Read MoreThat's all from the Business Live page after a tumultuous week. Join us again from 06:00 for more business news.

Here's a very thoughtful and interesting discussion in the New York Times, external by senior economics correspondent Neil Irwin.

He looks into why large swathes of voters in the US and UK appear to be rejecting the underlying logic of a globalised economy.

The major US stock indexes clung to modest increases on Friday, helped by encouraging US manufacturing data.

The indexes have erased almost all their losses stemming from the Brexit vote.

"Clearly, people have assessed that either, one, it's not a big deal, or, two, it's not going to happen at all, and they're positioning according to those views," said Walter Todd, chief investment officer at Greenwood Capital.

The Dow Jones industrial average finished up 17.33 points, or 0.10%, at 17,947.32, the S&P 500 had gained 4.01 points, or 0.19%, up to 2,102.92, and the Nasdaq Composite added 19.90 points, or 0.41%, to finish at 4,862.57.

Director of Institute of Fiscal Studies says austerity will now continue through 2020s.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

BBC Scotland business and economy editor tweets...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

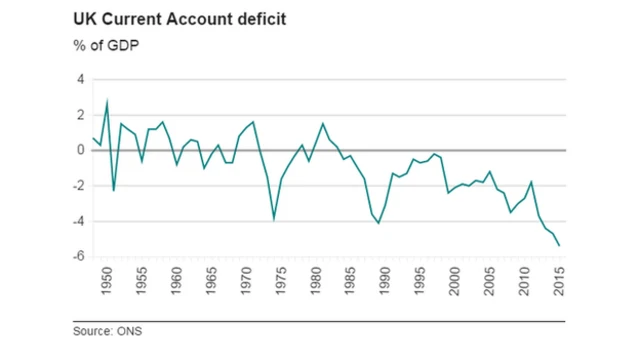

Why is foreign investment so important to the future of the UK economy?

Why is foreign investment so important to the future of the UK economy?

Read MoreBBC Newsnight editor tweets...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

BBC business presenter tweets...

The Competition and Markets Authority has written to car hire websites, external to ask them to make some information more easy to access for consumers.

Fuel charges, young driver surcharges, excesses and collision damage waiver exclusions are all pieces of information that need to be made more apparent, the CMA said.

Luke Hickmore, senior investment manager at Aberdeen Asset Management, points the finger at central banks for what he calls a "veritable alphabet soup of extraordinary policies" over the past 20 years.

Quote MessageThey have perhaps done more than anything else to turbo charge the income disparity between rich and poor which has been steadily growing for years. The sense of unfairness and injustice that income disparity established is part of what has created this great debunking of the establishment in the UK. It’s a similar story in other European countries and could be in the US come November. The result for the economies of these countries is that they very much will play second fiddle to the politics in the years to come. Whether that is a good thing or not depends on your perspective. Some will say that it is a welcome end to untrammelled capitalism. Others will question whether it’s prudent for political whim to define so much about our economic future. Expect more volatility: the market is very bad at pricing political change."

Image source, PA

Image source, PAYet more reaction to Chancellor George Osborne's announcement that he's abandoning his budget surplus target - this time from the chairman of the Treasury Committee, Andrew Tyrie.

Quote MessageThe Chancellor was right to abandon the fiscal rule. It’s the latest in a long line of fiscal rules, targets and objectives of successive governments to have bitten the dust. Any rule which required the Chancellor to adjust public spending or taxation twice a year to take account of small changes in the OBR’s forecasts was always likely to be vulnerable. To be credible it needed to be put in a longer term framework.

Andrew Tyrie MP, Chairman of the Treasury Committee

Most US companies expect to experience only a "negligible impact" as a result of last week's Brexit vote, according to a new report.

The Institute for Supply Management, external said 61% of the firms it polled saw a negligible impact compared to 6% who expect a "negative impact" for the remainder of the year.

There was little difference between non-manufacturing and manufacturing firms.

Of those who forecast a negative impact, they mostly believed it would be a result of changes in foreign exchange rates following on from 'Brexit' vote.

The survey found that," while most procurement executives do not foresee major disruptions, many are cautiously watching the situation closely and believe Brexit will hamper growth".

Image source, Getty Images

Image source, Getty ImagesDutch Prime Minister Mark Rutte said on Friday that a strict 20% cap imposed last year on bonuses in the financial sector has "some flexibility" for foreigners, reports Reuters.

The comment was made in response to questions about what the Netherlands can do to attract businesses following the Brexit vote.

The Netherlands is considered by some as a possible alternative to London because of its advanced infrastructure, strategic location, good schools and high level of English proficiency. It has Europe's largest port and fourth largest airport.

The UK's vote to leave the EU has prompted companies in London to reconsider where they are headquartered, due to the possibility that their access to the European single market might be restricted once the vote is implemented.

Image source, AFP

Image source, AFPBoth the FTSE 100 and the FTSE 250 - which includes more UK-focused businesses have hung onto their gains today.

Shares were given a boost yesterday by Bank of England Governor Mark Carney's hints that interest rates could be cut over the next couple of months.

Precious metals mining companies were among the biggest gainers as investors looked for a safe haven.

Fresnillo rose by 7% and Johnson Matthey by 5.57%.

The FTSE 100 ended the day at 6,577.83 - that's a rise of 1.13%.

The FTSE 250 closed up 1.19% at 16,465.49.

Meanwhile Sterling - which fell after Mr Carney's comments - is still trading a shade lower against the dollar.

Business Daily presenter tweets

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

BBC Technology of business reporter tweets

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Why is foreign investment so important to the future of the UK economy?

Read More Image source, Getty Images

Image source, Getty ImagesWall Street opened higher for the fourth day in a row buoyed by the prospect of central banks around the world acting to boost their economies.

The recovery - which comes after two days of sharp falls in the wake of last week's Brexit vote - was helped yesterday by Bank of England Governor Mark Carney's comments raising the possibility of interest rate cuts over the next couple of months.

"I think we are going to have a slow drift up," said Brad McMillan, chief investment officer of Commonwealth Financial Network in Massachusetts.

"Everybody is at the beach already and I don't expect a lot of action, in the absence of some kind of market-moving information."

A short while ago the Dow Jones was at 18,001.76 - a rise of 0.40%.

The Nasdaq was up 0.73% at 4,878.08.

And the S&P 500 stood at 2,108.07 - that's up 0.44%.