Budget watchdog delays Brexit forecastspublished at 11:14 BST 1 July 2016

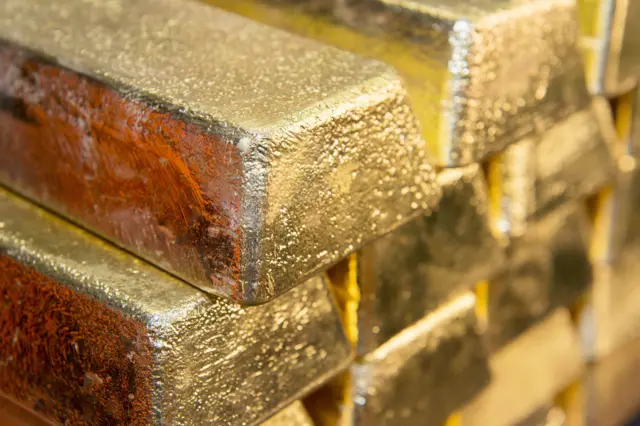

Image source, AFP/Getty Images

Image source, AFP/Getty ImagesThe government's budget watchdog has pushed back its long-term forecasts following the Brexit vote.

The Office for Budget Responsibility was due to release the fiscal projections later this month, but has pushed it back due to the "uncertainty about our future relationship with the EU".

It will now come later this year or early 2017.