FTSE closes near record highpublished at 16:45 BST 4 October 2016

The FTSE 100 has closed near to its record high of 7,103.98. The share index closed at 7,074.34, up 1.30%.

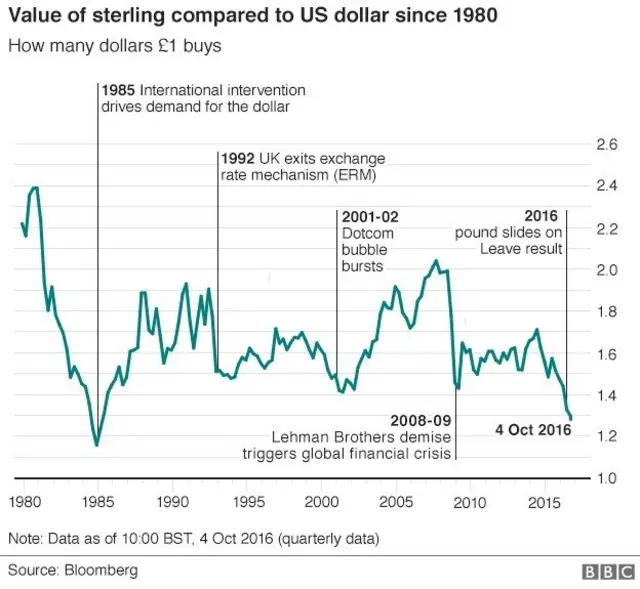

Sterling fell to its lowest in more than three decades after fears of a "hard" Brexit where the UK leaves the single market in favour of imposing controls on immigration.

With a cheaper currency promising to bolster earnings, the FTSE 100 index rose.