UK 'heading for full Brexit'published at 07:48 BST 4 October 2016

Today Programme

Today Programme

BBC Radio 4

Image source, Getty Images

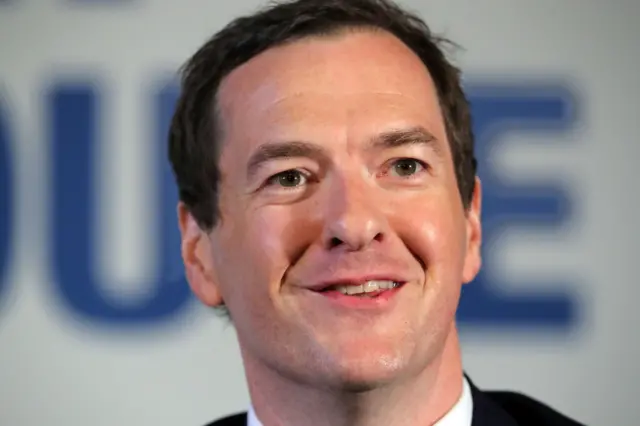

Image source, Getty ImagesIt's becoming clear that the UK will "fully exit" the European Union, says George Osborne's former chief of staff, Rupert Harrison.

Rather than remain part of the European Economic Area like Norway, the UK will come up with its own deal which tries to recreate the existing relationship as closely as possible, he says.

The Brexit negotiations will then vary sector-by-sector for businesses, he predicts.

Some will be "rule takers" - like car makers - so they can continue to access the EU single market. For others, like the City of London, it's a "non-starter" for them to have rules dictated by the EU, he says.