Postpublished at 21:30

That's it for another day. Please join us tomorrow from 06:00

Sterling extends losses, falling to $1.21 as the FTSE 100 closes down

Fujitsu to cut up to 1,800 jobs in UK

Airbus hits out after losing Poland defence deal

Samsung abandons Galaxy Note 7 smartphone

Pure Gym abandons £190m float

Pensions regulator calls for more powers

Get in touch: bizlivepage@bbc.co.uk

Russell Hotten

That's it for another day. Please join us tomorrow from 06:00

US stocks fell as some disappointing corporate results unsettled investors.

The market is "very cautious" on earnings after five straight quarters in which the S&P 500 reported declining profits, said David Levy, portfolio manager at Republic Wealth Advisors.

At the closing bell the Dow Jones was at 18,128.66, down 1.1%, the broad-based S&P 500 shed 1.2% to 2,136.73, and the Nasdaq sank 1.5% to 5,247.10.

Newsnight's editor tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Resolution Foundation's head of research tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, AP

Image source, APWall Street continues to head south on disappointing corporate results.

Alcoa shares sank 10.9% after the metals company's quarterly profit missed analysts' estimates.

Illumina shares tumbled 25.6% and were among biggest drags on the S&P 500 after the diagnostic test maker's weak quarterly update.

Investors have been looking for US corporate earnings to strengthen after four quarters of declines, in order to support relatively high valuations for stocks.

About 30 minutes before the closing bell, Dow Jones was down 1.23%, the S&P 500 lost 1.39%, and the Nasdaq had slipped 1.68%.

Jonty Bloom

BBC Business correspondent

The pound has fallen heavily again today. Hopes of higher interest rates in the US have made the dollar a more attractive currency to invest in, but the pound has also been depressed by worries over Brexit and in particular whether the UK will leave the single market as well as the EU itself.

A leaked report from the Treasury, revealed in the Times, warned that leaving the single market could cost the government tens of billions of pounds in lost tax revenues.

The reason why that might happen was revealed at a conference on Brexit in the City of London today - big banks reducing operations in London.

In the clip below, Rob Rooney, chief executive of the American giant Morgan Stanley, is clear about why single market access is important for UK jobs.

Image source, Getty Images

Image source, Getty ImagesHouse prices in China's biggest cities - and some second tier ones - soared by 27% year-on-year in July and by 28% in August, according to research by investment bank UBS.

It has fueled concerns about a bubble in the real estate market, UBS says. But the central government had curiously chosen not to act, perhaps because it is trying to support economic growth.

UBS believes the risk of a property market crash is limited, but warns the "rapid expansion of household leverage is unsustainable".

The bank says: "Prudent housing policies... are needed to prevent land and property prices from overheating."

Image source, Getty Images

Image source, Getty ImagesCelebrated economist Paul Krugman has written an interesting blog, external on the fall of sterling, which he says may offer some benefits for parts of the UK economy.

As he points out, the pound has been propped up by the dominant position of the City as an exporter - a position now threatened by the prospect of a "hard Brexit".

However, he says a lower pound is also likely to boost manufacturing exports, which have been "crowded out" by the City for years.

Overall, the state of play will make Britain poorer, he says - but it may also benefit those whose lives depend on manufacturing income.

"It’s not completely incidental that these were the parts of England (not Scotland!) that voted for Brexit," he adds.

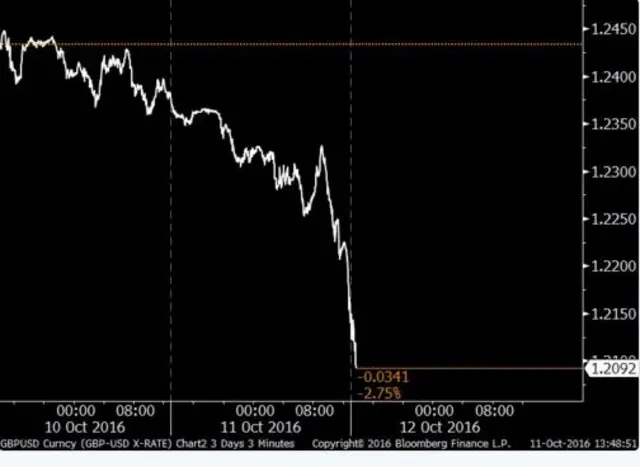

Image source, Bloomberg

Image source, BloombergBBC economics editor tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

On Ada Lovelace day the 19th century mathematician still inspires women in technology.

How do you inspire more women to get into science, technology, engineering and maths? One idea is to celebrate the achievements of women working in those industries. And that's happening right now; today is Ada Lovelace Day. She was a 19th century mathematician, considered to be the world's first programmer.

Image source, Reuters

Image source, ReutersInitial public offerings can be risky things, with the shares of over-hyped companies often tanking after their debuts.

However, a notable decline in the number of new listings in recent decades has got the world's biggest sovereign wealth fund worried.

Oyvind Schanke, chief investment officer at Norway's oil fund, one of the world's largest equity investors, told the FT, external the trend raised "questions for society as a whole".

“You are running the risk of investing only in yesterday’s businesses and technology," he said.

"Countries with a higher rate of listed companies on average do better in terms of growth. From a public interest point of view, public listing gives you all these benefits. So why is it that more and more companies choose to stay private, particularly large ones in the US?”

Sterling has extended its decline versus the dollar this evening to 2%, hitting a session low of $1.2107.

The economist, broadcaster and diplomat, Peter Jay, was a civil servant in the Treasury in the early 1960s when Harold Wilson was Prime Minister. He tells the BBC that the pound has, in effect, been devalued.

"It certainly has been devalued relative to where it was before the Brexit vote," he says. "From the point of view of consumers buying foreign goods, [it] means that they will pay higher prices.

"From the point of view of those kind of economists who believe that a competitive exchange rate is vitally important for full employment and for exports and for economic growth, it will be welcome news."

There's much speculation about whether Opec oil producers can agree a production cut. Certainly, the price of crude has risen on expectation that a deal can be done.

Opec and some non-Opec producers are due to meet for talks in Istanbul on Wednesday - although there will be a big absentee. Saudi Arabia's Energy Minister Khalid al-Falih will not attend.

"Tomorrow's meeting is a very informal consultative meeting between the countries that happened to be here," Mr Falih told Reuters at the World Energy Congress in Istanbul.

"Unfortunately due to prior commitments I am leaving now, so I will not be in the meeting but I will be following it from afar and I will be getting indications about what countries have agreed to," he said.

It's unlikely that Opec will agree anything substantive, however, given that Saudi is the most powerful member within the organisation.

Image source, Getty Images

Image source, Getty ImagesBlockchain is best known as the technology that underpins cryptocurrency Bitcoin. But the online settlements system is increasingly being used in other areas such as banking, where it is said to reduce risk and improve the efficiency of transactions.

Now its the turn of gold, after tech firm Paxos and consultants EY said they would partner to deliver the first blockchain settlement service for the market.

"Gold market participants are showing interest in exploring how innovation can deliver tangible benefits," said David Williams, partner for capital markets innovation at EY.

"We expect this to be a key early example of the type of collaboration between FinTech firms and existing market participants that will truly transform the marketplace."

The FTSE 100 finished short of its record close on Tuesday after hitting new mid-session highs, as the pound tumbled on Brexit jitters.

The top-flight index closed down 0.38%, or 26.62 points, at 7,070.88, just shy of its all-time closing high of 7,103.98.

It comes after the top tier set a new mid-session record of 7,129.83 points earlier on in the day - marking its highest level since reaching 7,122.7 in April 2015.

Against the dollar, sterling dropped more than 1.2% to trade at around $1.220. Against the euro, the pound fell over 0.5% to around €1.103.

Doubling of flights between the two countries

Image source, PA

Image source, PATransport Secretary Chris Grayling said the agreement would provide "massive opportunities" to boost trade, tourism and jobs in the UK.

Under the deal, the limit on passenger flights between Britain and China is to be raised from 40 to 100 each week in each direction, while there will be no restriction on cargo flights.

A rule limiting to six the number of airports which airlines can serve in each country is to be lifted, so that flights will be permitted to and from any destination in the UK and China.

BBC transport correspondent tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The FTSE 100 closed down 0.38% at 7,070.88 points, just shy of its 7,103.98 record close, after hitting a new mid-session high of 7129.83 points earlier on in the day.

The Unite union says the up to 1,800 redundancies would affect sites across the UK, including at Bracknell, Crewe, Manchester, Belfast, Stevenage, Wakefield and Warrington.

The cuts represent about 18% of the workforce.

Unite national officer for IT Ian Tonks said: “This is a hammer blow for these hardworking employees who have given their all to make the UK subsidiary highly profitable.

“It is not good news for the UK economy as the company says that it intends to offshore many of these jobs, with increased automation also responsible for job losses.

“Fujtsu’s main UK subsidiary made £85.6m profit last year and we see no reason for these job losses. Unite will be doing its utmost to fight for these jobs, as well as giving our members maximum support at this very worrying time.”