Summary

Bank of England holds interest rates at 0.25%

Carney raises 2017 growth and inflation forecasts

Sterling extends gains on interest rate decision

Sir Philip Green pursued by pensions regulator over BHS

UK services sector grows in October

Live Reporting

Tom Espiner

More reaction to Brexit high court rulingpublished at 10:31 GMT 3 November 2016

That ruling in full...published at 10:29 GMT 3 November 2016

10:29 GMT 3 November 2016Journalist and commentator Paul Mason tweets a link to the High Court Brexit decision:

This X post cannot be displayed in your browser. Please enable Javascript or try a different browser.View original content on XThe BBC is not responsible for the content of external sites.Skip X postThe BBC is not responsible for the content of external sites.Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

End of X postSterling above $1.24published at 10:26 GMT 3 November 2016

10:26 GMT 3 November 2016 Image source, Getty Images

Image source, Getty ImagesSterling jumped briefly past $1.24 for the first time in more than three weeks after the Supreme Court ruled the government must seek parliamentary approval to begin the formal process of leaving the European Union.

The pound rose by just under a full cent to $1.2450 before retreating on signs that, as many in markets had expected, the government could appeal the ruling at a hearing in early December.

Sterling jumps on Brexit rulingpublished at 10:18

10:18The High Court ruling has sent the pound sharply higher.

This X post cannot be displayed in your browser. Please enable Javascript or try a different browser.View original content on XThe BBC is not responsible for the content of external sites.Skip X postThe BBC is not responsible for the content of external sites.Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

End of X postAltman backs regulatory action against Sir Philip Greenpublished at 10:11 GMT 3 November 2016

10:11 GMT 3 November 2016 Image source, Getty Images

Image source, Getty ImagesBaroness Ros Altmann, former minister of state for pensions, has weighed in on the Sir Philip Green/ BHS debacle in a lengthy blog, external.

Unsurprisingly, she says the Pensions Regulator is right to pursue the tycoon over the collapsed business's pension deficit.

"There are two vital questions that lie at the heart of this sorry saga. Firstly, why did Sir Philip not get clearance from the Pensions Regulator before selling BHS?" she says.

"Secondly, how did he and Dominic Chappell believe the company was going to pay more than half a billion pounds of pension debt to cover BHS workers’ pensions?"

She adds: "If I were Sir Philip, I would take back responsibility for the BHS scheme and manage it on an ongoing basis to find the best way to meet the liabilities over time... This is what he promised Parliament he would do."

High Court Brexit rulingpublished at 10:07

10:07Breaking

The High Court has ruled that the Government needs parliamentary approval to trigger Article 50, which would lead to the UK leaving the European Union.

This means the government cannot trigger Article 50 of the Lisbon Treaty - beginning formal discussions with the EU - on its own.

Theresa May says the Brexit referendum and ministerial powers mean MPs do not need to vote, but campaigners argue this is unconstitutional.

The government is expected to appeal.

Economy has done 'better than forecast'published at 09:56 GMT 3 November 2016

09:56 GMT 3 November 2016 BBC Radio 5 live

BBC Radio 5 live Image source, PA

Image source, PAWith just a few hours to go before we get that interest announcement from the policymakers at the Bank of England, let's catch up with what Vicky Pryce, chief economist at CEBR, an economic consultancy, had to say on the matter on Wake up to Money.

Asked if she thought rates would be cut, she said: "I don't think we're going to get that, certainly not today,"

She pointed out that back in August when rates were cut to 0.25% the way was left open for further cuts should the economic conditions remain precarious.

"What we have seen so far is that the economy has done better than had been forecast," she said.

"Inflation has gone up quite significantly, to 1% in September. It suggests to me that... the MPC will wait and see what the conditions are when they look at data again perhaps in a couple of months time, what their agents are telling them about confidence.

"And also of course what the inflation prospects are which are probably going to be considerably greater than what they had expected in August," added Ms Pryce.

UK services sector grows in October, despite inflationpublished at 09:47 GMT 3 November 2016

09:47 GMT 3 November 2016 Image source, AFP PHOTO / CARL COURT

Image source, AFP PHOTO / CARL COURTThe UK services sector grew strongly in October despite mounting inflation, a survey has claimed.

The Markit/CIPS UK Services Purchasing Managers Index rose to 54.5 from 52.6 in September, its highest level since January. Any score over 50 marks expansion.

It mirrors other data showing the UK economy has broadly maintained its momentum since June's Brexit vote.

But it also found that price pressures - driven by a slump in the value of sterling - hit their highest level in five and a half years during the month.

The pound has lost around 17% of its value against the dollar since the vote to leave the EU, helping British exporters but also raising inflation.

"An encouraging picture of the economy gaining further growth momentum in October is marred by news that inflationary pressures are rising rapidly," said Chris Williamson, chief economist at survey compiler IHS Markit.

The survey lends weight to expectations that price rises will be passed on to consumers early next year.

FCA promises to improve competition in retail bankingpublished at 09:33 GMT 3 November 2016

09:33 GMT 3 November 2016 Image source, Getty Images

Image source, Getty ImagesNot everyone was happy with the competition regulator's proposals to improve competition in the retail banking sector; Labour MP Rachel Reeves even accused it of a "dereliction of duty", after it decided not to cap unauthorised overdraft charges.

Nonetheless, the Financial Conduct Authority today said it would take action on the Competition and Markets Authority's recommendations.

This could include improving transparency for overdraft users, helping consumers assess the differences in service quality between banks, and encouraging customers to consider switching bank accounts when better services are available.

Most importantly, it could overrule the CMA's decision on capping overdraft charges if its own investigations support the move.

Egypt aims to clamp down on forex black marketpublished at 09:24 GMT 3 November 2016

09:24 GMT 3 November 2016 BBC World Service

BBC World ServiceEgypt has announced it will allow its currency to be traded freely on the open market, as part of measures designed to bolster confidence in its economy.

The BBC World Service has more detail ...

It reports the central bank has devalued the Egyptian pound by 48% as a guidance rate before it takes effect. The move aims to end the black market in foreign currency. It also fulfils a key condition from the International Monetary Fund, which is considering providing Egypt with a $12bn (£9.7bn) loan.

M&S to quit China?published at 09:10 GMT 3 November 2016

09:10 GMT 3 November 2016Andreas Illmer

Business reporter in Singapore Image source, Getty

Image source, GettyMarks & Spencer is reportedly planning to close some of its stores in China as part of a broader cost cutting drive by the UK's largest clothing retailer

According to Bloomberg, external, M&S is looking to trim its loss-making international operations.

In 2008, the retailer opened its first Chinese store in Shanghai but last year closed five smaller regional outlets to refocus their efforts on Shanghai.

According to Bloomberg, the decision and details will be announced on 8 November.

The cuts come at a difficult time for British retailers following the collapse of BHS and the pound's decline in the wake of the Brexit vote. Many are struggling to pass on cost increases from the slide in sterling to consumers.

Tate & Lyle profits leap on weak poundpublished at 08:55 GMT 3 November 2016

08:55 GMT 3 November 2016 Image source, Getty Images

Image source, Getty ImagesShares in Tate & Lyle have jumped 6% this morning, after the ingredients business reported strong profits on the back of the weak pound.

In the six months to 30 September revenue jumped 13% to £1.3bn while adjusted profit before tax leapt 30% to £140m. But on a constant currency basis the rises were 1% and 22% respectively.

The company saw strong growth in sweetener sales to US soft drink makers. The group, which generates less than 2% of its revenues in the UK, has also benefited from the fall in the pound since the UK voted for Brexit.

The firm has revised its profit forecasts upwards for the the full year.

Tate & Lyle made its name in sugar refining, but sold off that part of the business in 2012 to focus on other ingredients.

'Things starting to look up' for Morrisonspublished at 08:47 GMT 3 November 2016

08:47 GMT 3 November 2016 Image source, PAQuote Message

Image source, PAQuote MessageAfter a tough few years, things are starting to look up at Morrison. The British Retail Consortium say that food sales just had their strongest quarter since 2013, and another quarter of like-for-like sales growth at Morrison makes it four in a row. Morrison’s strong balance sheet has given it the power to invest in improving its shops and lowering prices, and so far customers are responding well. Transaction numbers show good momentum, and record seasonal sales mean that the Halloween proved to be of a treat. This certainly bodes well for Morrison, but, with the other main supermarkets raising their games too, the festive period will prove to be the real test.

George Salmon, Equity analyst, Hargreaves Lansdown:

Sales up, profits down at Inmarsatpublished at 08:37 GMT 3 November 2016

08:37 GMT 3 November 2016 Image source, Getty Images

Image source, Getty ImagesInmarsat, the British satellite communications business, saw profits fall but sales rise in the third quarter as it faced "challenging trading conditions".

Total revenues climbed 5.8% year on year to $341.9m, driven by increasing demand from airlines for onboard wifi and services to governments. But profit after tax slipped 13.3% to $53.9m.

Chief executive Rupert Pearce said: "Trading continues to be challenging, with economic and budgetary pressures affecting our customers generally.

"We are nevertheless competing aggressively and successfully in each of our core markets."

Sir Philip Green 'now faces bill' for BHS pensionspublished at 08:25 GMT 3 November 2016

08:25 GMT 3 November 2016 Today Programme

Today Programme

BBC Radio 4 Image source, Gett

Image source, GettMore on the proposed 'enforcement action' against Sir Philip Green over the BHS pension deficit.

Steve Webb, minister for pensions under the Coalition government, tells the Today programme: "I think the problem with Philip Green is he'd kept making promises and not delivered and the regulator has finally lost patience."

He says the process against Sir Philip could take years but that a bill, in effect, has been served upon him. Sir Philip may have been asked to cover pensions incrementally "as they become due", he adds, "which would be a more credible option than making a huge payment up front".

He doesn't think others should share the blame for what went wrong at BHS.

"The regulator didn't have the power to block the sale of BHS [to Dominic Chappell for £1]... In hindsight I think it should have had those powers."

FTSE 100 flatpublished at 08:14 GMT 3 November 2016

08:14 GMT 3 November 2016Let's check in on the UK stock market and there's little change on the FTSE 100 since it started trading at 8am.

It has edged up just 0.08% to 6,850.68.

Egypt shares open up 8%published at 08:09 GMT 3 November 2016

08:09 GMT 3 November 2016More on the news that Egypt's central bank is floating the country's pound as part of its drive to boost confidence in the economy ...

The Egypt Stock Index opened up 8.2% following the announcement.

The bank said it had moved to a "liberalised exchange rate... to create an environment for a reliable and sustainable supply of foreign currency".

The aim is to attract billions of dollars in foreign investment.

Egypt has been struggling to bump up its foreign currency reserves in the political and economic turmoil following the uprising in 2011 which resulted in the overthrow of former President Hosni Mubarak.

Hang Seng sees more lossespublished at 08:07 GMT 3 November 2016

08:07 GMT 3 November 2016 Image source, Getty Images

Image source, Getty ImagesAsian investors, it seems, can't really make up their mind this Thursday. But though mixed, markets at least didn't add too much to yesterday's losses.

Shanghai has in fact been going strong all day and closed up by 0.8%. In Hong Kong though, the Hang Seng wrapped trading 0.4% lower in a second day of losses.

In Australia, the ASX 200 meandered between slight losses and gains only to eventually close flat.

In South Korea, the Kopsi was firmly negative around lunchtime but found its way up later, closing 0.3% higher.

Japan's Nikkei 225 is closed for a public holiday.

Falling pound set to 'squeeze budgets'published at 08:03 GMT 3 November 2016

08:03 GMT 3 November 2016 BBC Radio 5 live

BBC Radio 5 live Image source, Getty Images

Image source, Getty ImagesProfessor David Miles, who sat on the Bank's Monetary Policy Committee until last summer - that means he was one of the people making that decision on rates...

On 5 Live Breakfast he's asked what decision he would have made on rates had he still be on the Committee.

He says "I would have left things where they are," at least this month.

On inflation, he says it's likely that - starting from its present low level - inflation will pick up a bit. It's likely to exceed its 2% target and then break through the 3% barrier next year, he thinks.

Having seen a significant fall in the value of the pound in such a short time, he says, it's inevitable that this will feed through to the cost of living and puts a bit of a squeeze on people budgets.

New Yorkshire mine to create thousands of jobspublished at 07:57 GMT 3 November 2016

07:57 GMT 3 November 2016 Today Programme

Today Programme

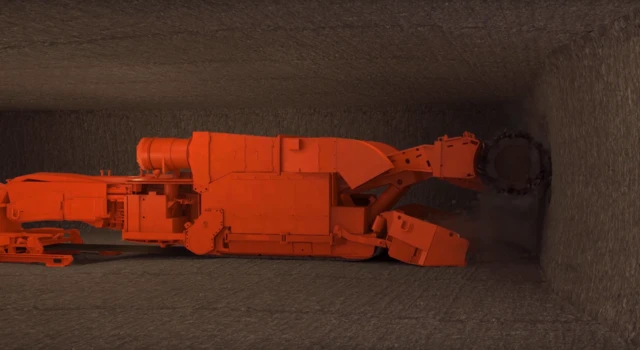

BBC Radio 4 Image source, Sirius Minerals

Image source, Sirius MineralsSirius Minerals is going to open a giant potash mine near Whitby in Yorkshire and has just raised £1bn to do so.

Chief executive Chris Fraser says it will produce a new multi-nutrient fertiliser - and North Yorkshire has the largest reserves of the required minerals in the world.

The mine will be almost a mile underground and minerals will be transported all the way to Teeside via a 36km tunnel.

The project will create around 2,000-3,000 jobs over five years, he says.