Good nightpublished at 21:31 GMT 30 November 2016

That's it for another day on Business Live.

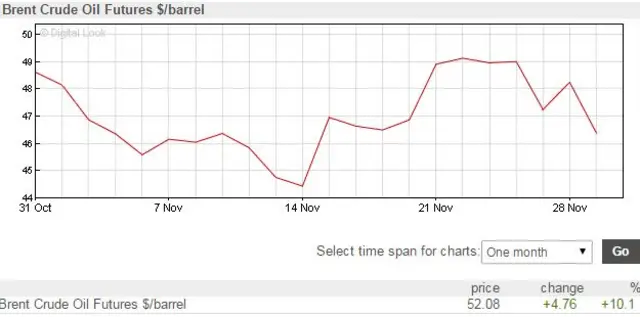

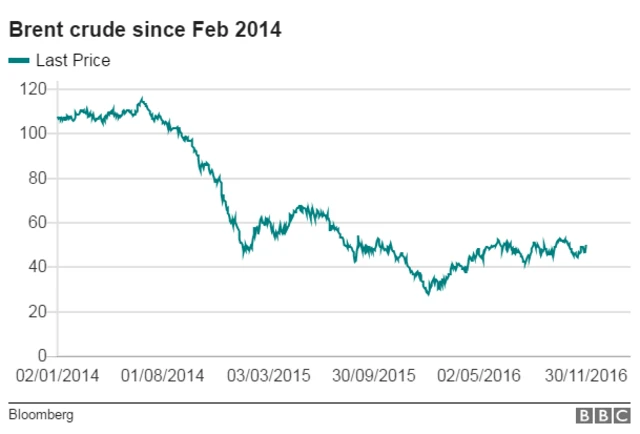

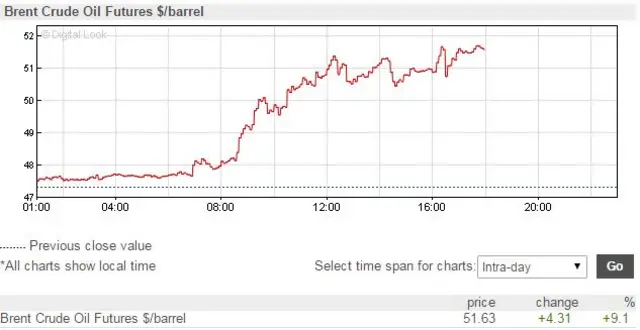

It's been a busy one, with the Bank of England's bank stress tests dominating the early part of the day, and those output cuts by the oil producing nations dominating later headlines.

Do join us again from 6:30am tomorrow, if you can, for all the news that the world of business has to bring.