Who is Wilbur Ross?published at 14:45 GMT 30 November 2016

Image source, Getty Images

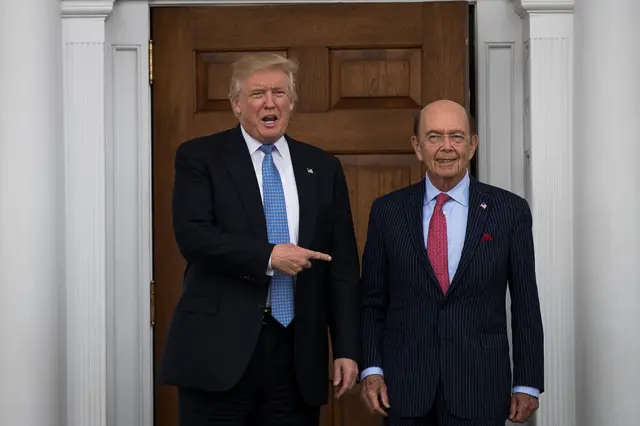

Image source, Getty ImagesApart from Steve Mnuchin as treasury secretary, Donald Trump has also said he plans to nominate Wilbur Ross as US commerce secretary?

So what do we know about him? According to the President-elect's official announcment Mr. Ross spent 25 years heading up Rothschilds, He has also "successfully grown businesses in the telecommunications, textiles, steel, and coal industries".

Then in 2000, he founded the investment firm WL Ross & Co.

He was Mr Trump's top economic advisor on trade policy. He also "agrees with President-elect Trump’s plan to bring back jobs, eliminate the trade deficit and make good deals for America’s workers".