Good nightpublished at 21:30 GMT 15 March 2017

Thanks for tuning in to Business Live. We'll be back at 6am tomorrow.

Fed raises benchmark interest rate to a range of 0.75% to 1%

US growth forecast at 2.1% in 2017 and 2018

Chancellor in U-turn on National Insurance increase

NI increase did not meet "spirit" of Tory manifesto

Get in touch: bizlivepage@bbc.co.uk

Daniel Thomas

Thanks for tuning in to Business Live. We'll be back at 6am tomorrow.

Image source, Getty Images

Image source, Getty ImagesAround 2.5 million workers are enduring unacceptable working conditions in India's leather industry, making shoes and clothes for Western brands, a study has found.

The India Committee of the Netherlands (ICN), a human rights NGO, said the workers faced long hours with toxic chemicals for poverty wages.

It added: "Accidents regularly occur with machine operators getting trapped, workers cleaning underground waste tanks suffocating from toxic fumes, or workers drowning in toxic sludge at the tannery premises."

India is the world's second largest producer of footwear and leather garments and the majority of its footwear exports go to the EU.

ICN called for more transparency in global supply chains.

Elon Musk's Space Exploration Technologies has won a $96.5m GPS satellite launch contract over rival United Launch Alliance, a partnership of Lockheed Martin and Boeing.

The GPS launch contracts won by SpaceX cover production of a Falcon 9 launch vehicle, mission integration, launch operations and spaceflight certification, the US Air Force said.

Where will the Chancellor find the £2bn to plug the gap from not raising National Insurance rates for the self-employed?

Business editor Simon Jack says he has to find the money to keep to his deficit reduction programme.

"This was a Chancellor... who looked like someone who had both hands tied behind his back... The election promises were that they [the Conservative government] wouldn't raise National Insurance, VAT or income tax. He tried to squeeze one through on a technicality by saying 'Well, I didn't really mean that National Insurance, I meant Class 1 National Insurance' - well, no-one was really having that..."

Simon adds that there are very few sources for him to find the money, and there are lots of ring-fenced areas such as the NHS and education.

"So, he's got a problem."

Image source, Getty Images

Image source, Getty ImagesCanada's consumer watchdog is to investigate some of the country's biggest banks over claims their tellers pressured customers into buying unnecessary services.

It follows a report by public broadcaster CBC which uncovered widespread use of possibly criminal tactics to get customers to extend credit limits, sign up for credit cards or make riskier investments that earned the banks higher commissions.

According to CBC, employees felt pressured by managers to up-sell and even to cheat and lie.

Shares in major lenders such as Toronto Dominion, Royal Bank of Canada and Scotiabank have fallen since the report was aired last week.

Image source, Getty Images

Image source, Getty ImagesWall Street stocks closed higher after the Fed raised the benchmark interest rate by 0.25%.

The Dow Jones gained 0.54% to 20,950.10, the S&P 500 rose 0.84% to 2,385.26, and the Nasdaq was up 0.74% at 5,900.05.

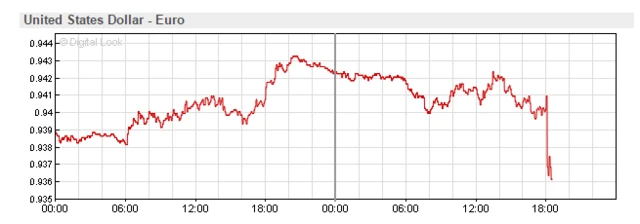

The dollar plunged, however, after the Fed said it would stick to a plan to make only three rate hikes in 2017 (including today's).

It shed 1.19% against the euro to 0.93150 euros.

Andrew Walker

World Service economics correspondent

Image source, Getty Images

Image source, Getty ImagesBack in the depths of the financial crisis the US Federal Reserve cut its main interest rate to close to zero.

It was an effort to prevent an even more severe economic downturn.

In late 2015, the Fed finally started the slow return towards economic normality - with the first rate rise in almost a decade.

The next move came a year later and now we have rate rise number three.

Image source, Getty Images

Image source, Getty ImagesThe US stock market rally inspired by Donald Trump's election has slowed somewhat since the Fed's December meeting (when serious talk of an impending rate hike first surfaced) says Kathleen Brooks.

The analyst at City Index says: "The big question now is, can the Trump rally survive with two further fed rate hikes on the cards in the coming months and no sign yet of the Trump administration’s tax cuts or fiscal stimulus plan?

"We believe that markets have the potential for further upside, but another leg higher will not be achieved unless Trump manages to get Congress to agree to an enormous fiscal stimulus plan that can truly boost growth."

World Business Report explains

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesKully Samra, UK managing director of Charles Schwab, says he expects three rate hikes this year (including today’s) and a further two in 2018.

However, he says: "If White House plans for deregulation, tax cuts and more government spending are realised, then growth and inflation could be stronger than expected and lead to more hikes.

"On the other hand, potential border taxes, trade tariffs and tighter monetary policy could slow growth and inflation.”

Is a new Glass-Steagall Act - separating retail and casino banks - a good idea? Treasury Secretary Steve Mnuchin has mooted the idea.

Ms Yellen isn't playing ball. She says she's not sure what a 21st century Glass-Steagall Act would look like. Her reading of the financial crisis is not that unified retail and casino banks caused the thing, she said.

An important reform in the aftermath of the crisis was making sure investment banks have enough capital, she adds.

Image source, Getty Images

Image source, Getty ImagesNeil Wilson of ETX Capital says the Fed's "dovish" approach today is because of lingering doubts about the US economy.

"There are still meaningful doubts about just how quickly and how far the Fed should raise rates in this cycle," he says.

"This case is simply based on a lack of wage growth, which holds back inflation."

He adds: "There is consensus around growth picking up and inflation holding near to the 2% level. But overall caution prevailed - household spending is rising only moderately, jobs growth is solid."

Image source, Getty Images

Image source, Getty ImagesFed chief Janet Yellen is now asked about an opinion from the Bank of International Settlements, which says central bankers have ignored asset price inflation, such as fast-rising stock markets.

"We do look at market valuations" including stock prices, she says, but she seems unfazed.

High stock prices can boost consumption spending, she says. Risk spreads for lower grade corporate borrowers have narrowed, as well, she says.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesHas Ms Yellen met Steve Mnuchin, the new treasury secretary, she is asked?

Yes, a couple of times, she says. "I fully expect to have a strong relationship with Secretary Mnuchin," she says.

She also had a brief meeting with President Trump, she said.

Image source, Getty Images

Image source, Getty ImagesAnthony Doyle, fixed interest Investment Director at M&G Investments, says markets have "fully anticipated" this decision.

"The FOMC determined that the US economy needs higher interest rates following the continued tightening of the labour market and building inflationary pressures," he says.

"The surge in headline inflation to a five-year high of 2.7% in February is a concern for the Fed, who will be keen to ensure that inflation expectations remain well-anchored," he adds.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Gradual increases will also be the order of the day so that any "shocks" to the economy can be accommodated without dropping rates again, Ms Yellen says.

"The trajectory you see is the median in our projections," she says, when asked what "gradual" means. Central bankers aren't known for their bluntness.

She says the 2004 days of a rate raise every Fed meeting (every six weeks) is not what she expects.

There's still some room for improvement in the job market, but Ms Yellen says she wants to avoid a rapid increase in rates.

She says the federal funds rate will probably be 3% by the end of 2019. That's the rate at which banks lend to each other overnight via the Fed.

The US dollar has fallen after the Fed said it would stick to its plan to make just three rate rises in 2017.

It is 0.55% lower against the euro at 0.93740 euros, and 0.89% lower against the pound at £0.81550.