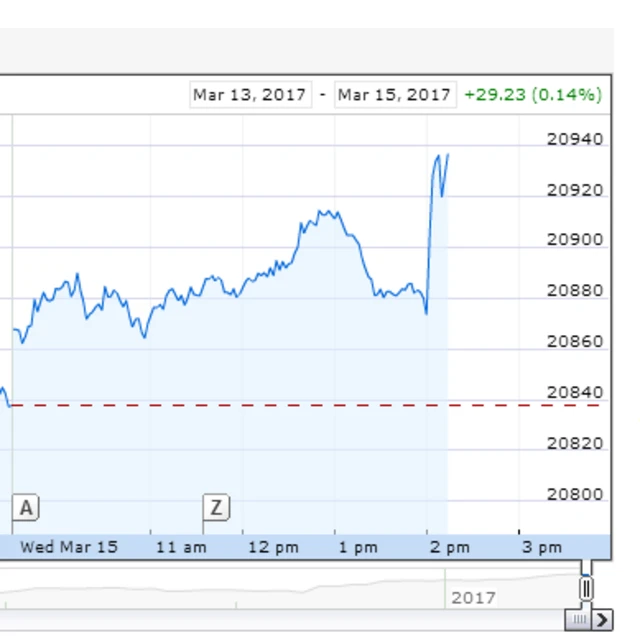

Business sentiment 'favourable' - Yellenpublished at 18:37 GMT 15 March 2017

Fed chief Janet Yellen is delivering her analysis to the press conference.

Business investment has "firmed somewhat" and business sentiment is "favourable", she said.

Unemployment is "near a recent low" and "labour market underutilisation" - so-called slack, which depresses wages, is also "low, she said.

Energy prices are now feeding into inflation and she anticipates 2% core inflation in the next couple of years, she adds.