Postpublished at 21:46 BST 24 April 2017

That's us finished for another day. Please check in again from 6am on Tuesday.

Euro jumps on Macron's first-round win

Cac-40 in Paris up 4.4%, FTSE 100 up 2%

France launches emissions probe into PSA

US stocks hold gains

Get in touch: bizlivepage@bbc.co.uk

Daniel Thomas

That's us finished for another day. Please check in again from 6am on Tuesday.

Image source, Getty Images

Image source, Getty ImagesUS stocks jumped on Monday, tracking a relief rally that swept through Asian and European markets after centrist candidate and market favorite Emmanuel Macron won the first round of the French presidential election.

The Nasdaq surged to a record close of 5,983.82 points, up 1.2%. The Dow Jones rose 1.1% to end the session at 20,764.03, and the broad-based S&P 500 also advanced 1.1% to close at 2,374.13.

Image source, Getty Images

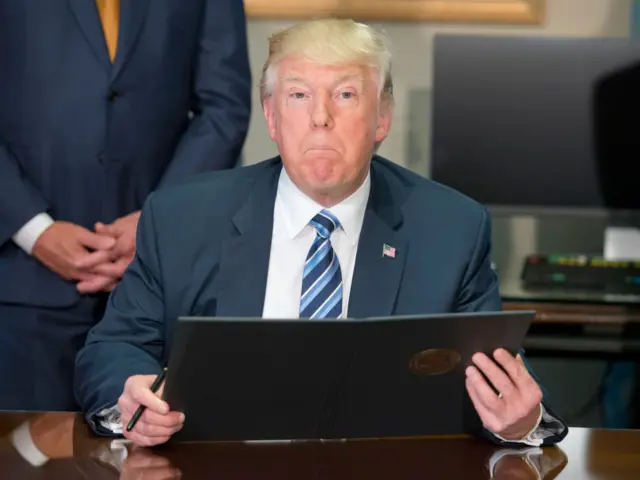

Image source, Getty ImagesUS President Donald Trump has apparently ordered his administration to come up with a draft plan to slash the corporate rate to 15% by Wednesday, the WSJ reports, external, quoting a source.

This would be meeting a campaign promise although would likely lead to a rise in the national deficit - a price Mr Trump is allegedly willing to pay.

The US corporate tax rate is currently 35%.

Last week, Mr Trump said he would unveil a massive tax cut this week on Wednesday.

The White House has so far not responded to request for comment on the WSJ's article.

Image source, Getty Images

Image source, Getty ImagesGreece is to sell a controlling stake in Thessaloniki Port to a German-led consortium for 231.9m euros.

The sale is a part of the country's international bailout signed in 2015 and comes less than a year after China's Cosco Shipping bought a 51% stake in Piraeus Port, Greece's biggest, for 280.5m euros.

The consortium is led by Deutsche Invest Equity Partners, a private equity firm, in partnership with French port operator Terminal Link SAS.

The group will also take over the operation of the port for the next 34 years under a separate lease agreement that Greece expects to bring in more than 170 million euros in additional revenue.

BBC Radio 5 Live tweets

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesOrganic grocery chain Whole Foods could see a takeover bid from Albertsons, the Financial Times has reported, external, citing people familiar with the matter.

Albertsons, the second largest operator of grocery stores in the United States, has had preliminary talks with bankers about making a bid - although it has made no formal approach, the paper said.

Albertsons, which is controlled by buyout group Cerberus Capital Management, said it did not comment on speculation, while Whole Foods declined to comment.

Shares in Wholefoods climbed by more than 4% before easing back.

Image source, Getty Images

Image source, Getty ImagesA US court has rejected an appeal by carmaker GM to block potentially billions of dollars in consumer claims over faulty ignition switches.

GM claimed its 2009 bankruptcy should protect it from lawsuits related to the switches, which could shut off unexpectedly during driving and have been linked to more than 100 deaths.

But the plaintiffs said the company should be liable because it knew about the defect long before the bankruptcy.

GM said the Supreme Court's decision "departed substantially from well-settled bankruptcy law".

It also said plaintiffs would still have to "establish their right to assert successor liability claims. From there, they still have to prove those claims have merit."

Image source, Getty Images

Image source, Getty ImagesThe lawyer representing Dr David Dao, who was dragged from a United Airlines plane, will also represent a woman who clashed with an American Airlines flight attendant last week.

Thomas Demetrio told CNBC that Surain Adyanthaya's tale was "compelling".

The American Airlines attendant is accused of forcibly removing a pram from Ms Adyanthaya and hitting her in the process, narrowly missing her baby.

A passenger filmed the incident and posted it to Facebook where it went viral.

It follows the forcible removal of Dr Dao a week earlier from an overbooked plane in Chicago, resulting in him losing two teeth and sustaining other injuries.

Image source, Getty Images

Image source, Getty ImagesFrance has opened a judicial inquiry into allegations the car group PSA cheated on diesel pollution tests.

Quoting a judicial source, the AFP news agency said PSA might have rigged controls which could "render its merchandise dangerous for human or animal health".

PSA, which owns Peugeot and Citroen, denied the claims and said it would "defend its interests". It said it respected regulations "in all countries where it operates".

Investigators have made similar allegations about PSA's French rival Renault, and are looking into allegations surrounding Volkswagen and Fiat-Chrysler.

Image source, Getty Images

Image source, Getty ImagesThe main US share indexes have held their gains after each opened higher, although they have not matched the highs seen in Italy, France and Germany.

In early afternoon trade the Dow Jones is 1.1% higher, the S&P 500 is up 1.05%, and the Nasdaq has gained 1.2%.

Image source, Getty Images

Image source, Getty ImagesMachine manufacturer Caterpillar has posted its first quarterly increase in revenue since 2012, with sales up 1% year-on-year, external in the three months to February.

The US firm has been hurt by sluggish demand in the construction and energy industries, and it cut 12,300 jobs worldwide in 2016.

Its shares were up 2.8% in early afternoon trading in New York.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Pierre Gattaz, the president of Medef, a group that helps companies network, says Emmanuel Macron can win the trust of French businesses.

He told World Business Report: “He wants to make France more attractive and make French business more competitive.”

Image source, Getty Images

Image source, Getty ImagesEuropean shares surged today following Emmanuel Macron's win in the first round of the French election.

The Milan stock exchange closed 4.77% higher, the French CAC 40 gained 4.41%, and Germany's DAX was up 3.37%.

The Euro Stoxx 50, an index of leading Eurozone businesses, gained 3.99%.

World Business Report presenter tweets...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesThe FTSE 100 ended the day higher after centrist Emmanuel Macron topped the first round of voting in the French general election on Sunday.

The blue chip index gained 2.11% to 7,264.68 while the FTSE 250 climbed 1.26% to 19,602.83, an all time high.

Sterling slipped as the euro surged, however, falling 1.41% to 1.17710 euros and it was also down against the dollar, dropping 0.18% to $1.27870.

BBC Radio 4

BBC Radio 4

Over the last few years executive pay packages have been widely criticised as being too high.

However, chairman of the Remuneration Consultants Group Dr Martin Read CBE rejects these claims.

He says pay hasn't "rocketed up" and the system has worked quite well since the financial crisis.

A decision by Indian prime minister Narendra Modi to abolish high denomination bank notes last year sparked panic among small firms, who still do most of their business in cash.

But digital workarounds are now gaining in popularity and may rule out such concerns in future.

As Global Business reports, this small-scale Indian vendor seller takes digital payments, even for single cigarettes

Image source, Getty Images

Image source, Getty ImagesKathleen Brooks, an analyst at City Index, says investors could be getting carried away after Emmanuel Macron's win in the first round of the French election.

While the centrist is odds on to win in the second round, she says Mrs Le Pen is not a spent political force yet.

"It is worth remembering that France has National Assembly elections in June, and if Macron can’t get enough of his En Marche members elected, and the Front National increases its number of seats, then Marine Le Pen is likely to remain a major force in French politics."

As such, the "sigh of relief" from markets this morning may be a little premature.

Image source, Getty Images

Image source, Getty ImagesUS investors have given safe haven assets the cold shoulder this morning and embraced stocks, following Emmanuel Macron's leading performance in the first round of the French election.

The yield on 10-year Treasury bonds climbed to 2.3% - the highest in two weeks - before edging back a touch. Gold is down 0.9% at $1,272.82 an ounce.

Image source, Getty Images

Image source, Getty ImagesIconic high street chain Woolworths could be returning to the high street, almost a decade after closing its doors nationwide, the Daily Star has reported, external.

Former brand director Tony Page said he had approached brand owner Shop Direct to buy the name back.

"I am still emotionally attached to it," he told Daily Star, "I still think it has got a role in the future."

Mr Page said he wanted to bring Woolworths back in a "similar format" but place stores more at the "heart of the communities" rather than major shopping centres.

Woolworths collapsed into administration in 2008, leading to 27,000 job losses.