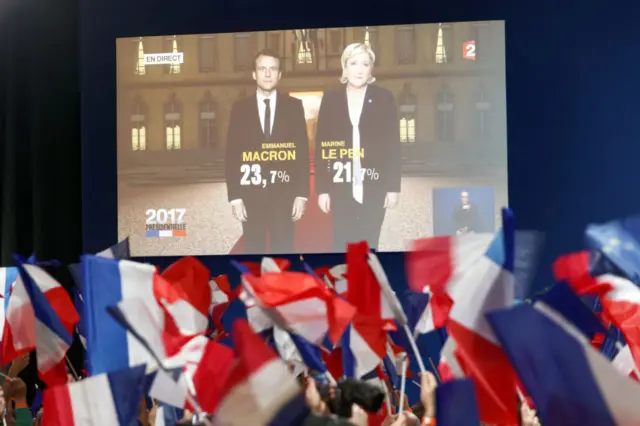

Macron result 'bodes well for world economy'published at 14:59 BST 24 April 2017

Image source, Getty Images

Image source, Getty ImagesJake Robins, a manager at investment firm Premier Asset Management, believes Emmanuel Macron is now certain to become the next French president, and that this bodes well for the global economy.

He points out that last week, European PMI figures (a measure of future economic output) rose yet again and Chinese growth has also beaten expectations. Even Japan is seeing a pick-up in exports.

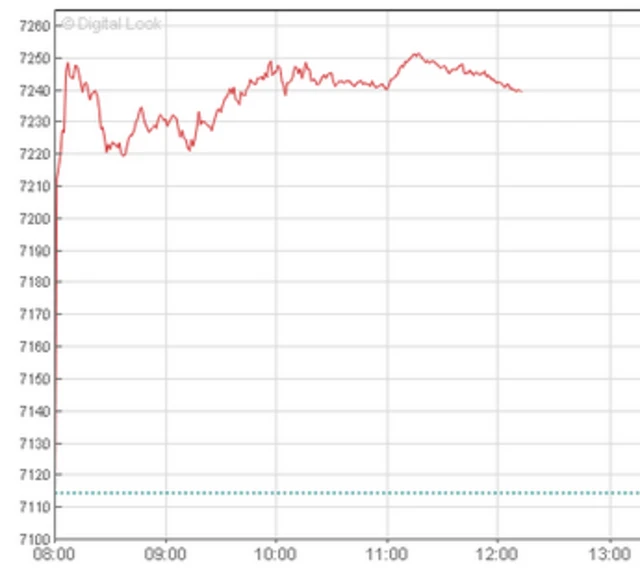

He also says markets that have sagged due to political risk could now shift "to a more bullish and cyclical stance" over the next few months.