Good nightpublished at 21:21 BST 20 June 2017

Thanks for reading Business Live. We'll be back at 6am sharp tomorrow with more business news and analysis.

Get in touch: bizlivepage@bbc.co.uk

Pound slides after Carney comment on rates

Barclays charged by SFO over Qatari investments

Hammond says UK 'weary' over austerity

Simon Neville

Thanks for reading Business Live. We'll be back at 6am sharp tomorrow with more business news and analysis.

Image source, Getty Images

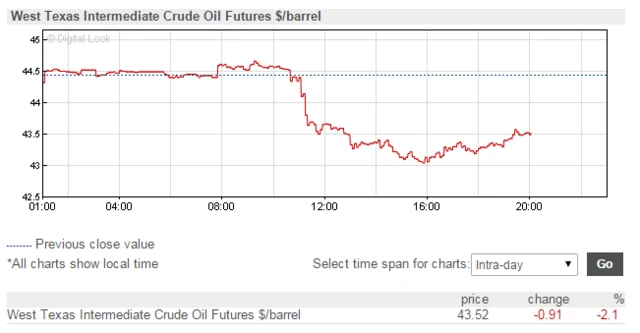

Image source, Getty ImagesUS stocks fell on Tuesday as investors dumped energy shares following a dive in crude-oil prices.

The S&P 500 index closed 0.67% lower at 2,437.03, the Dow Jones lost 0.3% to 21,467.14, and the Nasdaq fell 0.8% to 6,188.03.

The prices of Brent Crude and West Texas Intermediate both dipped by more than 2% per barrel on fresh fears of oversupply in the global market.

BBC World Service

BBC World Service

It's just emerged that Sir Vince Cable is running for the leadership of the Liberal Democrats - but what would he do for the UK economy?

World Business Report asked him earlier this month.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

US crude-oil prices on have fallen into bear-market territory, defined as a drop of at least 20% from its most recent peak.

The fall on the West Texas Intermediate Crude Oil Futures of nearly 3%, sent the cost of a barrel to just under $43 during trading at 4pm, East-coast time.

It means we are officially in bear territory because the WTI is down more than 20% from its 52-week high of $55.24 back in January.

Image source, AFP

Image source, AFPGood news for Facebook-owned Instagram, as bosses claimed it has increased the number of users for its Stories service by 50m since April.

Facebook's global head of sales Carolyn Everson told CNBC: "If you think about it a year ago when we sat together, Instagram Stories didn't exist.

"Today on the platform, we not only have 250m people using it, but actually a third (of the most viewed stories) are businesses using Instagram Stories and one million are advertisers."

But Instagram's gains have been at the cost of rival Snapchat, which saw its shares dive 3.3% to $17.29 on the back of the news.

Instagram Stories overtook Snapchat in April, when bosses said it had 200m active users.

Ms Everson said copycat allegations were not true, because Facebook invented the "Feed" format first.

Image source, Getty Images

Image source, Getty ImagesUS markets are still struggling today, as the low oil prices stayed at 10-month lows.

Oil and gas companies were naturally the biggest-hit shares.

But fast-food chain Chipotle was also badly dented, with shares set to record their biggest one-day fall this year.

The company saw shares drop 6.3% to $429.86 after bosses admitted marketing and promotional costs are set to rise by between 0.2% and 0.3% in the current quarter, versus the first three months of the year.

Investors in the burrito chain are worried that profits could be squeezed as a result.

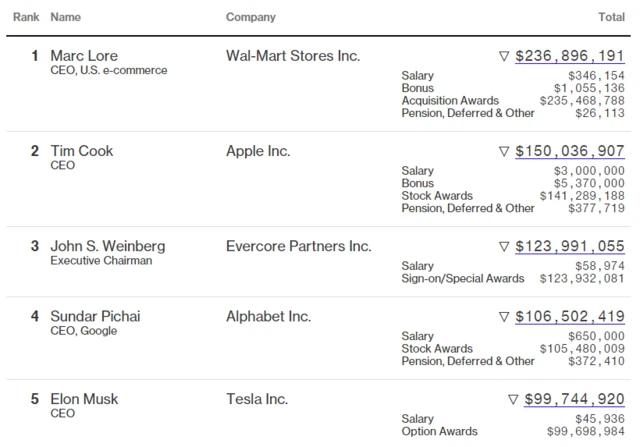

Bloomberg has pulled together a list of the highest paid CEOs in the US., external

For anyone who thought British CEOs get paid a lot... Hold onto your hats.

Topping the list is the Wal-mart boss, but the list is dominated by tech firm chiefs (with notable mention to former Goldman Sachs executive John S. Weinberg, who bagged a massive sign on fee at Evercore Partners.

The highest paid UK chief executive in 2016 was WPP boss Sir Martin Sorrell taking home £40m, while the average UK chief executive bagged just over £5m last year, according to the Equality Trust, external

Image source, Bloomberg

Image source, Bloomberg Image source, AFP

Image source, AFPSticking with Qatar for a moment, the chief executive of Qatar Petroleum, Saad al-Kaabi (pictured), says he reckons the country can stay under "blockade forever" if it needs to.

Speaking to Qatar-based TV network Al Jazeera, he said the UAE, Saudi Arabia, Egypt and Bahrain blockades against the country were not working.

He explained: "With what we have prepared, we can stay under the blockade forever, and our gas and oil industries will not be affected.

"We [still] import everything we need for our industries, maybe except some logistical needs, and UAE's port of Jebel Ali will be the biggest loser [in the dispute], not us."

Image source, Getty Images

Image source, Getty ImagesGoing back to the comments earlier today from Standard and Poor's sovereign ratings chief, Moritz Kraemer, who was interviewed earlier today at the Global Markets Forum.

He spoke at some length about Russia's credit rating and was asked about the country's "positive outlook" position S&P has stated previously.

Mr Kraemer said: "Any renewed deepening of geopolitical risks could diminish the chances of an upgrade. This is because the consequences of a tightening sanctions regime might choke off the recovery of the Russian economy with fiscal but also potential political risks."

But he added that, despite falling oil prices the country's economic recovery is "surpassing our expectations and we have also seen progressive improvement in the Russian financial system".

Another economic powerhouse in the region, Qatar, was hinted at being downgraded though, over the recent sanctions introduced by neighbouring countries.

He said: "We do not see a wave of downgrades in the Middle East, but there are individual countries with a negative rating outlook. Among them is Qatar".

Image source, Getty Images

Image source, Getty ImagesPrivate hire firm Uber, which has faces some of its harshest criticism ever in recent months, said today it has introduced tipping on its app for riders in Houston, Minneapolis and Seattle.

The company has been hauled over the coals due to sexism allegations, harassment in the workplace and questionable conduct.

It led to a slew of senior executives resigning and co-founder and CEO Travis Kalanick taking an extended leave of absence.

No word on whether the tipping policy - which Uber has resisted introducing in the past - will be introduced in other countries.

But the company said it'll be adding more US cities over the coming weeks, eventually making it available throughout America.

Image source, AFP

Image source, AFPLabour MPs are attempting to persuade its leader Jeremy Corbyn to adopt a softer approach to Brexit - echoing the voices of some of the biggest business leaders in the country.

In an open letter to the Guardian newspaper, external, 51 MPs, Peers and MEPs including Chuka Umunna, David Lammy and Lord George Foulkes, have called for the UK to remain a member of the Single Market.

They write: "Jeremy Corbyn has rightly said that Labour’s position on Brexit is to focus on a deal that prioritises jobs first. We are all united behind that goal. For us that means membership of the single market.

"A country can be a member of the single market without being a member of the EU and we must be clear – “access” to the European single market is both different and inferior to “membership” of the single market."

Image source, Getty Images

Image source, Getty ImagesThe Unison union is having its annual conference in Brighton today, and general secretary Dave Prentis (pictured) had some tough words for the Government.

He told assembled members that he planned to campaign against the "brutal" Trade Union Act, which aims to make it harder for unions to strike, and wanted to "smash" the Government's cap on public sector pay rises.

Mr Prentis said: "This Government's austerity pay policies have crushed public services under their heel. They have ground down public service employees. They're worried about their jobs, their families and can't go through another five years of poverty pay.

"Now is the time to shout 'enough is enough'. "This is the year to smash the pay cap. We will not stop taking industrial action because of the draconian legislation against us."

Image source, AFP

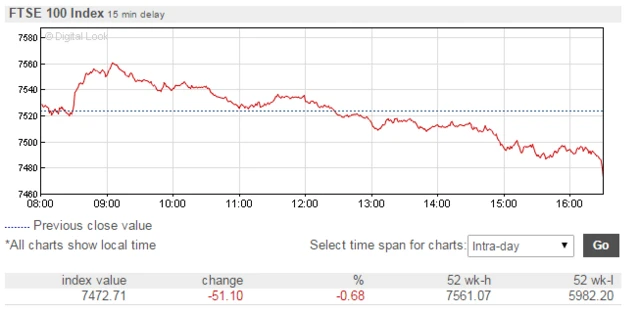

Image source, AFPThe FTSE 100 produced a rare result today - compared with its behaviour in recent months.

Typically, when the pound falls against the dollar, the FTSE rises. Logic being that, foreign investors can benefit from the low pound and stocks become "cheaper" when bought in dollars.

This then pushes up the market.

However, today was unusual because even though the pound was down (£1 is $1.2626 compared to 1.2742 dollars at the previous close) the FTSE was also down.

The biggest fallers were primarily mining giants, including Antofagasta, Glencore, BHP Billiton, Rio Tinto and Anglo American made up five of the seven biggest fallers).

And they typically fall when the oil price is down - it fell 2.2% today.

So - does this mean the FTSE starting to become more susceptible to oil price movements (as it traditionally was before the Brexit referendum) or will the dollar continue to be the major influence on the market?

Image source, Getty Images

Image source, Getty ImagesFor those of you suffering from the heat across much of the country, there has been one big beneficiary of the hot weather.

Retail expert Steve Dresser complained earlier that Amazon had run out of fans, leading to Argos revealing it has sold nearly 100,000 fans on Monday.

Investors weren't overly impressed with the extra business though. Shares in Sainsbury's (which owns Argos) were down 1.2% today.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Chris Johnston

Chris Johnston

Business reporter, BBC News

It is somehow appropriate that the US company Boom Supersonic used the Paris air show to say it has moved a step closer to getting a Concorde-like passenger plane in the sky.

After all, not one but two Concordes are in the museum at Le Bourget airfield, where the huge aerospace trade show is being held this week.

Boom's founder, Blake Scholl (pictured), aims to get a 55-seat passenger plane (about half the number of seats BA offered in its Concorde) flying by 2023 after getting a sub-scale demonstrator in the air by the end of next year.

Despite having the likes of Richard Branson as backers, Boom has a long way to go before passengers are forking out something like $5,000 for a return flight to New York. That would still be substantially less than the price of a ride on nosiy old Concorde, though.

Ding ding!

Stock markets across Europe have closed for the day.

The FTSE 100 index of leading companies took a 51.1 point hit, down 0.68%, to 7472.71.

Oil prices, comments from S&P and Carney's Brexit gloom all seem to have contributed to the lacklustre day.

The World at One

The World at One

BBC Radio 4

The Chancellor, Philip Hammond, has used a speech to city leaders at the Mansion House to say he wants to make the economy the top priority in Brexit negotiations.

He said the government did not want to shut down migration, and said the customs union could be maintained for a time after the UK leaves the EU, during a 'transitional period' to protect key industries.

The chief executive of Siemens in the UK, Juergen Maier, who is leading an industrial strategy review for the government, welcomes the idea of 'transitional' arrangements which he says, will give businesses more time to organise themselves.

Mr Maier also told Martha Kearney it had taken a while to get the Brexit talks started, but it was now important to get on with the negotiations.

The Prime Minister's link to the business world has quit after just 10 months, according to Joel Hills at ITV News.

Theresa May has always had a difficult time trying to win the City over to her point of view - mainly due to the hardline position she took on Brexit before the recent election.

General election campaigns typically involve business leaders signing numerous letters in support of Conservative Party policies, but they were remarkably silent this time round.

The only letter that came along was last week, with the biggest business groups calling for a softer Brexit.

Chris Brannigan is a former Royal Scots Dragoon Guards Lieutenant Colonel who commanded a tank squadron to liberate Basra in 2003.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Standard and Poor's boss in charge of sovereign ratings, Moritz Kraemer, has been speaking to Reuters today about a range of topics.

We'll delve into some of them later.

But the main take home comments were he said S&P may not wait until the Brexit terms are known, before shifting its rating down again.

S&P cut the UK to AA from AAA after the Brexit vote last year, with a negative outlook.

He said: "We will review the UK every six months... and if necessary more often... We will be watching the economic implications, the implications for the public finances, the constitutional implications like the whole Scotland situation... and things like the currency and if it will maintain its reserve status."

Chris Johnston

Chris Johnston

Business reporter, BBC News

There are planes from lesser known manufacturers such as Russia’s Irkut, and Canada’s Bombardier, as well as Embraer of Brazil; helicopters, drones, and pretty much anything else that flies. That also includes missiles, with the likes of Raytheon showing off their wares. One of its missiles, the SkyCeptor, is promoted as being “low-cost but high-performing” compared with other “hit-to-kill effectors”.

Although a new passenger jet can cost hundreds of millions of dollars, the global spend on defence aerospace technology leaves commercial aviation in its wake. It’s no wonder that the hundreds of companies exhibiting at the show go out of their way to encourage the top brass from the air forces of the world to stop way, as well as wooing slightly less visible customers.

The bulk of the aerial displays are performed by defence aircraft, be they jet fighters, transporters or helicopters performing sometimes hair-raising manoeuvres at high speed – and high decibels. An A380 might be able to carry several hundred passengers, but it most certainly cannot loop the loop.