FTSE 100 edges down at openpublished at 08:08 BST 20 June 2017

Image source, Getty Images

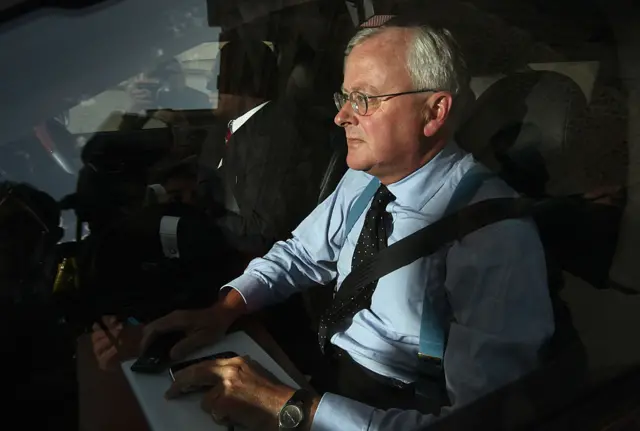

Image source, Getty ImagesThe FTSE 100 has fallen slightly ahead of the Mansion House speeches from Chancellor Philip Hammond and Bank of England governor Mark Carney.

Shortly after the open the index was at 7,523.01, a fall of 0.02% or 1 point.