Good nightpublished at 21:29 BST 30 April 2018

That's all from us. We'll be back from 6am tomorrow.

Sainsbury's says there will be no store closures or store job losses from its merger with Asda

TSB says still only half of online customers can access their accounts

Carpetright forecasts full year loss of £7m to £9m

Interserve reports 'extremely poor' year

Get in touch: bizlivepage@bbc.co.uk

Russell Hotten

That's all from us. We'll be back from 6am tomorrow.

Wall Street stocks finished lower as worries about trade conflicts and Iran policy overshadowed positive earnings announcements.

The Dow Jones Industrial Average lost 0.6% to close at 24,163.15 points. The S&P 500 dropped 0.8% to 2,648.05 points, and the tech-rich Nasdaq Composite Index also shed 0.8% to 7,066.27.

Image source, Reuters

Image source, ReutersRemember the Greek debt crisis? It used to make headlines daily. But since it slipped down the news agenda Athens has made huge economic strides. At least that's what the head of the Organisation of For Economic Cooperation and Development thinks.

Greece has made an "enormous" reform effort and its international lenders must now grant the country debt relief, Angel Gurria said on Monday.

Gurria, who met Greek Prime Minister Alexis Tsipras in Athens, urged Greece to continue with reforms after its third international bailout expires in August.

In its latest survey on Greece, the OECD sees the Greek economy growing by 2% this year and possibly by 2.3% next year, Gurria said.

"I want to congratulate the entire Greek people for an enormous reform effort, it was a very ambitious reform package," he said. "And these reforms are bearing fruit."

Image source, PA

Image source, PANorway will consider introducing a tax on fish farmers because of their use of the country's national resources, the finance ministry says.

Fish farms, which mainly raise salmon and rainbow trout, tend to be located in deepwater fjords along the country's coast.

The industry is Norway's second-largest export industry after oil and gas production, with sales of 63.7bn crowns (£6bn) in 2016, according to latest official figures.

"The government will... study and possibly recommend a tax on the use of natural resources to be introduced in 2020," the finance ministry said. "Such a tax is under consideration without a detailed plan yet ready."

Leading Norwegian producers include Marine Harvest, Salmar, Leroy Seafood, Grieg Seafood and Norway Royal Salmon.

Image source, Reuters

Image source, ReutersThousands of people marched through Moscow, throwing paper planes and calling for authorities to unblock the popular Telegram instant messaging app.

Protesters chanted slogans against President Vladimir Putin as they launched the planes - a reference to the app's logo.

"Putin's regime has declared war on the internet, has declared war on free society... so we have to be here in support of Telegram," one protester told Reuters.

Russia began blocking Telegram on 16 April after the app refused to comply with a court order to grant security services access to its users' encrypted messages. onday.

Image source, Internet archive

Image source, Internet archiveThe French government is being sued over the way it has sought to take over the France.com web domain.

In 2015, France started legal action against Frenchman Jean-Noel Frydman, who had registered France.com in 1994.

Two years later, a French court ruled in France's favour and the government began to lobby domain host web.com to take control away from Mr Frydman.

And now Mr Frydman, who built a business around the domain, says France has "illegally" seized the site.

He says France.com was taken away from him without warning in mid-March. And he has now begun legal action in Virginia in a bid to regain control of it.

Mike Coupe, caught singing "We're in the Money" on camera between interviews after the Asda merger was announced, was asked by Channel 4 News about his choice of tune.

Will he personally be in the money and what is in it for him, he was asked. "I am a big shareholder in Sainsbury's, my shareholding is a matter of public record, you can see how many shares I own.

"It is unfortunate I was caught singing, as I say I was relaxing at the time - this is an incredibly stressful day and maybe it was an unfortunate choice of song."

Sainsbury's boss Mike Coupe has been caught on camera enjoying a light-hearted distraction from the stresses and strains of his planned merger with Asda. He'll be hoping his choice of song - from The Gold Diggers of 1933 - won't come back to haunt him.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Wall Street has slipped, reversing gains from earlier in the session, with rising oil prices adding to worries about rising costs for companies.

Oil prices rallied after Israeli Prime Minister Benjamin Netanyahu said that Iran had lied about not pursuing nuclear weapons and had continued to preserve and expand its weapons knowledge after signing a 2015 deal with global powers.

US President Donald Trump has until 12 May to decide whether to restore sanctions on Iran that were lifted after a 2015 international agreement over its nuclear program.

Oil has risen this month to the highest since late 2014, driven by concerns over potential disruptions to Iranian crude flows.

But analysts said the market is extremely sensitive to any developments on the nuclear deal and sanctions due to the high degree of uncertainty. US West Texas Intermediate crude rose more than 61 cents to $75 a barrel.

With about 90 minutes left of trading, the Dow Jones was down 0.05% to 24,298.7, the S&P 500 was down 0.31% to 2,661.6, and the Nasdaq slipped 0.39% to 7,091.8.

Image source, Reuters

Image source, ReutersOil prices rose on Monday, reversing earlier losses as Israeli Prime Minister Benjamin Netanyahu said Israel had proof that "Iran lied" about its nuclear weapons capability, and that he was sure US President Donald Trump would do "the right thing" in reviewing the country's nuclear deal with western powers.

Brent crude futures were up 61 cents at $75.04 a barrel, while US West Texas Intermediate futures were up 80 cents on the day at $68.9 a barrel.

Earlier in the trading session, both benchmarks had been down about 1%. "Oil reacted very severely" to Netanyahu's announcement, said Phil Flynn, analyst at Price Futures Group in Chicago.

Uche Akolisa

Uche Akolisa

BBC Igbo, Lagos

Image source, AFP

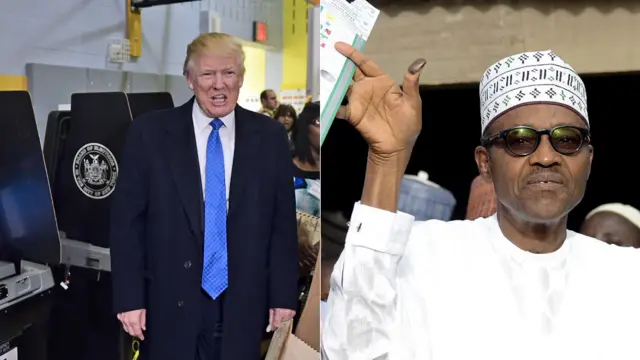

Image source, AFPAs Nigeria's President Muhammadu Buhari is about to meet his US counterpart Donald Trump, BBC Igbo has been looking at four things the men have in common.

1) Assumed office in their 70s

Mr Buharị was 73 when he assumed office in 2015 and Mr Trump was 70 when he came to power last year.

2) Their elections came as a surprise

Mr Buhari was Nigera’s first oppostion leader to win an election - never before had a sitting president been defeated at the polls. In the US, Hillary Clinton was tipped to win the 2016 election, but the US billionaire and Republican candidate claimed victory after a string of formerly Democratic states swung his way.

3) Troubled relationship with the media

President Trump does not hide his disdain for journalists and the press in general. Mr Buhari, a former military ruler, is equally as wary and only makes policy statement when he is outside the country, tending to shun local media interviews.

4) Known for their gaffes

Mr Trump's blunt language on Twitter is infamous and he is alleged to have used the word "shithole" to describe African nations – though he denies being racist. Mr Buhari has had equally embarrassing moments. He once responded to criticism from his wife by saying she belonged in his kitchen and earlier this year upset Nigerians by suggesting young people were not hard working.

Image source, Getty Images

Image source, Getty ImagesFrench hotel group AccorHotels has secured a deal to buy rival Movenpick Hotels & Resorts for 560m Swiss francs (£412m).

AccorHotels said the deal would add to group earnings from the first year onwards of the acquisition being completed, which it said should take place in the second half of 2018.

"With the acquisition of Mövenpick, we are consolidating our leadership in the European market and are further accelerating our growth in emerging markets, in particular in Middle East, Africa and Asia-Pacific," said AccorHotels chairman and chief executive Sebastien Bazin.

BBC business presenter tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Marvel Studio

Image source, Marvel StudioShares in Disney are doing well on the back of news that "Avengers: Infinity War" took in $630m in its first weekend, the highest global opening of all time.

That topped "The Fate of the Furious," the eighth installment of the high-octane action series starring Vin Diesel, Dwayne Johnson and Michelle Rodriguez that opened with more than $530m globally in 2017.

Disney shares are up 2%.

Brexit minister tells AMs he is confident of an EU deal that does not involve the customs union.

Read MoreThere's good and bad news in the latest Carillion update from the Official Receiver.

The number of jobs saved thanks to employees transferring to new suppliers stands at 11,450. Jobs lost has reached 2,257, including another 36 leaving this week.

About 3,300 employees are currently being retained to enable Carillion "to deliver the remaining services it is providing for public and private sector customers until decisions are taken to transfer or cease these contracts," the Official Receiver says.

Sainsbury's was the stand-out winner on the FTSE 100. The supermarket's shares finished 14.5% up as investors gave their verdict on the proposed merger with Asda. Meanwhile, WPP shares jumped 8.6% on the back of solid results.

Glencore was the biggest faller. Investors are increasingly worried about its exposure to US sanctions on Russia, which include aluminium producer Rusal. Glencore is a Rusal shareholder and one of its biggest customers. Glencore shares closed down 5%.

The FTSE 100 ended flat, at 7,509.3 points, while the FTSE 250 was also virtually unchanged at 20,285.

Sainsbury's thinks its Asda takeover will help it compete with the discounters, but integrating the two businesses will be a mammoth task.

Read MoreAllow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Sainsbury's boss Mike Coupe says that the ambitious price cuts they've announced will come from cutting costs.

Read More