Sainsbury's and Asda - the main pointspublished at 07:42 BST 30 April 2018

The BBC's Ben Thompson tweets

Sainsbury's says there will be no store closures or store job losses from its merger with Asda

TSB says still only half of online customers can access their accounts

Carpetright forecasts full year loss of £7m to £9m

Interserve reports 'extremely poor' year

Get in touch: bizlivepage@bbc.co.uk

Russell Hotten

The BBC's Ben Thompson tweets

Today Programme

Today Programme

BBC Radio 4

Sainsbury's boss Mike Coupe concedes that it is possible that the Competition and Markets Authority will seek store closures if they choose to investigate the proposed merger with Asda.

He says: "We are going into this with our eyes wide open and the important thing is that the authorities act on behalf of consumers, that's their job.

He then adds: "We think we've got a very compelling case because ultimately we'll be able to bring prices down for customers, improve quality, service and create a more flexible business."

The combined group will be led by Sainsbury's chief executive Mike Coupe.

He said he believed the two supermarkets were "the best possible fit".

"It will create a business that is more dynamic, more adaptable, more resilient and an even bigger contributor to the UK economy," he said in a statement.

Image source, Getty Images

Image source, Getty ImagesA brief interlude from supermarket merger news...WPP has reported better like-for-like sales for the first quarter.

In its first trading update since its founder and chief executive Sir Martin Sorrell resigned, the advertising giant said revenue fell by 0.1% compared to analysts' expectations of a 1% decline.

Total revenue fell 4% to £3.5bn.

WPP's joint chief operating officers Mark Read and Andrew Scott said: "In the last two weeks we have focused on spending time with our clients and people, and the response has been very encouraging."

They added: "Our priority is to focus on growth. We will proactively address the under-performing parts of our business and we need to ensure that our capital is deployed to those areas that will grow fastest and maximise shareholder value."

Today Programme

Today Programme

BBC Radio 4

Image source, Getty Images

Image source, Getty ImagesSainsbury's chief executive Mike Coupe, who will be the boss of the combined business following a merger with Asda, has reiterated to the Today programme that there will be no store closures if the deal goes ahead.

He says: "The stores will continue to trade and that's where the vast majority of employees of both companies actually work so we're confident there will be no store closures and therefore no job losses in the stores."

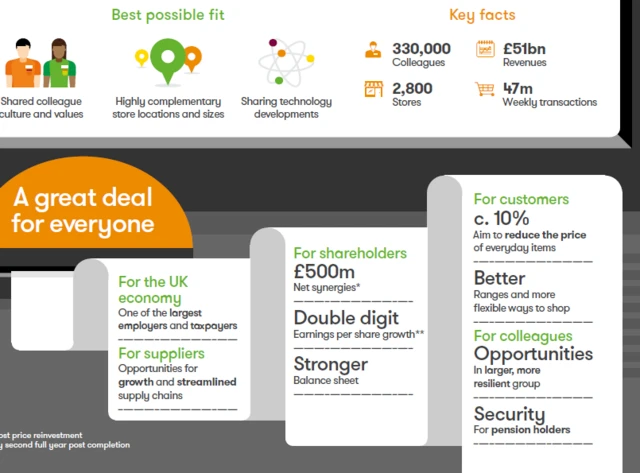

If you want to see all the details at a glance, here is the proposed tie-up in pictorial form courtesy of Sainsbury's.

Image source, Sainsbury's

Image source, Sainsbury's Image source, Sainsbury's

Image source, Sainsbury'sUnder the proposed tie-up, Walmart will own 42% of the new combined group. The BBC's business correspondent Emma Simpson suggests this means they will be able to tap into the US retail giant's buying power.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Reuters

Image source, ReutersSainsbury's statement claims that the tie-up with Asda will lower prices by around 10% on "many of the products customers buy regularly".

It also claims that the combination will "offer more opportunities for over 330,000 colleagues at all levels within the enlarged group".

It does not however give any reassurances over potential job losses due to the merger.

Sainsbury's and Asda have confirmed they intend to merge.

In an announcement, Sainsbury's said that Asda's US owner, Walmart, will hold a 42% stake in the combined business.

Assuming it gets regulatory approval, completion of the deal is expected in the second half of next year.

The statement also confirms the two separate brands: Asda and Sainsbury's will be retained.

Together the merger will create a network of 2,800 stores across the UK.

Today Programme

Today Programme

BBC Radio 4

Image source, Getty Images

Image source, Getty ImagesIf Sainsbury's and Asda do merge, it will create a supermarket with a 31% share of the UK market.

Mike Pullen, a specialist in competition law and regulation at Carter Ruck, says: "I think its certain there will be a referral to the CMA [the Competition and Markets Authority]."

He tells the Today Programme: "There have been numerous market inquiries into the supermarket sector. The big issue with supermarkets is no-one is in a dominant position, nobody has got over 50% of the market.

"A lot of the supermarket inquiries in the past have been damp squibs but the market is changing.

"As you know in 1997, the CMA blocked the Asda/Safeways merger that led to Safeways and Morrisons coming together but recently they've allowed Tesco to merge with Booker and that in lots of ways was technically a more problematic deal than the current deal."

Image source, Newscast

Image source, NewscastQatar Investment Authority (QIA), the biggest shareholder in Sainsbury's was aware of the merger talks with Asda and "supportive", according to Reuters.

Sainsbury's upcoming statement on the deal is expected to reflect QIA's position on the tie-up.

QIA, which ranks among the top 10 sovereign funds in the world, has a 22% stake in Sainsbury's.

Today Programme

Today Programme

BBC Radio 4

Image source, Getty Images

Image source, Getty ImagesStill on the Asda and Sainsbury's merger, retail analyst Steve Dresser describes Amazon as "the elephant in the room".

"Mainly because if they do come along they're unpredictable," he tells the Today programme. "They are very customer focused, they're not overly focused on profit which means they're very good for customers and less so for businesses."

He says: "They do a little bit with Morrisons at the minute around their own online service but certainly nothing that's going to really push anything. However, if they were to buy someone as they did with Whole Foods in the US, that was a massive disruptor, that's always the concern.

"If you look at them generally, they have grown from books and DVDs to virtually everything else."

Image source, Getty Images

Image source, Getty Images"Same as before" is how a TSB spokesperson describes the current situation at the bank.

That means that over a week after its IT upgrade, half of TSB's online banking customers are still unable to access their accounts.

The process that has led to the disaster involved moving 1.3 billion customer records from the old system run by its former parent bank, Lloyds, to one managed by its new Spanish owner, Sabadell, saving £100m a year as a result.

Today Programme

Today Programme

BBC Radio 4

Image source, Getty Images

Image source, Getty ImagesIt's fair to say people are still digesting the news that Sainsbury's and Asda are in merger talks but what is the rationale for the deal?

Steve Dresser, analyst at Grocery Insight Consultancy, says that Asda and Sainsbury's are, in terms of market share, "landlocked".

He tells the Today programme: "They are not really able to grow at any rapid rate due to Aldi and Lidl, Amazon and the whole online growth so with Tesco buying Booker and getting even more buying power I think they're viewing it as a deal to counteract that."

He adds: "Despite both chains being at opposite ends of the market in terms of Sainsbury's with quality and Asda with value...if both consolidate than obviously it makes the combined forces stronger.

"Certainly if they remain on their own, it is difficult to see how they get any real growth beyond standard organic growth which isn't necessarily going to be enough if Amazon joins the party so to speak or indeed if online markets continue to grow as they do."

Image source, Getty Images

Image source, Getty ImagesAMP is Australia's biggest listed wealth manager

A government-backed inquiry into Australia's banks and financial services sector has resulted in another resignation at AMP - the country's biggest listed wealth manager.

Catherine Brenner, AMP's chairman, resigned on Monday following further evidence at the inquiry that the financial giant had misled many customers - and the country's corporate regulator, ASIC.

AMP also announced on Monday the resignation of its legal counsel and said its directors' fees would be cut by 25%.

Earlier this month AMP's chief executive officer Craig Meller resigned following evidence that AMP had lied to ASIC for almost 10 years to cover a practice of so-called fees-for-no-service.

The banking inquiry, which started in February, is investigating alleged and established misconduct in the sector.

Australia's banks, which are among the most profitable in the world, have been accused of customer exploitation and corporate fraud, among other scandals.

Image source, Getty Images

Image source, Getty ImagesSainsbury's boss Mike Coupe (pictured) will be on Radio 4's Today programme later this morning to explain the rationale behind the deal.

Ahead of his appearance, business editor Simon Jack has outlined a few questions for him.

Two of the big questions are: How many stores will close and how many jobs will go?

So far Sainsbury's is saying no stores will close, which seems hard to believe.

Retail analyst Steve Dresser is doing his homework on the Sainsbury's and Asda tie-up by standing outside an Asda in Keighley in Bradford.

He points out that the two supermarkets are "absolute opposites - the only similarity is that they both run big shops".

But he believes the deal has been driven by the competition from Aldi and Lidl. He says the tie-up is the only way for Asda,which has been particularly hit by the cheaper rivals, to grow.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

BBC Radio 5 live

BBC Radio 5 live

Image source, Getty Images

Image source, Getty ImagesAnother mega deal annnounced at the weekend was that of US telecoms giant T-Mobile, which has agreed to buy its rival Sprint in a huge $26bn (£18.9bn) deal.

The merger of America's third and fourth largest mobile carriers is designed to create a more competitive firm with about 130 million customers.

Jessica Ground, equities fund manager at Schroders, believes the fast approaching advent of 5G has driven the deal.

"Everybody's gearing up for 5G and it's going to be a huge amount of investment.

"If you're the third or fourth player, getting together to help build a network is the only way," she says.

She also says that it's likely that fewer players will lead to a better network for consumers and thinks regulators may be sympathetic to the tie-up as a result.

BBC Radio 5 live

BBC Radio 5 live

Image source, PA

Image source, PAOfficial figures out on Friday showed the UK economy grew at its slowest rate since 2012 in the first quarter of the year.

GDP growth was 0.1%, down from 0.4% in the previous quarter, driven by a sharp fall in construction output and a sluggish manufacturing sector, according to the Office for National Statistics.

Despite the downbeat stats, Yael Selfin, chief economist at KPMG, says it's too early to worry.

She says the downward trend "may be gradually reversed later on this year"

"It's too early to tell if it's a negative trend or a one-off," she tells Radio 5 Live.

It's all about Sainsbury's and Asda today. We're expecting to hear more details on the mega £10bn deal later this morning. Chief executive Mike Coupe will also be explaining the rationale behind the tie-up. We will update you as soon as we have more information.