US producer prices rise 0.1%published at 13:40 BST 12 July 2019

US producer prices rose 0.1% in June, external, slightly more than economists polled by Reuters who had not expected any change.

That compares with 0.1% in May and 0.2% in April.

Get in touch: bizlivepage@bbc.co.uk

Car dealer Lookers warns on profits

Hiscox hit by cost of catastrophes

Thomas Cook in rescue talks with Fosun

WPP to sell 60% stake in Kantar

Daimler warns on profits

Rates could be 'cut to near 0%'

Tom Espiner

US producer prices rose 0.1% in June, external, slightly more than economists polled by Reuters who had not expected any change.

That compares with 0.1% in May and 0.2% in April.

Economics editor at Bloomberg tweets

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Reuters

Image source, ReutersCar firms Volkswagen and Ford have said they will work together on developing self-driving and electric cars in a bid to reduce costs on new technologies.

The two firms said whilst they remained "fiercely competitive" in the car market, the tie-up would give them "significant global scale" in new tech.

In total, VW plans to invest $2.6bn (£2bn) in Argo AI, a company developing autonomous vehicles, and in which it will become an equal shareholder with Ford. It values Argo at $7bn,

The move comes after the carmakers said in March they would build vans together.

The agreement is latest example of rivals joining up to develop new technologies.

Image source, WPP

Image source, WPPBack to that WPP deal to sell a 60% stake in Kantar to Bain Capital.

The advertising company intends to hand back around £1bn to shareholders from the proceeds of the sale.

"This transaction creates value for WPP shareholders and further simplifies our company. With a much stronger balance sheet and a return of approximately 8% of our current market value to shareholders planned, we are making good progress with our transformation," said Mark Read, chief executive of WPP (pictured).

The shares are up 3p at 958p.

Image source, Getty Images

Image source, Getty ImagesThe FTSE 100 is up 14 points at 7,524.

Housebuilders - Persimmon, Taylor Wimpey, Barratt Developments - are among the biggest risers.

The fallers are led by Hiscox, the Lloyd's of London insurer, which is down 4%. As mentioned earlier, the insurer has been talking about the impact on its profits from claims caused by hurricanes.

The pound is unchanged against the dollar at $1.2526.

Image source, MENZIES AVIATION

Image source, MENZIES AVIATIONJohn Menzies, the aviation services company, which earlier this month warned that full-year profits will fall below expectations, is getting a new chairman.

Dermot Smurfit is being replaced by current non-executive Philipp Joeinig as chairman with immediate effect.

The company said the chairman joined the board in July 2016 and oversaw a number of changes including the sale of Menzies Distribution, which allowed the group to pull out of the market to distribute newspapers and magazines.

He said: "I wish the group and its 36,000 employees the very best for the future as it embarks on the next stage of its journey. I believe that this now requires an industry specialist to bring Menzies to a new level of excellence. I wish my successor, Philipp Joeinig every success in that mission."

Donald Trump was tweeting about crypto-currencies earlier on Friday.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesThomas Cook's proposed £750m rescue deal is a sign of "desperate times" at the troubled travel company, according to Markets.com analyst Neil Wilson.

The proposal would effectively hand control of the firm over to its largest shareholder, Fosun. Mr Wilson said: "Shareholders face significant dilution – basically it’s wipe out time."

He said that publicity around the travel agent's financial difficulties was also deterring potential customers from booking holidays with the firm.

"So no surprise to see tour operator bookings are down 9%, with margins remaining weak due to intense competition and promotional activity."

What are the implications of that deal by WPP to sell a stake in Kantar, mentioned earlier?

Quote MessageLike the Chime communications agency WPP sold at the beginning of the month, Kantar has the advantage of being relatively self-contained and so can be split off from the parent with minimal restructuring costs. As a result the proceeds of the sale will drop straight through to the balance sheet and shareholders pockets. With the balance sheet back in rude health, and complexity significantly reduced, WPP needs to focus on the technological and creative transformation that will be vital to its long term future in a rapidly changing industry.

Nicholas Hyett, Equity Analyst at Hargreaves Lansdown.

Image source, Getty Images

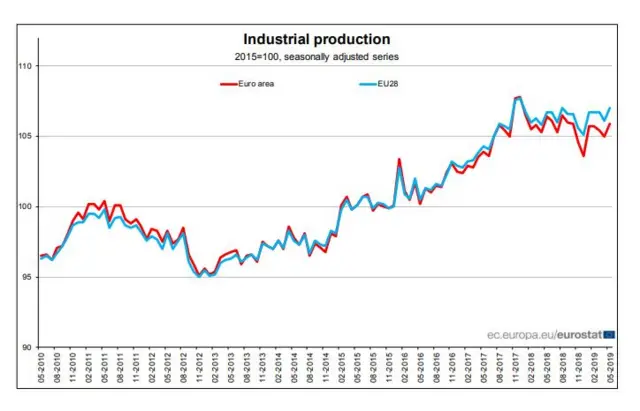

Image source, Getty ImagesBack to that data about industrial production in the eurozone mentioned earlier.

Jack Allen-Reynolds, senior Europe economist at Capital Economics, says it should "allay concerns about the wider economy falling into recession".

But it is still consistent with growth slowing the second quarter of the year, he said.

"With global economic growth likely to remain weak this year and next, industrial production across the eurozone looks set to remain sluggish, weighing on the wider economy," he said.

Image source, Getty Images

Image source, Getty ImagesMore from that speech by Gertjan Vlieghe, a member of the Bank of England's rate-setting committee.

If rates were cut, he says it is "highly uncertain when I would want to reverse these interest rate cuts, which would either be driven by an improvement in the underlying economy as the disruptive impact of no deal fades, or by upside risks to inflation if the exchange rate and tariff driven boost to inflation puts upward pressure on medium-term inflation expectations".

The speech is here , externalin which he says the Bank could improve its communications by showing a forecast with its preferred future path of interest rates

Reuters reporter tweets

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesGertjan Vlieghe, a member of the Monetary Policy Committee, has been speaking this morning at an event at Thomson Reuters.

He says rates would need to fall even lower than the 0.25% they were cut to after the EU referendum if there is a no-deal Brexit.

"Under a no deal Brexit, there would likely be significant near term supply-side disruption, as well as a further fall in the exchange rate," he said.

"The key question for the MPC would be to what extent medium-term inflation expectations remain anchored despite a likely temporary rise in inflation due to the exchange rate and possibly tariffs," he added.

He said his own view was that is that steady rates or a rate cut were more likely than a rate rise in response to temporarily higher inflation.

"On balance I think it is more likely that I would move to cut [rates] towards the effective lower bound of close to 0% in the event of a no deal scenario," he said.

The rate is currently 0.75%.

Image source, EUROSTAT

Image source, EUROSTATIndustrial production in the eurozone rose 0.9% in May compared with April, according to the EU statistics agency Eurostat.

That was more than the 0.2% consensus estimate and comes after industrial production fell by 0.4% in the eurozone in April, and by 0.6% in the EU.

Compared with May 2018, industrial production decreased by 0.5% in the eurozone and increased by 0.4% in the wider EU, Eurostat said.

Image source, Alamy

Image source, AlamyOutsourcing company Interserve has named Alan Lovell as its new chairman, replacing Glyn Barker.

Mr Lovell was chairman of the restructuring committee of Carillion, which collapsed last year.

Ernst & Young was appointed as administrators to Interserve in March.

BBC Radio 5 Live

BBC Radio 5 Live

Wake Up To Money

Image source, Getty Images

Image source, Getty ImagesAndy Chamberlain, deputy director of policy at IPSE, the Association of Independent Professionals and the Self-Employed, spoke to Wake Up To Money about IR35 legislation which is designed to stop people working through their own limited company to get tax benefits, when they are actually working as employees.

Yesterday the Treasury published new draft legislation that will mean large and medium-sized businesses become responsible for deciding whether their contractors fall under IR35 and should actually be staff.

He says: "We think this is a big mistake. This is going to be extremely damaging not just for contractors but for the businesses that use contractors and indeed the economy as a whole".

Image source, Getty Images

Image source, Getty ImagesChina's exports fell less than expected in June leaving the country with a trade surplus of $51bn (£40bn) compared with $42bn in May.

The 1.3% fall was less than the 2% that had been expected by analysts polled by Reuters.

Analysts have been trying to assess the impact of the trade dispute between the US and China.

Today Programme

Today Programme

BBC Radio 4

Image source, Reuters

Image source, ReutersHMS Montrose was shadowing a British tanker as it moved into the Strait of Hormuz

Commercial ships are being advised to stay away from Iranian waters after growing tensions in one of the world's busiest shipping lanes.

Worries for the safety of ships in the region started after Iranian boats threatened a British oil tanker in the region before it was driven off by a Royal Navy ship.

Guy Platten, secretary general of the International Chamber of Shipping, told the Today Programme that 20% of the world's oil passes through the Strait of Hormuz, which he said was a "vital route".

"We remain really concerned... I think we have to have some context. There's been no loss of life, no ships have been sunk yet or anything like that... It's still an isolated incident," he said.

"However we are concerned. The freedom of navigation is a fundamental principle of international law". That's how free trade operates, he says.

It was a major concern as shipping companies will be looking carefully at the route and insurance companies could charge higher rates.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

This is the fourth warning on profits this year and comes after it cut its profits forecast only last month.

The company listed three factors for the latest revision:

It also says there has been lower growth in its markets than expected.

Its shares are down around 1%.

Image source, Getty Images

Image source, Getty ImagesDaimler says it is "adjusting" its outlook for its financial performance and now expects a second-quarter loss of €1.6bn (£1.4bn) compared with €2.6bn of profit a year earlier.

This is "significantly below market expectations" the carmaker says.