Car dealership's shares go into reversepublished at 08:33 BST 12 July 2019

Image source, Getty Images

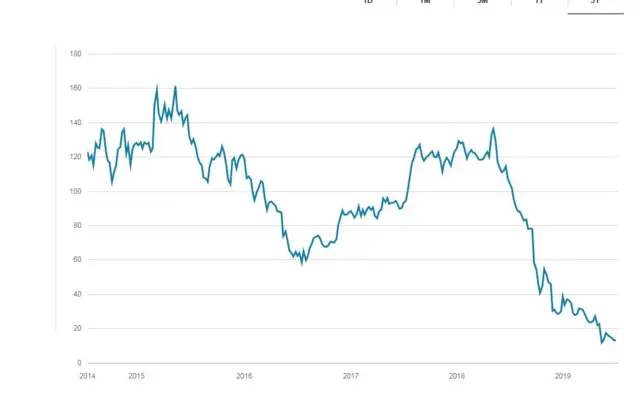

Image source, Getty ImagesThomas Cook isn't the only share price to suffer big falls today. Car dealership Lookers has seen its share price tumble 18% following a profit warning.

As reported earlier, the company said full-year profits would be below expectations due to weak consumer confidence and pressure on used-car margins.