Goodbyepublished at 17:00 BST 1 August 2019

That's it for today. We'll be back on Friday at 06:00.

Get in touch: bizlivepage@bbc.co.uk

Bank of England cuts UK growth forecasts

UK factories slowdown - report

Eurozone factories slowdown for sixth month - report

Shell shares slide after results disappoint

Sales of Rolls-Royce cars surge 42%

Thomas Cook shares jump

Kier leaps 40% on reduced debt

Pound dips through $1.21

Ben Morris and Jill Treanor

That's it for today. We'll be back on Friday at 06:00.

Image source, Getty Images

Image source, Getty ImagesThe pound slumped to a low of $1.2085 at one point during the day, its weakest since January 2017, although has pushed back up through $1.21 as London closes.

The FTSE 100 was little changed on the day as the market was closing, around 7,584 - that's 1.9 points lower.

The company that owns the London Stock Exchange was the biggest gainer after announcing a deal, mentioned earlier, to buy financial data company Refinitiv, rising 7%.

The FTSE 250 was 32 points lower at 19,634.

In the US, the Dow Jones Industrial Index and the S&P 500 were both around 1% higher.

Waitrose is extending a trial to remove packaging from many products after a positive response in its first store.

The "Unpacked" scheme was tested in Oxford, with customers using their own containers to buy produce such as pasta, wine and frozen fruit.

More than 200 products were taken out of their packaging at the Botley Road shop in June to cut waste.

Now the chain has announced the scheme will be rolled out to stores in Cheltenham, Abingdon and Wallingford.

Image source, Getty Images

Image source, Getty ImagesStandard Chartered is ending the day as one of the day's largest risers in the FTSE, up around 3%.

That's after the emerging markets-focused bank reported a 3% rise in first half profits to $2.4bn (£2bn).

"Concerns surrounding the potential escalation of trade tensions has affected sentiment and central banks' commentary is indicating a reversal of monetary policy normalisation," said Andy Halford, finance director.

Image source, Getty Images

Image source, Getty ImagesThis is an interesting read, behind the FT's paywall., external

But the gist is that London has become a testing ground for the use of facial recognition technology.

With 420,000 CCTV cameras it the second most monitored city in the world after Beijing - according to data from the Brookings Institution.

The Metropolitan Police have been using the technology as well as Transport for London.

Private companies have also been investing.

But experts are worried that there is no ethical or regulatory framework for the use of the tech.

Image source, Getty Images

Image source, Getty ImagesBarclays shares are ending the day around 1% higher after its half-year results, mentioned earlier.

The bank has since said it has cut 3,000 jobs in the second quarter as it keeps a lid on costs. It employs around 83,500 globally.

Image source, CASIO

Image source, CASIOIan Giles, antitrust and competition partner at Norton Rose Fulbright, has been looking at the Competition and Market Authority's fine on Casio, mentioned earlier.

“The CMA’s decision reflects a trend of increased enforcement against brand owners trying to control market pricing of their products, notably in online sales. The level of penalty will send a strong message to businesses.

“The European Commission has issued some similar fines, and is in the middle of a review of the rules applied to such 'vertical agreements' between manufacturers and distributors. Its research has shown that such practices are widespread.

“That said, there are a number of voices arguing that competition agencies should only focus on such restrictions where there is market power.

"Competition law remains a blunt tool in this respect, and it is hoped the current review might address more clearly the situations where problems arise".

BBC economics correspondent tweets

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Chief market analyst at CMC tweets

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The Dow Jones Industrial Average is also rising, back up through 27,000, some 221 points higher at 27,085.50.

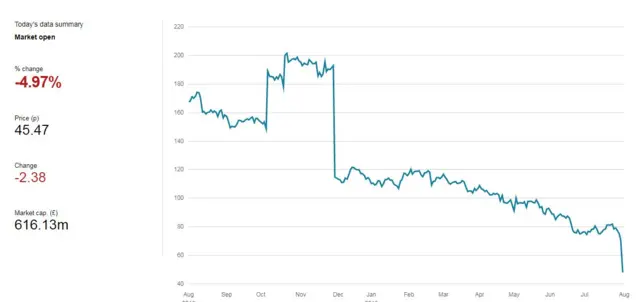

Shares in shopping centre owner Intu have continued to fall after plunging more than 20% on Wednesday. That was after it issued results showing wider losses and warned it might have to raise equity as it cuts its debt.

With less than hour to go before London closes, its shares are in record-low territory and down another 7% at 44p.

Image source, Reuters

Image source, ReutersJeff Bezos, the founder of Amazon and the world's richest man, has sold $1.8bn of stock in recent days.

Reports say these are his first sales since he and his former wife MacKenzie agreed a record-breaking divorce settlement worth at least $35bn (£27bn) in April.

Image source, Getty Images

Image source, Getty ImagesYou might not have heard of NIO, but it is one of China's biggest makers of electric cars.

And it had a racing team that won the first FIA Formula E championship in 2015.

Well now e-racing365 reports, external that it has sold that racing team to Shanghai based Lisheng Racing.

The move probably reflects NIO's tough financial circumstances. It reported a loss of $390m, external in the first quarter of 2019, and in June received an investment from a state-owned firm.

After Wednesday's sharp falls when the US Fed appeared to rule out any more interest rate cuts this year, US stocks rose.

The Dow Jones Industrial Average is ahead 0.27% to 26,935.61.

The S&P 500 also rose by 0.27%, to 2,988.55 and the Nasdaq is up 0.79% at 8,239.62.

Image source, Getty Images

Image source, Getty ImagesFormer Deputy Prime Minister Nick Clegg (C) has been asked to answer MPs' questions about the Facebook's earlier testimony

British MPs are taking Facebook to task over evidence appearing to contradict testimony the US tech company gave about the Cambridge Analytica scandal.

Facebook bosses told MPs they had learned users' data had been misused via a December 2015 Guardian report.

But a US watchdog has now said Facebook workers flagged the problem three months earlier.

MPs want answers by mid-August. The social network has said it will respond "in due course"

Image source, Getty Images

Image source, Getty ImagesThe chairman of BMW has warned Boris Johnson he must listen to business in relation to Brexit.

Announcing the German carmaker's results, Harald Krueger advised the new UK Prime Minister: "Listen to the economy and listen to the people. He needs to be in a dialogue with business. I would visit Johnson to tell him this."

The company builds the Mini at its Cowley plant near Oxford where it employs 4,500 people.

BMW reported a 28.4% fall in pre-tax profits for the second quarter to €2.2bn (£2bn).

But revenues rose 2.9% and Mr Krueger said the firm remained on track to meet its financial targets.

The dollar is trading at two year highs after the US Federal Reserve cut interest rates on Wednesday. Why?

"Markets interpreted the Fed’s communication as slightly hawkish and therefore further rate cuts in the immediate future were somewhat priced out," David Milleker, senior economic adviser at Union Investment, told Reuters.

It helps explains some of the pressure on the pound, which has previously been dropping on fears of a no-deal Brexit.

It means sterling has fallen through $1.21.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, PACEMAKER

Image source, PACEMAKERSteve Turner, Unite assistant general secretary for manufacturing, is in Northern Ireland where the future of Harland & Wolff is in doubt. He says:

“We are on the precipice of a manufacturing meltdown turbo charged by Brexit uncertainty and the threat of a job destroying no deal Brexit.

"Burning through millions of pounds on a no-deal PR blitz will not secure UK manufacturing or the jobs it sustains. Boris Johnson and his team need to tell the UK’s talented manufacturing workers directly that they will not betray them or their families by condemning them to the dole queue."

He is urging the Prime Minister to take "no-deal off the table".

Quote MessageThe Monetary Policy Committee is not as hawkish as its new inflation forecasts appear to suggest and instead has become less inclined to raise interest rates if there’s a Brexit deal. That won’t help stem sterling’s recent fall.

Paul Dales, Chief UK economist, Capital Economics

Image source, Getty Images

Image source, Getty ImagesData from the US Labor Department shows that initial claims for state unemployment benefits rose 8,000 to a seasonally adjusted 215,000 for the week ended 27 July.