It's not just Brexit weighing on manufacturingpublished at 11:00 BST 1 August 2019

Image source, Getty Images

Image source, Getty ImagesThomas Pugh, UK economist at Capital Economics, has been looking at the PMI manufacturing indicator published earlier.

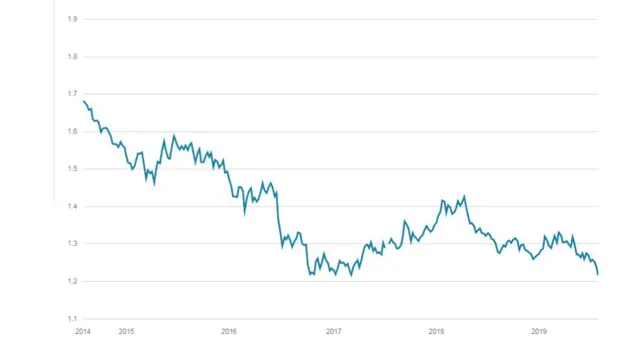

He says the indication that manufacturing contracted at the start of the third quarter will not be a surprise to the Bank of England - which will announce at noon the outcome of its latest interest rate setting meeting - so rates will be left as they are.

"Some of the weakness can be blamed on Brexit but it seems more plausible that a weaker global economy should take most of the blame. Indeed, manufacturing PMI’s in the eurozone and the US both fell in July as well. And it makes sense that as the manufacturing sector is more exposed to global economic conditions it would be hit first and hit hardest," he said.