Thank you for joining uspublished at 11:59 GMT 14 December 2022

We're wrapping up our live coverage now. Here's a round-up of what's been happening this morning:

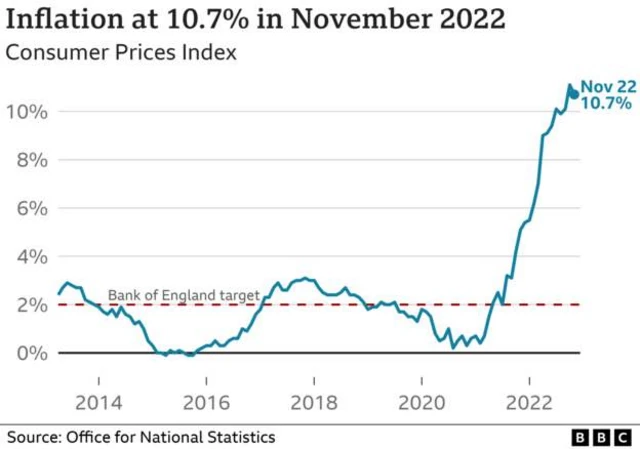

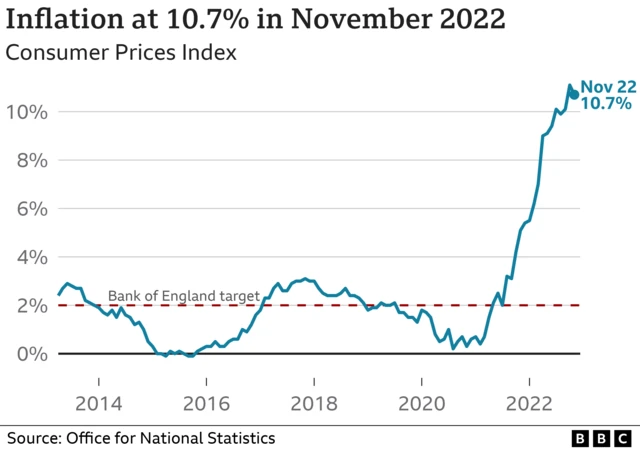

- The UK inflation rate dropped slightly to 10.7% in November, down from 11.1% in the year to October, according to new figures released by the Office for National Statistics, external

- But the cost of living is still close to a 40-year high

- The price of food and non-alcoholic drinks went up by 16.5% in the 12 months to November - up slightly from 16.4% in October. It marks the highest rate seen since 1977

- One of the big drivers behind inflation starting to slow was an easing of the costs of petrol and diesel and second-hand cars

- Fuel prices rose by 17.2% in the year to November 2022, down from a 22.2% increase in the year to October

- But the chief economist at the ONS said it's too early to say we're past the peak of inflation