Expect the second fastest inflation rate in more than 40 yearspublished at 06:55 GMT 14 December 2022

Andy Verity

Andy Verity

BBC Economics correspondent

Figures will be released shortly that are expected to show the rate of inflation has slowed down in the year to November compared with the previous figure.

Analysts expect the figures to show a rise in the cost of living of 10.9% – compared with 11.1% in the year to October – as global inflationary pressures start to ease.

If the average forecast proves accurate, a 10.9% rise in the cost of living would still be the second fastest rate of inflation in more than four decades.

It’s been driven up, overwhelmingly, by global inflationary pressures – and global pressures are also expected to drive it down again.

Wholesale gas for delivery in March for example still costs nearly twice what it did a year ago – but less than half its peak price in the summer.

And at $81 a barrel, the price of Brent crude oil is only $7 higher than a year ago. In the United States yesterday, the markets rallied after inflation fell back by more than expected to 7.1%, down from 7.7% the previous month.

Some UK-specific factors have exacerbated the situation here – such as post-Brexit trade barriers boosting the cost of importing food, and the weakening value of the pound over the past year.

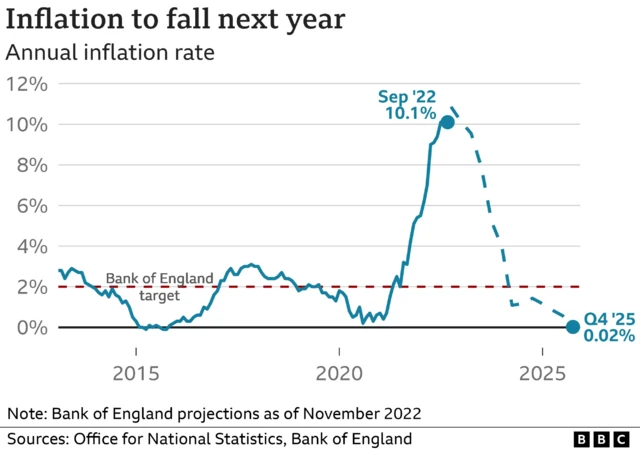

Nevertheless, the rate of inflation is expected slowly to fall from its peak in the coming months – to average 7.4% in 2023.