We're ending our live coveragepublished at 14:14 GMT 23 March 2023

We're bringing our live coverage of the interest rates decision to a close now.

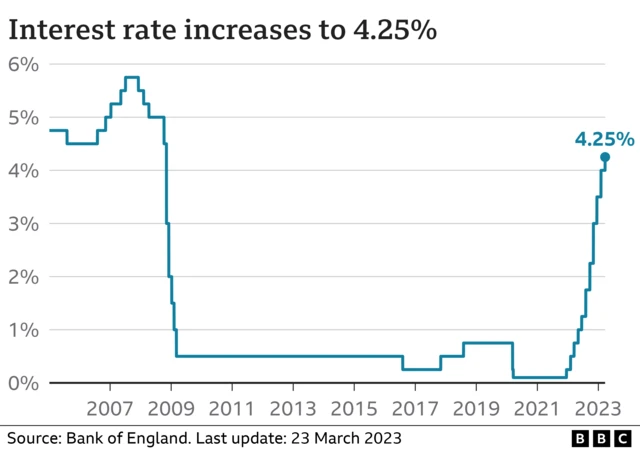

You can continue to follow the story and learn more about why the Bank of England changes interest rates here.

To follow how shortages of salad and other vegetables helped push food prices to a 45-year high and learn more about why prices are rising so much click here.

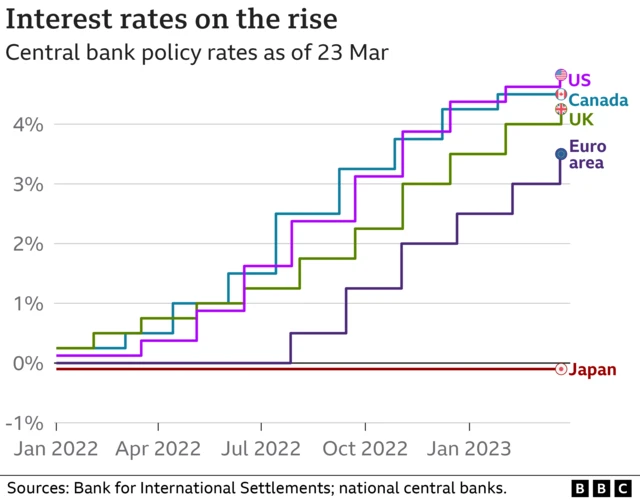

For more on the reasons why UK inflation is higher than other countries, read this.

With a thanks to the writers who were Beth Timmins, Michael Sheils McNamee, Anna Boyd, Thomas Mackintosh and Tom Espiner. The editors were Jennifer Meierhans and Rob Corp.

There's more live coverage on the BBC News website this afternoon:

- TikTok CEO Shou Zi Chew facing Congress grilling over app safety

- Mass protests grip France as pensions row rages

Thanks for joining us.