Signs the interest rate peak has been reachedpublished at 12:07 GMT 23 March 2023

Faisal Islam

Faisal Islam

Economics editor

Another rate rise up to 4.25%.

While that is the latest in what has been a relentless series of rises, there are signs that the peak has been reached.

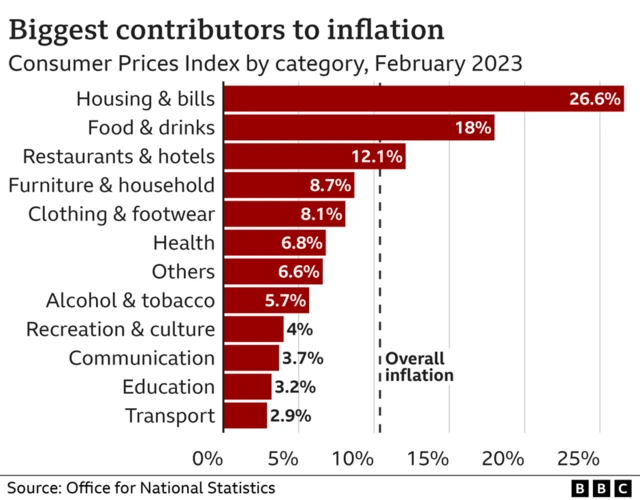

The increase was smaller than recent rises, and the Bank noted that it expected inflation to fall even more sharply than last month, on the back of Budget cost-of-living measures. Those measures, including prolonging help with energy bills, will also boost the economy, and means that the Bank no longer anticipates that the UK is currently in technical recession, though the economy has been broadly flat for some months.

The Bank says that global financial fragility has increased the funding costs for banks, and that might be passed in to the economy.

A discussion over pausing rate rises seems likely in May, at the same time as the Bank’s economists release its quarterly forecast for inflation.