Thanks for joining uspublished at 11:48 BST 24 May 2023

Emily McGarvey

Emily McGarvey

Live reporter

We're ending our live coverage now. Thanks for following along as we broke down the UK's latest inflation figures published by the Office for National Statistics this morning.

Looking ahead, Ofgem is expected to announced a drop in the energy price cap tomorrow morning, which limits how much suppliers can charge per unit of energy. It's forecast to fall to about £2,000 per year - nearly double the amount when the cap was announced in 2019.

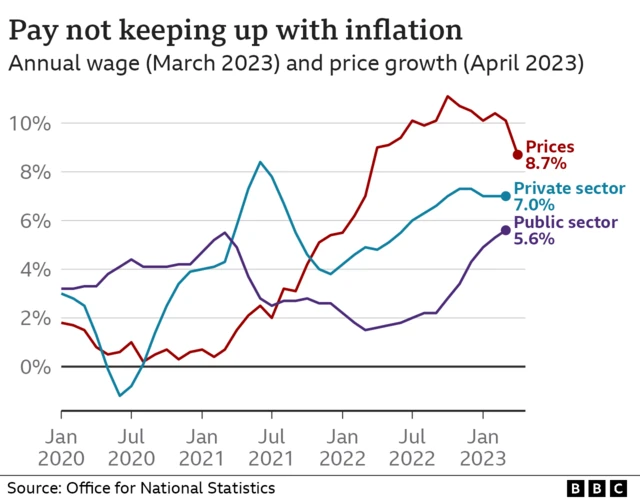

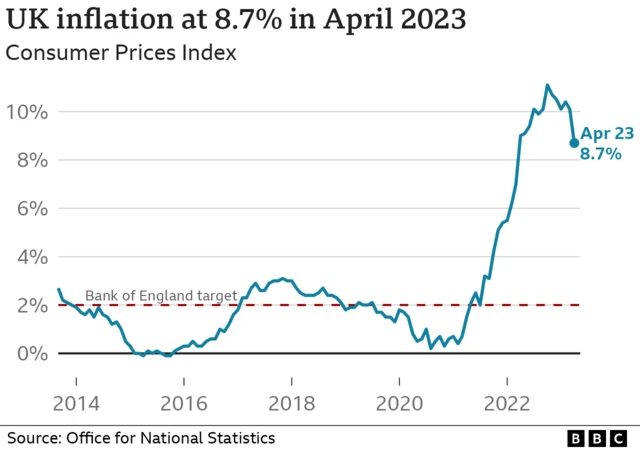

- To read more about how the UK inflation rate fell sharply to hit 8.7% in the year to April -the first time its dipped to single figures since last August - click here.

- To help get your head around why inflation is falling but prices are still increasing, look no further than here.

- And to understand more about what can be done to tackle inflation, click here.

Today's live page was written by Thomas Mackintosh, Luke Mintz, Jen Meierhans and Dearbail Jordan. It was edited by myself and Jamie Whitehead.

Prime Minister's Questions is getting underway shortly, my colleagues Emma Owen and Owen Amos will take you through that here