How much are prices rising for you?published at 08:05 BST 24 May 2023

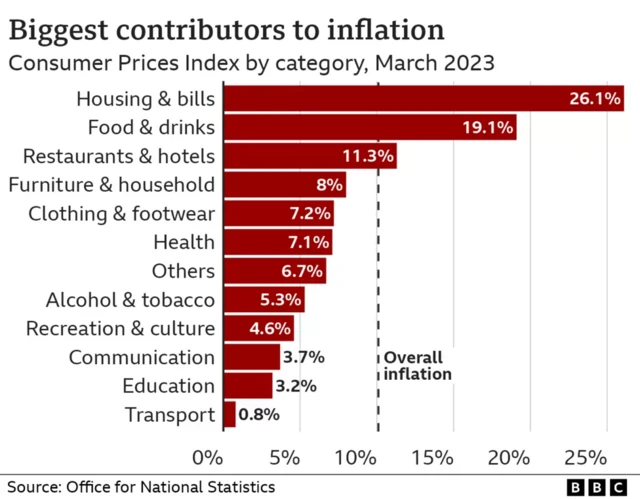

Every month there's a new figure for inflation - it estimates how much prices are rising across all the goods and services in the economy.

As we've been reporting, in the 12 months to April 2023 the figure was 8.7%. That means things costing £1 in April 2022 cost more than £1.08 in April 2023.

But your own inflation figure will depend on what you spend your money on.

Our personal inflation calculator, built by the Office for National Statistics (ONS) in collaboration with the BBC, shows you what the inflation rate is for your household, and identifies the items in your household budget that have gone up the most in price over the past year.