Government could feel the wrath of voterspublished at 08:16 BST 21 June 2023

Nick Eardley

Nick Eardley

Chief political correspondent

The chancellor’s response to this morning’s figures is to stick to its guns when it comes to a plan for the economy.

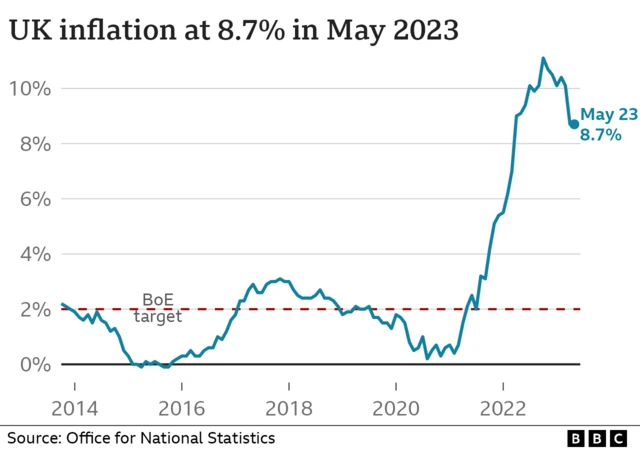

Jeremy Hunt said the UK needed to “squeeze every last drop of high inflation out of the economy”.

To do that, he argues spending constraints are needed. That also means continuing to resist the tax cuts some Conservatives are desperate for.

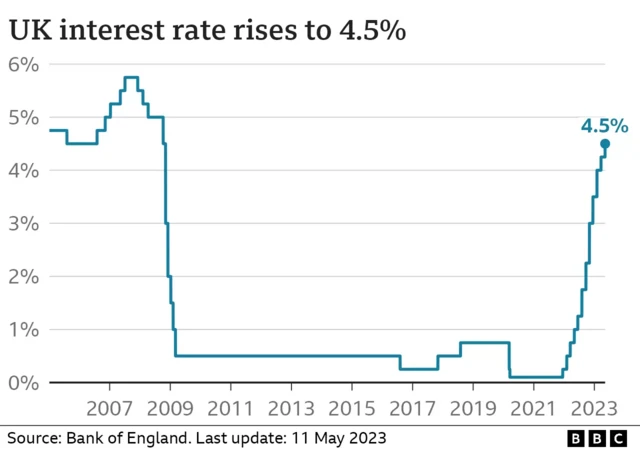

The chancellor is also arguing in interviews this morning that a scheme to help people with mortgages would be a bad idea – because it could make inflation worse.

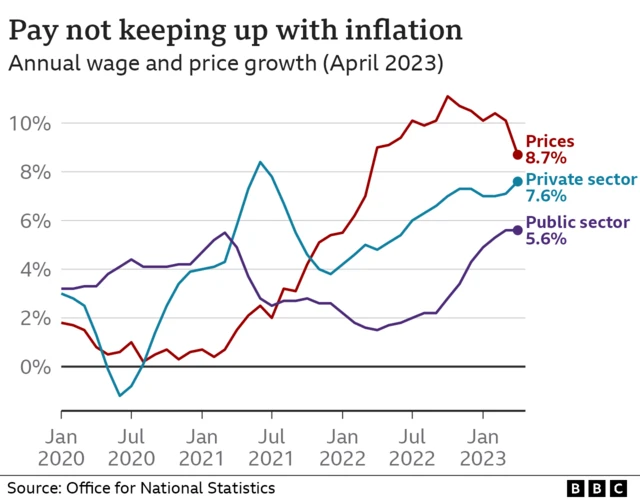

But the fact prices are still rising at a fast rate is not just bad news for consumers – its bad news for the government too.

Ministers have promised to get inflation down this year, to around 5%. That was previously seen as likely – now there’s more doubt.

The government also knows that it could feel the wrath of voters who are seeing their household income squeezed.

That pain will only be compounded if – as expected – interest rates go up further tomorrow.

Labour said this morning that the government is part of the problem.

The Shadow Chancellor Rachel Reeves argued: “This Tory government can’t get a grip of this problem because they are the problem.“