Thanks for joining uspublished at 12:23 BST 20 September 2023

We're ending our live coverage now - thanks for reading. Today's top lines:

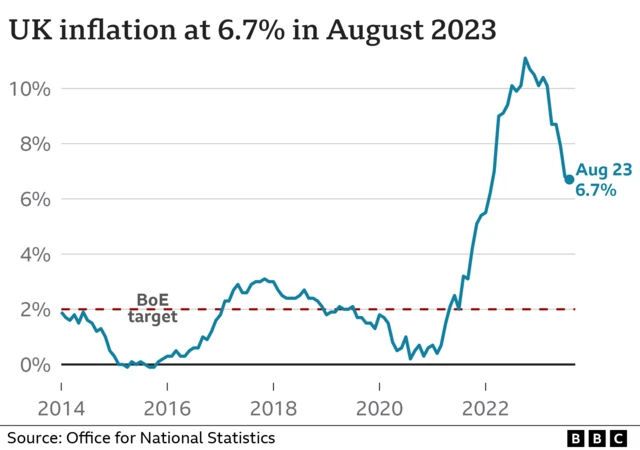

- Inflation slowed to 6.7% in the 12 months to August - down slightly from 6.8% in July

- It means prices are still rising, but at a slower rate

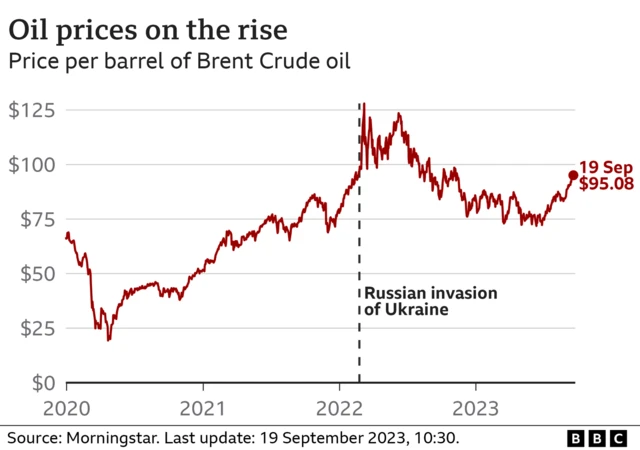

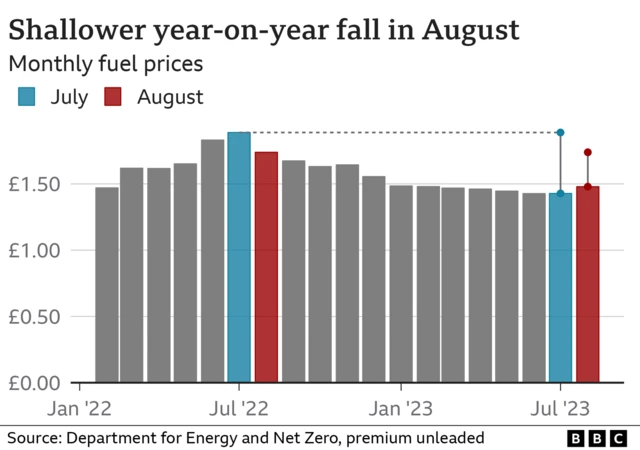

- The figure was a surprise to most economists, who had expected a slight rise, due to increasing petrol and diesel prices

- Core inflation, which strips out food and energy, slowed to 6.2%

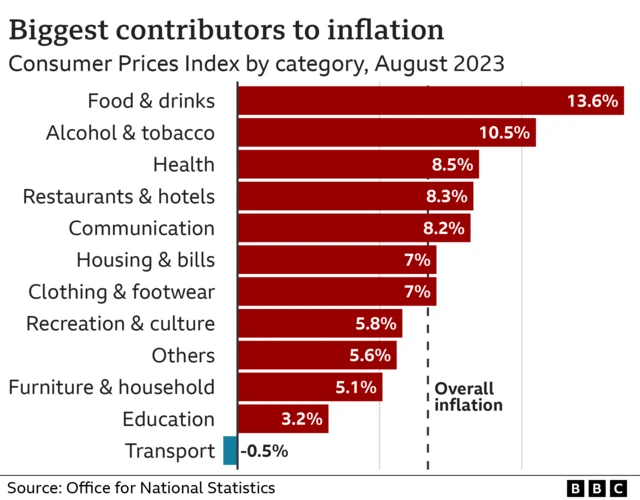

- Price rises for food and non-alcoholic drinks also eased to 13.6% in the year to August

- Chancellor Jeremy Hunt said it was a sign the government's plan was working - "plain and simple"

- But Labour said that the dip would mean "very little to families across the countries that can't afford to pay their bills"

- Some analysts suggested it could change the Bank of England's interest rate decision, which is due tomorrow at midday

Want to read more? Our full write up with all of the key numbers and reaction is here.

Today's writers were Lora Jones, Gem O'Reilly, Suneil Asar, Tara Mewawalla, and Owen Amos.