How is the UK faring against other countries?published at 08:01 BST 20 September 2023

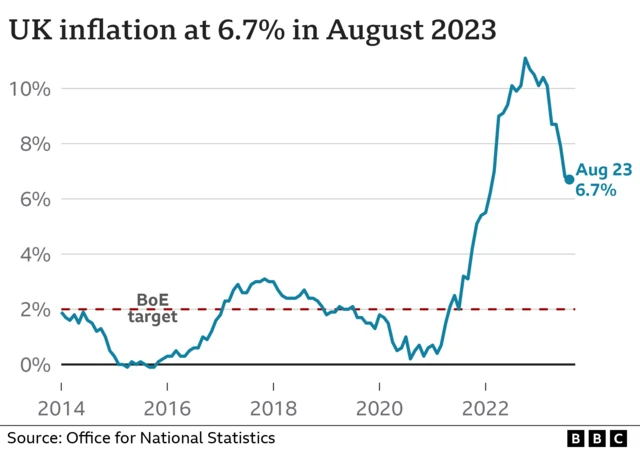

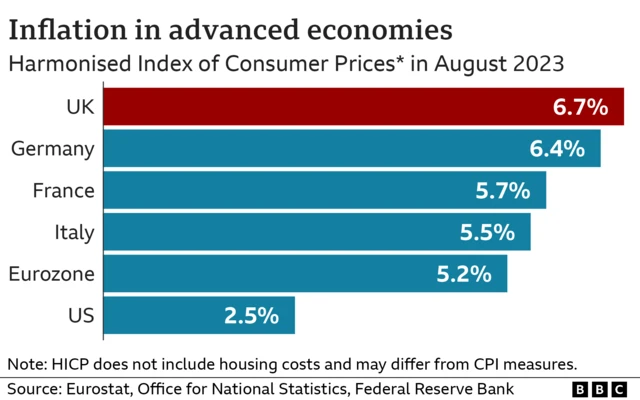

Despite the surprise drop in inflation, prices are still rising faster in the UK than in several other big economies like France, Germany and the US.

One forecast suggested yesterday that prices will rise faster in the UK than any other major economy this year.

The Organisation for Economic Co-operation and Development said UK inflation would average 7.2% in 2023.

It said this would be the highest rate in the G7 group of major economies. It's worth bearing in mind there are some differences in how countries measure inflation.