What is happening to mortgage rates?published at 12:48 BST 21 September 2023

Kevin Peachey

Kevin Peachey

Cost of living correspondent

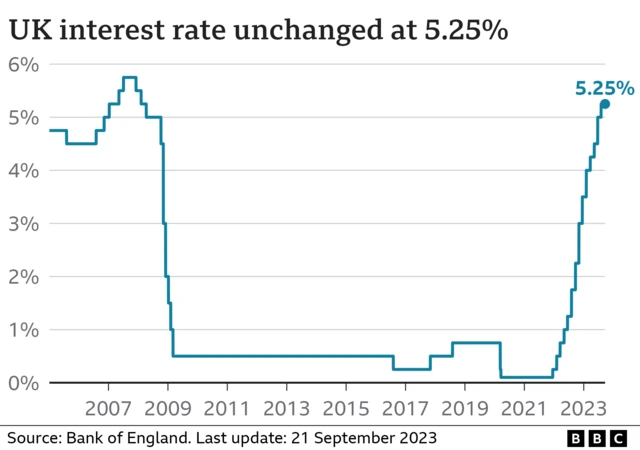

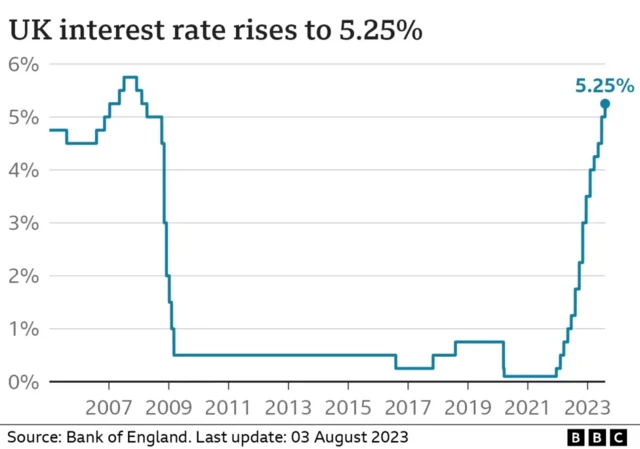

The decision today, and perhaps more significantly the mood music from the Bank of England, is relevant for future mortgage rates.

There is some competition back in the market on fixed rate deals and if this is the end of a cycle of interest rate rises, then lenders may feel more confident to offer lower mortgage rates.

But the reality for homeowners is that their next deal is still likely to be significantly more expensive than the last one.

Of course, those on tracker or standard variable rates are more directly impacted by what policymakers do, and so will be relieved to see the end of a run of rises.

And tenants in the private rental sector are affected by what their landlords are facing - and so have seen rents rising at a rapid rate.