Where now for interest rates?published at 10:02 BST 18 October 2023

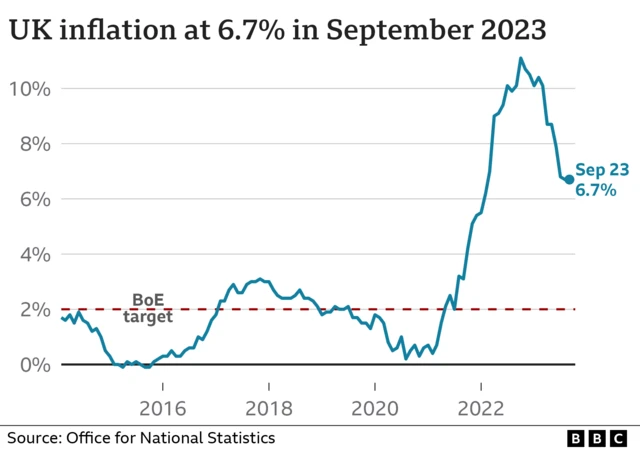

We've been bringing you the latest analysis and reaction after the Office for National Statistics said UK inflation remained unchanged at 6.7% in the year to September.

We're going to be ending over live coverage here - but we'll leave you with the view of two economists as they look ahead to the Bank of England's next interest rate decision on 2 November.

Last month the bank held interest rates at 5.25%.

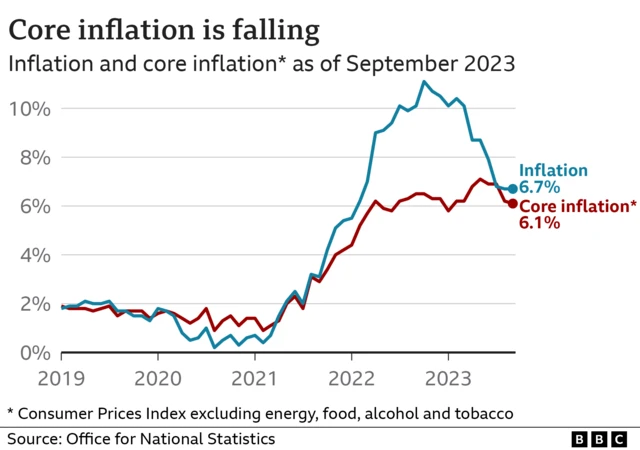

Jake Finney, economist at accountancy firm PwC, reckons that the bank's committee will again vote to hold rates because, even though the headline rate of inflation failed to budge in September, the core inflation rate dipped a little bit.

"Lower household utility prices should shave around 1.5 percentage points off headline inflation in October. Combine that with an overall easing of inflation pressures and inflation should end the year under 5%,” he said.

KPMG's chief economist, Yael Selfin said: “Despite ongoing pressures, the overall outlook for inflation looks more positive in the coming months.

"Together with the ongoing loosening of the labour market, this should be sufficient for the Bank of England to keep interest rates on hold as it takes stock of the impact of past tightening.”

For more on today's inflation rate figures - including the first fall in food prices for two years - you can read the main story here.

And there are lots more tips and help with understanding the cost of living crisis here.