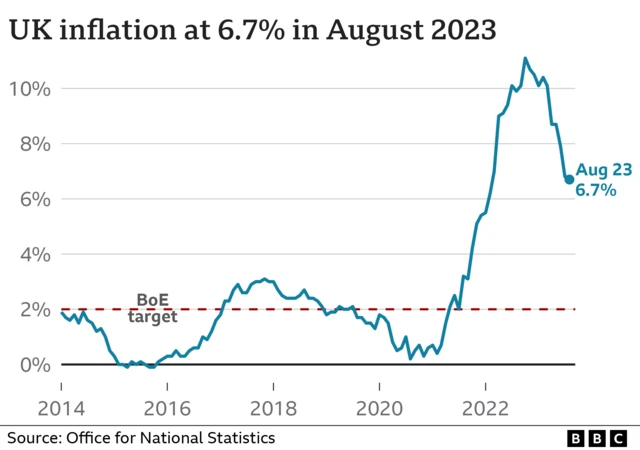

UK inflation unchanged at 6.7%published at 07:02 BST 18 October 2023Breaking

The UK rate of inflation remained at 6.7% in the year to September, according to official figures.

We'll unpick the figures here and bring you the latest comment and expert analysis.