Inflation rises to 4%, surprising economy watcherspublished at 11:11 GMT 17 January 2024

James Harness

James Harness

Live reporter

We are ending our live coverage of today's surprise rise in inflation.

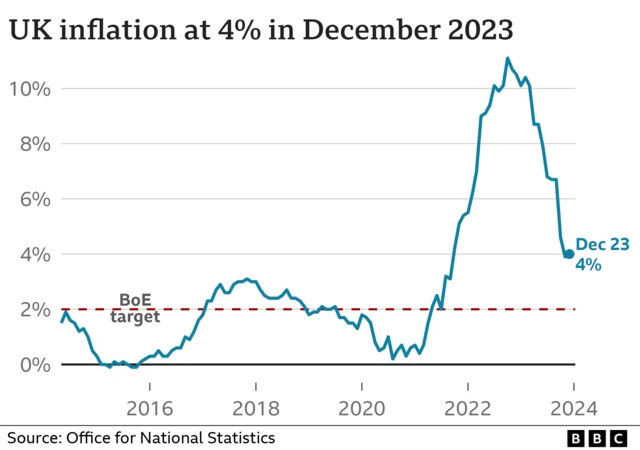

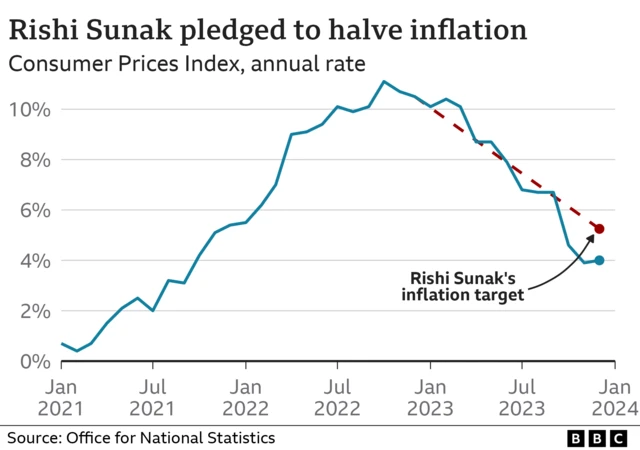

Earlier this morning we thought - based on analyst forecasts - the UK inflation rate was going to drop from 3.9% in November to 3.7% in December. At 07:00 GMT the Office for National Statistics published its numbers, revealing a small rise to 4%.

A small increase, but a shock to those who closely watch economic data. A closer look revealed the rise was stoked by an increase in alcohol and tobacco prices. Perhaps surprisingly, the cost of cat food played a part too.

Despite all this, economists are still forecasting a cut in the interest rate by the Bank of England by the middle of this year.

We will be covering PMQs on another page, here, where questions might be asked about the continuing rise in the cost of living.