Purchasing power of your money still affected by rising pricespublished at 08:42 GMT 17 January 2024

Kevin Peachey

Kevin Peachey

Cost of living correspondent

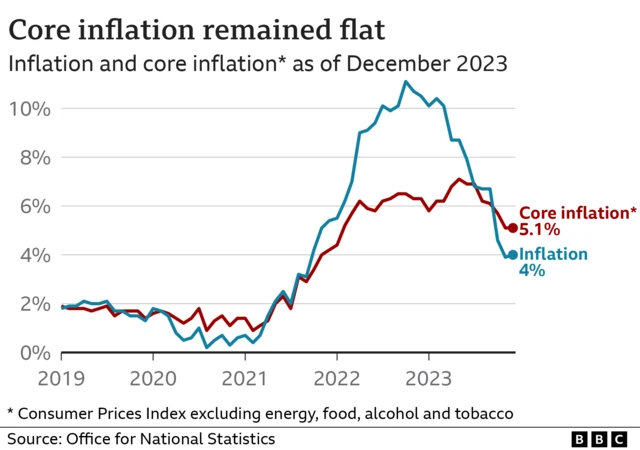

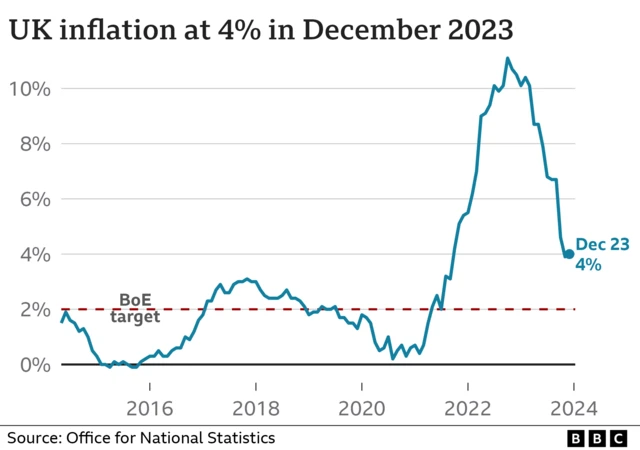

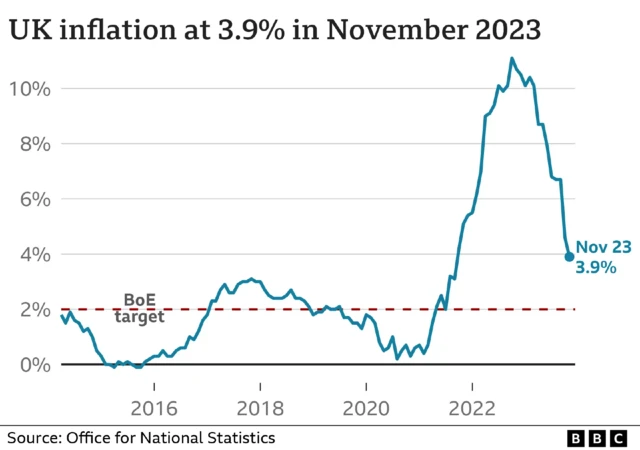

Policymakers may be pondering that the route to the 2% inflation target never did run smooth.

There’s already lots of chat about how big a bump in the road towards lower interest rates and borrowing costs this is.

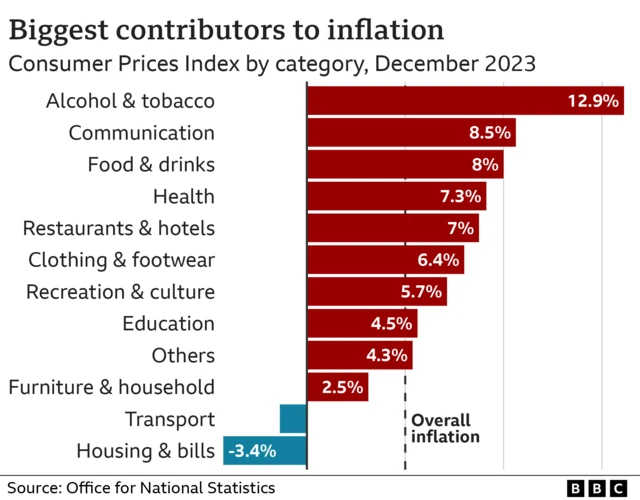

But it is worth considering what these latest figures tell us. It was already pretty expensive to be a smoker and drinker. They’ve seen comparatively big price rises over the last year.

Also the purchasing power of your money is still being affected by rising prices in general, as it has since the pandemic.

January is never a bad time to review your finances, for unnecessary spending and so on, and it makes even more sense now.

Take a look at our inflation rate calculator here to see how much prices are rising for you.